Elliott Wave View: Dow futures (YM) ready for new all-time high [Video]

![Elliott Wave View: Dow futures (YM) ready for new all-time high [Video]](https://editorial.fxstreet.com/images/Markets/Equities/DowJones/yahoo-finance-web-pages-on-apple-ipad-16477994_XtraLarge.jpg)

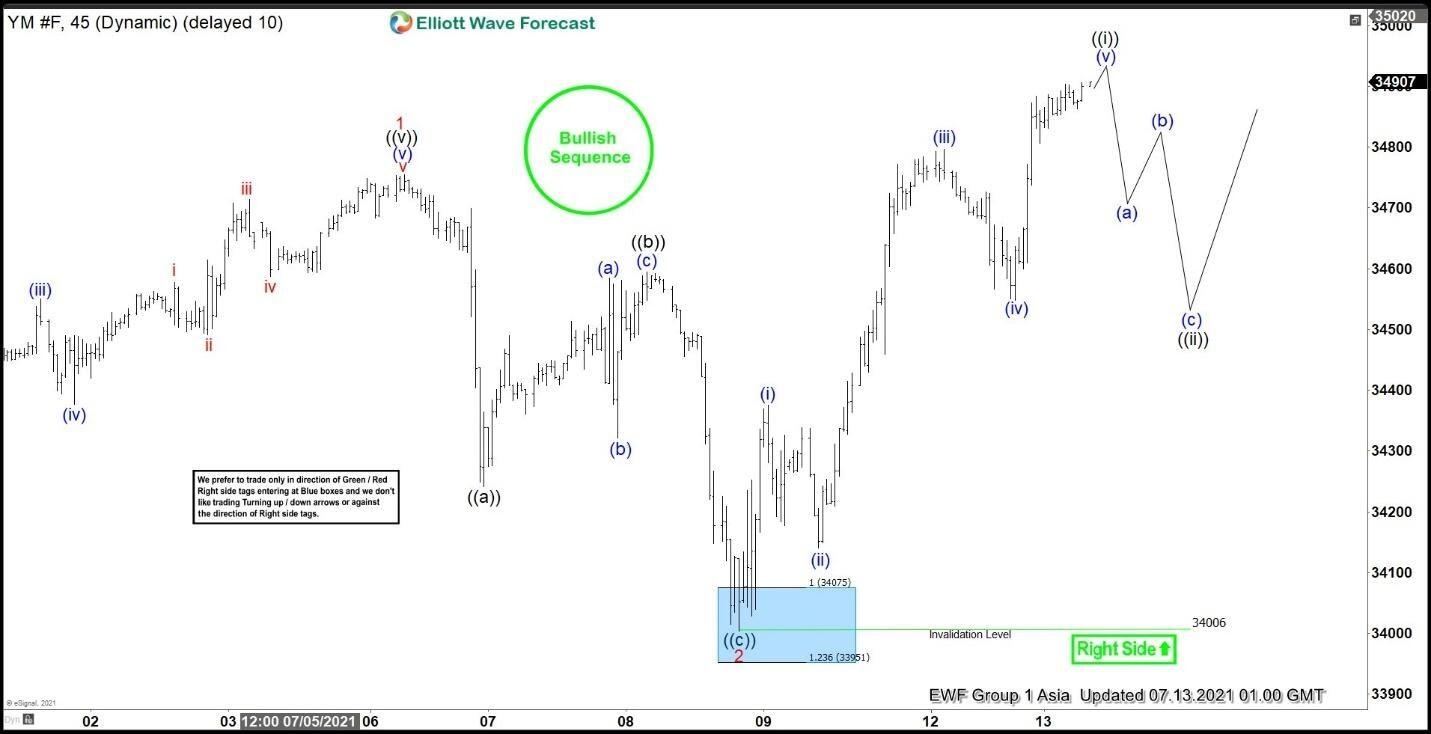

Short term Elliott Wave view in Dow Futures (YM) shows the rally from June 21, 2021 low is unfolding as a 5 waves impulse Elliott Wave structure. Up from June 21 low, wave 1 ended at 34755 and pullback in wave 2 ended at 34004. Internal subdivision of wave 2 unfolded as a zigzag structure. Down from wave 1, wave ((a)) ended at 34241, rally in wave ((b)) ended at 34595, and final leg lower wave ((c)) ended at 34006. This completed wave 2 in higher degree.

Index has broken above wave 1 at 34755, suggesting the next leg higher in wave 3 has started. Up from wave 2, wave (i) ended at 34375, and pullback in wave (ii) ended at 34140. Index resumes higher in wave (iii) towards 34796, and pullback in wave (iv) ended at 34548. Expect Index to soon end wave (v) which should also complete wave ((i)). It then should pullback in wave ((ii)) to correct cycle from July 8 low before the rally resumes. Near term, dips is expected to find support in 3, 7, or 11 swing against July 8 low (34006) for further upside.

Dow Futures (YM) 45 minutes elliott wave chart

Dow Futures (YM) elliott wave video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com