Elliott Wave View: GBPJPY Ended Correction [Video]

![Elliott Wave View: GBPJPY Ended Correction [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/billete-de-cinco-libras-de-la-reina-isabel-ii-gm459233197-17697841_XtraLarge.jpg)

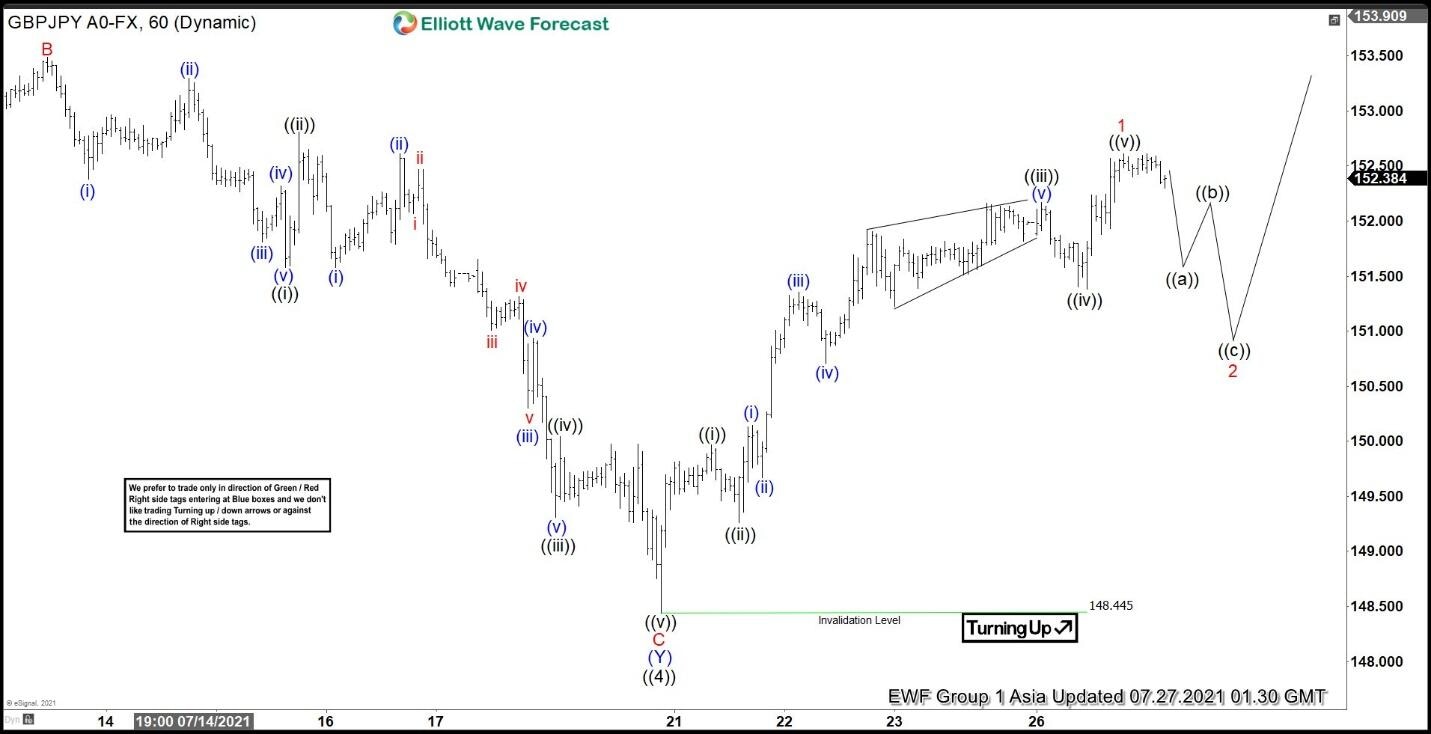

Short Term Elliott Wave in GBPJPY suggests that the correction from May 27, 2021 peak has ended in wave ((4)) at 148.44. The internal subdivision of wave ((4)) took the form of a double three Elliott Wave structure. Down from wave ((3)) peak on May 27, wave (W) ended at 151.32 and rally in wave (X) ended at 155.15. Final leg lower wave (Y) ended at 148.46 which should complete wave ((4)). The pair has started wave ((5)) higher but still needs to break above wave ((3)) at 156.07 to rule out a larger double correction.

Up from wave ((4)), wave ((i)) ended at 149.96 and pullback in wave ((ii)) ended at 149.26. Pair resumes rally higher in wave ((iii)) towards 152.16, and pullback in wave ((iv)) ended at 151.38. Expect final leg higher wave ((v)) of 1 to end soon. Afterwards, it should pullback in wave 2 to correct the entire rally from July 20 low before the rally resumes in wave 3. Near term, as far as wave ((4)) low pivot at 148.44 remains intact, expect dips to find support in 3, 7, or 11 swing for further upside.

GBPJPY 60 Minutes Elliott Wave Chart

GBPJPY Elliott Wave Video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com