Elliott Wave view: AUD/JPY looking for 3 waves pullback [Video]

![Elliott Wave view: AUD/JPY looking for 3 waves pullback [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Crosses/AUDJPY/forex-australia-and-japanese-currency-pair-with-calculator-4780678_XtraLarge.jpg)

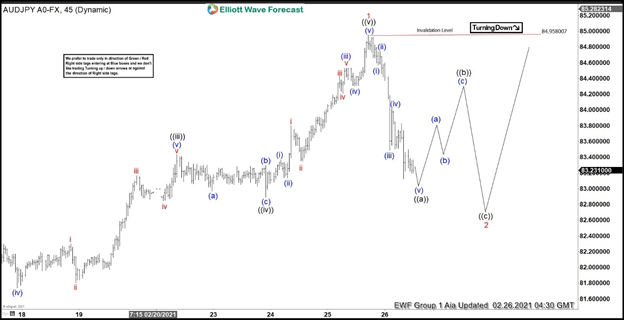

Short term Elliott Wave View in AUDJPY suggests cycle from January 28 low has ended with wave 1 at 84.95. The rally from January 28 low unfolded as a 5 waves impulse where wave ((i)) ended at 80.647 and pullback in wave ((ii)) ended at 79.52. Index resumed higher in wave ((iii)) which ended at 83.43, and pullback in wave ((iv)) ended at 82.89. The final leg higher in wave ((v)) ended at 84.95 and this completed wave 1 in higher degree.

Wave 2 pullback is currently in progress as a zigzag Elliott Wave structure. Down from wave 1, wave (i) ended at 84.57 and bounce in wave (ii) ended at 84.74. Pair resumed lower in wave (iii) towards 83.49 and bounce in wave (iv) ended at 84.01. Expect wave (v) of ((a)) to end soon, then pair should bounce in wave ((b)) to correct cycle from February 25 high before turning lower again in wave ((c)) of 2. As far as pivot at 84.95, pair has scope to turn lower one more time to complete a 3 waves zigzag correction before pair resumes higher again. Potential target higher is 100% – 123.6% Fibonacci extension from October 20, 2020 which comes at 86.94 – 91.73.

AUD/JPY 45 Minutes Elliott Wave chart

AUD/JPY Elliott Wave video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com