Elliott Wave analysis: EUR/USD could move further low after a pullback

Markets are consolidating as the USD Index saw some limited upside, even vs JPY as yields turned slightly lower in recent sessions, but this may again change later today during FOMC speeches. From an EW perspective, we see USD INdex in a corrective pullback; ideally, that's going to be a three-wave set-back within wave four that can stabilize at 95.00-95.25.

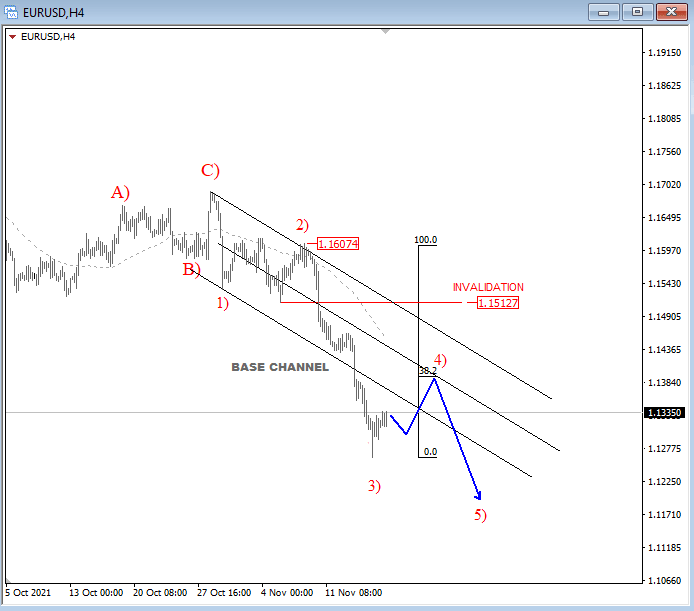

EURUSD is coming much lower with an extended and accelerating price action away from 1.1607 that looks like wave 3) based on characteristics rather than wave C). As such, in the 4-hour chart, we think there will be more weakness after a pullback in wave 4), ideally down to 1.1180 area for wave D) on a daily target that can belong to a triangle, while the price is below 1.1512 invalidation level.

EUR/USD 4h Elliott Wave analysis

Check more of our analysis for currencies and cryptos in members-only area. Visit EW-Forecast for details!

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.