Elliott Wave: S&P 500 futures forecasting the path

In this technical blog we’re going to take a look at the Elliott Wave charts charts of S&P 500 Futures $ES_F published in members area of the website. As our members know $ES_F is giving us pull back ((4)), which is correcting the cycle from the 24th September low. Recently the futures found sellers after completing short term recovery as Elliott Wave Zig Zag. In further text we’re going to explain the forecast and Elliott Wave Patterns.

Before we take a look at the real market example, let’s explain Elliott Wave Zigzag.

Elliott Wave Zigzag is the most popular corrective pattern in Elliott Wave theory . It’s made of 3 swings which have 5-3-5 inner structure. Inner swings are labeled as A,B,C where A =5 waves, B=3 waves and C=5 waves. That means A and C can be either impulsive waves or diagonals. (Leading Diagonal in case of wave A or Ending in case of wave C) . Waves A and C must meet all conditions of being 5 wave structure, such as: having RSI divergency between wave subdivisions, ideal Fibonacci extensions and ideal retracements.

$ES_F 1 hour Elliott Wave analysis 9.23.2021

Wave (X) blue correction can be in progress as Elliott Wave Zig Zag pattern. First leg of the (X) bounce has subdivision in 5 waves. Then we got 3 waves pull back B red . Now ideally doing 5 waves up in C red. We expect to see more short term strength in SP Futures. Approximate area where (X) blue connector can complete comes at the A-B red equal legs : 4424.3-4488.8. From that zone we expect to see another leg down. There is no incomplete bearish sequences at the moment, and we don’t recommend selling.

$ES_F 1 hour Elliott Wave analysis 9.23.2021

Recovery made 5 waves in C red leg as we expected. $ES_F completed Elliott Wave Zig Zag Structure at 4471.77 high. At the moment we are getting 3 waves recovery in short term X red connector. As far as the price holds pivot at 4471.77 high in place , the futures can see more weakness in (Y) blue leg. We need to see break of (W) blue low -09/20 to confirm next leg down is in progress.

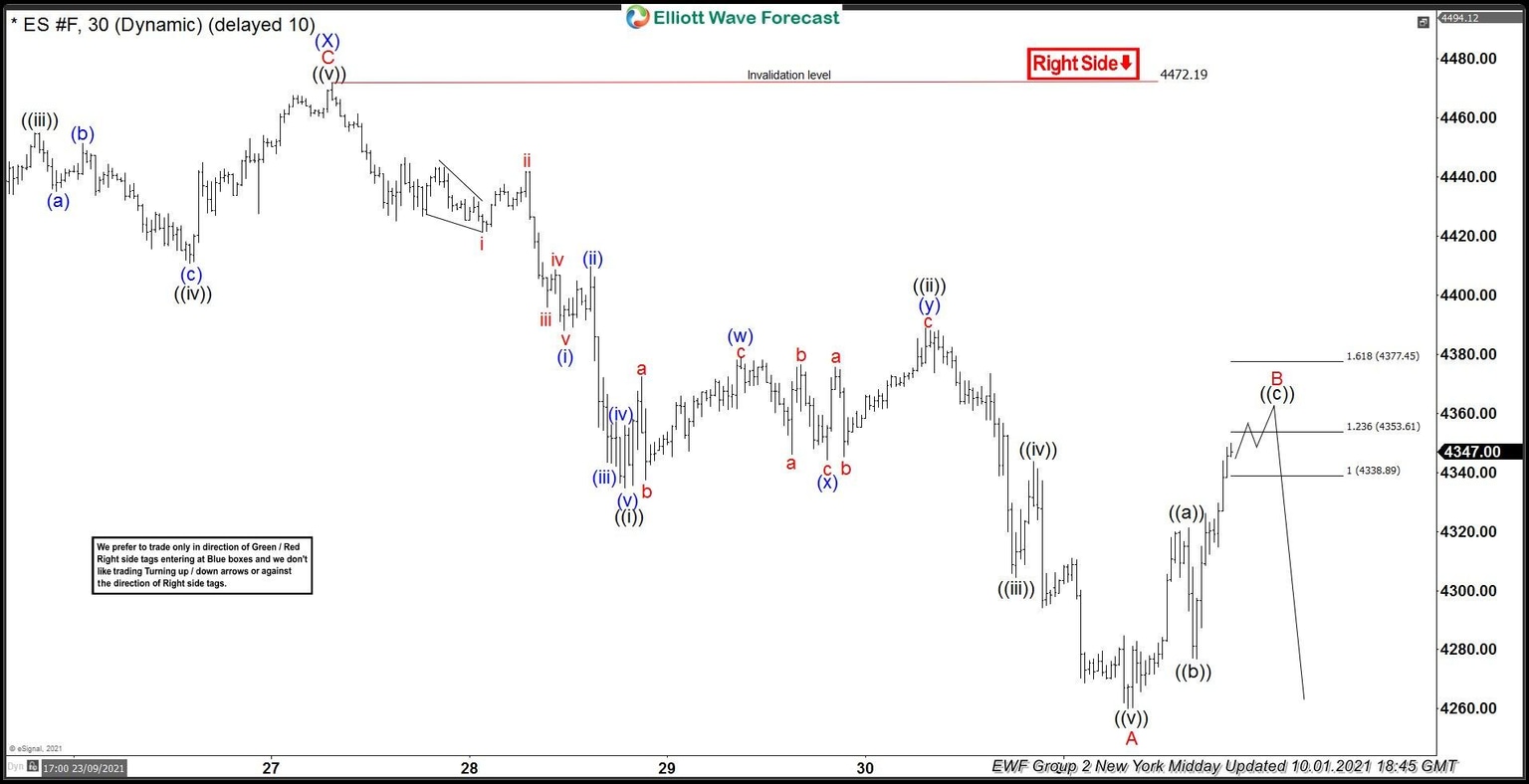

$ES_F 1 hour Elliott Wave analysis 10.01.2021

We got further decline after 3 waves bounce. Eventually the price has broken 09/20 low , making lower low sequences. That made $ES_F bearish against the 4472.19 high in near term, targeting 4214.8-4154.3 area. Short term recovery can be ending soon at 43338.8-4377.4 area.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com