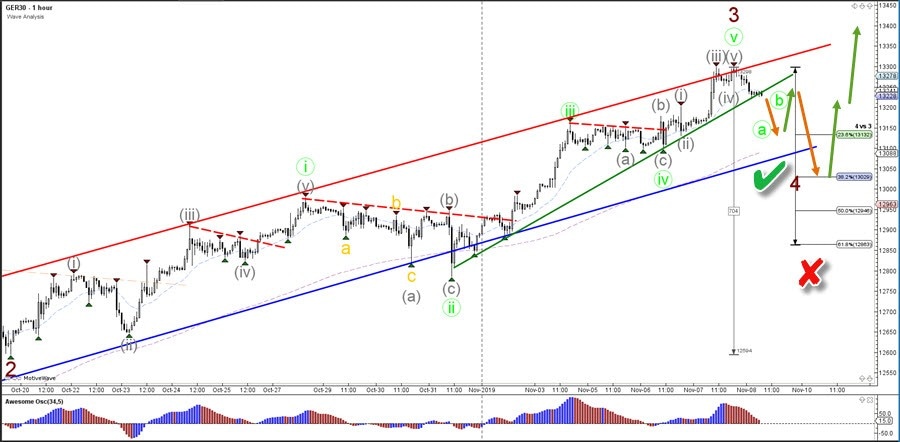

DAX30 Uptrend Requires Pullback to 38.2% Fibonacci

The German index DAX 30 seems to have completed an impulsive wave 3 (dark red) at the top of the bullish channel. A bearish pullback seems imminent.

DAX 30

4 hour

The DAX 30 index could build a wave 4 (dark red) retracement back to the Fibonacci support levels of wave 4 vs 3 if price manages to break below the support trend line (green). A bullish bounce at the wave 4 Fibs could confirm (green check) the bullish trend continuation whereas a break below the 61.8% Fib invalidates (red x) the expected wave structure. A breakout is aiming for the Fibonacci targets (red circle).

1 hour

The DAX 30 could build a bearish ABC (green) pullback to the Fibonacci levels of wave 4 vs 3. The main bouncing spot (green check) for an uptrend continuation (green arrows) is probably the 38.2% Fibonacci retracement level.

The analysis has been done with the CAMMACD.MTF template.

For more daily technical and wave analysis and updates, sign-up up to our ecs.LIVE channel.

Author

Chris Svorcik

Elite CurrenSea

Experience Chris Svorcik has co-founded Elite CurrenSea in 2014 together with Nenad Kerkez, aka Tarantula FX. Chris is a technical analyst, wave analyst, trader, writer, educator, webinar speaker, and seminar speaker of the financial markets.