Earning reports from household names – Part 1

Original content: Stocks News and Forecast: Earning reports from household names – Part 1

Last weeks’ turbulent market is about to head into another. The intensity of the upcoming turbulence will depend on how these household names have performed in Q2 as per their earning reports. Whether they have performed poorly, in line with expectation, or extraordinarily well, the market will have a strong opinion and a possibly strong reaction.

Last week recap: Fresh highs for US indices ahead of earning reports

Last week started with investor jitters taking the SPX500 and NAS100 down, a non-insignificant amount, for a third straight day (and the US30 down for the second straight day). The apparent cause of the Jitters? The spread of the Delta variant of the Coronavirus picks up in Europe and APAC countries (South Korea, Thailand, Vietnam, and Australia in particular).

By Tuesday, the jitters had subsided, and investors ploughed back into the market. The SPX erased Monday losses, while the NAS100 was up by 50 points over Monday’s open. By the close of the market on Friday, all three major indices were at record highs.

At the time of writing, DOW JONES E-MINI FUTURES, NASDAQ-100 E-MINI FUTURES, and E-Mini S&P 500 are all flat, half a day out from the US markets opening.

Too many earning reports this week

This week is the busiest Q2 earning reports week of the year. As such, this article will be broken up into several parts.

Monday earning reports

Companies that are worlds apart are reporting Monday. The $105B defence contractor, Lockheed Martin (NYSE: LMT) and the $13B toymaker, Hasbro (NASDAQ: HAS), are first to the batting plate.

Hasbro is forecasting annual growth in sales of 10% for the next two years as it expands its gaming portfolio. In response, analysts have HAS projected to reach a price 24% above the current stock. Unfortunately, 2021 Q2’s earnings are anticipated to be down compared to Q1. However, it is good to note that the toymaker has been reporting at the top end of its estimates in the past three quarters, with last quarter beating expectations by an impressive 55%.

Lockheed Martin is expected to report earnings per share of $6.53, up by 13% over the PCP. Overall sales are forecast to have lifted to $16.9B, up by 4.5% over the PCP. A steady flow of high-value government contracts has kept Lockheed’s out of any trouble all 2020 and 2021. The Company currently has an order backlog worth $150B.

Lockheed and Hasbro will both be presenting their results before the market opens on Monday.

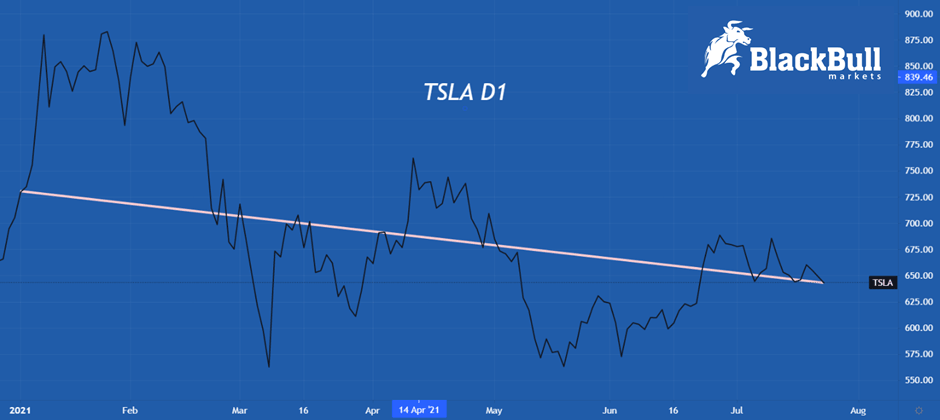

Tesla Inc (NASDAQ: TSLA) will be reporting after the bell on Monday. Even as it beat its earnings per share estimates, the EV manufacturer has disappointed investors in its previous two quarters. For example, TSLA has lost 11% since its last report three months ago. Tesla is again expected to beat its estimates in Q2 2021. The third consecutive earnings beat might be enough to reverse the sell-off the Company has experienced in 2021.

Tuesday to Friday earning reports

I will omit comment on every Company in this article. Instead, separate pieces will be devised for each day of this week so that the information does not become overwhelming. For now, take note of the following lists and what days companies on your watchlist are reporting their earnings.

Tuesday:

- General Electric (NYSE: GE)

- Apple (NASDAQ: AAPL)

- Alphabet (NASDAQ: GOOG)

- Microsoft (NASDAQ: MSFT)

- AMD (NASDAQ: AMD)

- Mattel (NASDAQ: MAT)

- Starbucks (NASDAQ: SBUX)

- Visa (NYSE: V)

- Mondelez International (NASDAQ: MDLZ)

Wednesday:

- McDonald’s (NYSE: MCD)

- Shopify (NYSE: SHOP)

- Facebook (NASDAQ: FB)

- Ford Motor (NYSE: F)

- Boeing (NYSE: BA)

- Pfizer (NYSE: PFE)

- PayPal (NASDAQ: PYPL)

- Spotify (NYSE: SPOT)

- Shopify (SHOP)

Thursday:

- Anheuser-Busch InBev (NYSE:BUD)

- Amazon (NASDAQ: AMZN)

- Fortinet (NASDAQ: FTNT)

- T-Mobile US (NASDAQ: TMUS)

- Merck (NYSE: MRK)

Friday:

- AbbVie (NYSE: ABBV)

- Caterpillar (NYSE: CAT)

- Chevron (NYSE: CVX)

- Exxon Mobil (NYSE: XOM)

- Procter & Gamble (NYSE: PG)

Author

Mark O’Donnell

Blackbull Markets Limited

Mark O’Donnell is a Research Analyst with BlackBull Markets in Auckland, New Zealand.