Equities Rebound as Trade Uncertainty Continues

Equity markets continued to whipsaw. The equity index recovered from Tuesday’s losses. This comes as news sources cite that the US and China were moving closer to an agreement. President Trump was also seen confirming that the trade talks were going well.

Euro Trades Mixed Amid Weak US Data

The Institute of Supply Management’s non-manufacturing activity slowed in November. The latest figures show that services activity slowed to 53.9 on the index. This was down after the index rose slightly to 54.7 in the month before. The slowdown in the services sector comes amid a contraction in the manufacturing sector.

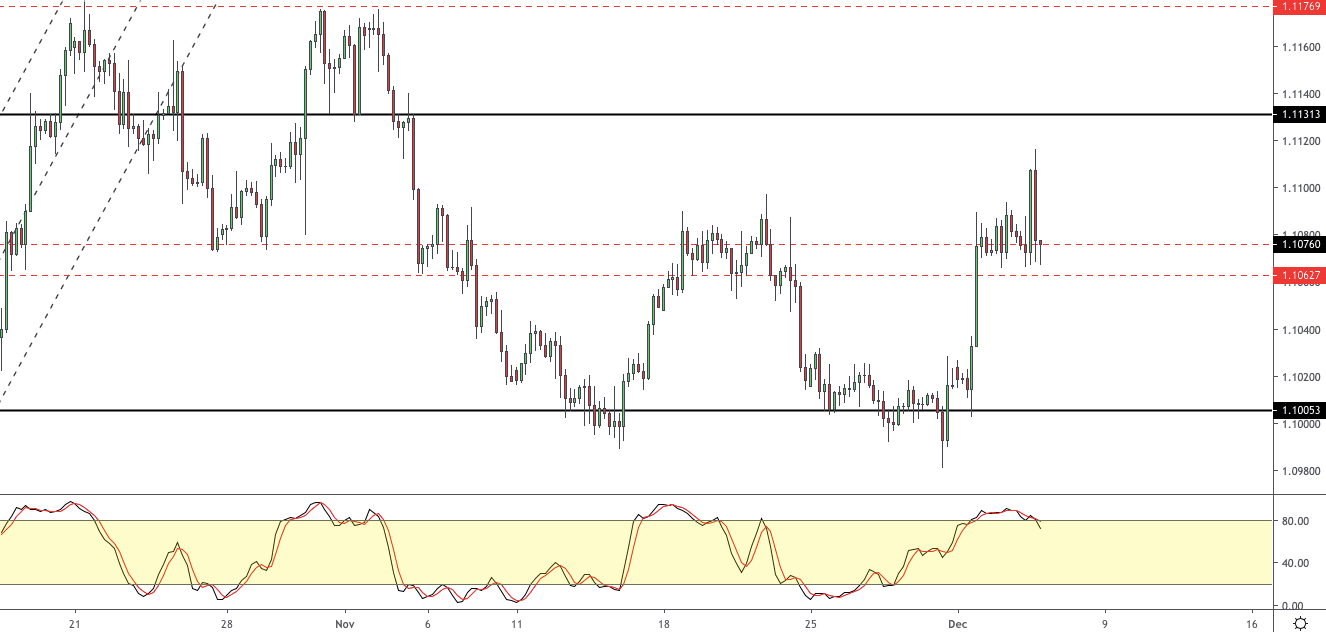

EUR/USD Establishing Support

The currency pair briefly slipped back to the previously established resistance level of 1.1062 – 1.1075. If this support level holds, then the currency pair could be on track for further gains. The next upside target is at 1.1131 level. To the downside, only a clear break below the current levels will confirm a shift in the bias.

Crude Oil Gains on Inventory Drawdown

The latest weekly inventory report by the Energy Information Administration (EIA) showed a drawdown in oil inventories. For the week ending November 29, crude oil prices fell 1.6 million barrels. This comes after a consistent weekly build up in oil inventories. The upcoming OPEC meeting is also weighing on the oil trades.

WTI Breaks Past Resistance

Crude oil prices broke past the resistance level of 58.00, rising over 3% on the day. The breakout past the resistance area confirms potential further upside. There is scope for WTI Crude oil to retrace back to the 58 region to establish support. As long as this level holds, price action could see further gains with 60.00 as the next main level of interest.

Pound Sterling Gains as Odds of a Tory Win Rises

The pound sterling continued to advance gains, rising to a seven month high on Wednesday. The currency picked up momentum after latest polls put the Conservative party in the lead. Besides leading the polls, the rally comes as investors hope that PM Johnson’s party will win a majority. This is expected to pave way for a Brexit deal which is due for review by January 31, 2020.

GBP/USD at 7-month High But at Risk of a Pullback

The cable managed to post strong gains as it broke past the resistance level of 1.2960. The clear breakout above this level indicates further upside. But there is a risk that the currency pair could be looking to retrace the gains. A retest of the 1.2960 level to establish support will see price action establishing itself toward further gains. For the moment, the price level of 1.3100 could be holding out as resistance.

Author

John Benjamin

Orbex

John is a market analyst for Orbex Ltd. and is a forex and equities trader having been involved in trading since late 2009. John makes use of a mix of technical and fundamental analysis and inter-market relationships.