Currency Market: USD/CAD vs GBP/JPY, EUR/JPY, CAD/CHF

A mathematical division exists between and among currency pairs and prices. And ths division is how central banks price their respective currency pairs. Today's highlight is USD/CAD.

Note in Sunday's post for the mid point to 18 currency pairs equates to 1.2718. A vital number to view USD/CAD yet a vital number to insights for all 24 currency pairs. However today is USD/CAD.

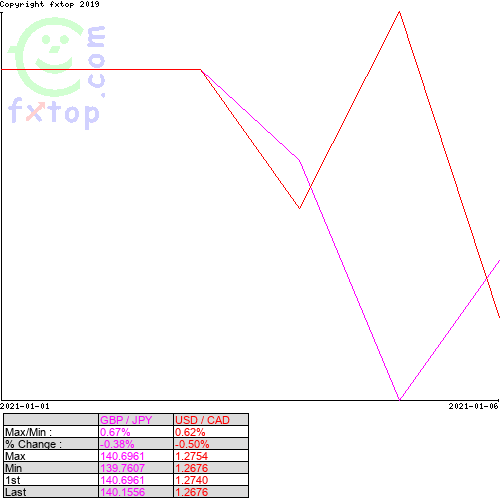

USD/CAD Vs GBP/JPY

1.2686 USD/CAD Vs GBP/JPY 140.49. USD/CAD absolute top is located at 140.49 or 1.4049. The correlation between USD/CAD and GBP/JPY runs minus 96%. This means a GBP/JPY rise equates to a USD/CAD drop. A USD/CAD rise equates to a GBP/JPY drop.

The Correlation also means USD/CAD at 1.2686 to GBP/JPY 140.49 or 1.4049. Re arrange retains the same Correlation.

The division from 1.4049 is 0.1363 or a mid point at 1.3367.

Now we have 1.4049 and 1.3367 as absolute tops for USD/CAD.

Most vital is the crossovers for currency prices and as can be seen from the bottom 1 week chart, USD/CAD crossed below GBP/JPY. Confirms not only the Correlation but a terrific and profitable trade that required no knowledge nor anything to do except 2 clicks for GBP/JPY and USD/CAD.

USD/CAD Vs EUR/JPY

Now break down USD/CAD further to EUR/JPY for additional tops and trades. The USD/CAD Vs EUR/JPY Correlation runs minus 96% and matches perfectly to GBP/JPY. Both EUR/JPY and GBP/JPY are the same exact pairs so Correlation will always match to USD/CAD.

USD/CAD 1.2686 vs EUR/JPY 127.21 or 1.2721. Both are trading in sync. And this means warning to big moves due to the similarity of prices. Forget the names and focus on prices.

Now we have an additional top for USD/CAD at 1.2721. The mid point math division at 17 pips is located at 1.2703 USD/CAD.

Together we have perfect math divisons at 1.4049, 1.3367, 1.2721 and 1.2703.

Note the 1 week chart, EUR/JPY and USD/CAD already crossed and a great trade. EUR/JPY due to the similarity of prices to USD/CAD will respond much quicker than GBP/JPY's far away prices. Its the lead / lag to currency pair prices.

If EUR/JPY crossed USD/CAD then GBP/JPY will immediately follow. Now we have an earlt warning to a great and easy trade for big profits.

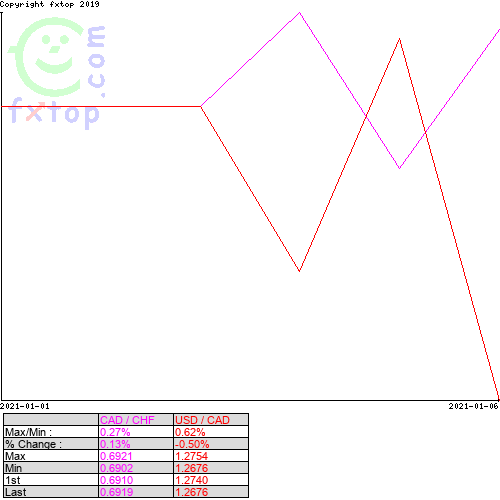

USD/CAD Vs CAD/CHF

CAD/CHF is found by division of USD/CHF and USD/CAD. The Correlation runs +44% and is fairly weak yet positive. CAD/CHF is a 0 point currency pair and not much assistance to USD/CAD except to know the Correlation is positive.

Then must view CHF/CAD at 1.4392 and USD/CAD 1.2721. A mid point at 0.0835 or USD/CAD 1.3556.

Together, we have 1.4049,1.3556, 1.3367, 1.2721 and 1.2703.

From the 1 week chart, CAD/CHF crossed above USD/CAD which means CAD/CHF, EUR/JPY and GBP/JPY crossed above USD/CAD and 4 trades.

Taken further as the mathematical division can go to every currency pair traded on the planet.

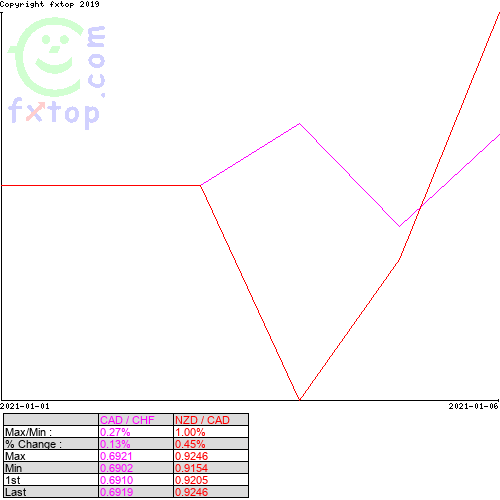

CAD/CHF 0.6934 Vs USD/CAD 1.2721 contains a mid point at 0.2893 and factors to 0.9827 or the AUD/CAD top.

See AUD/CAD highs Vs CAD/CHF 1 week chart

OR NZD/CAD Vs CAD/CHF

Author

Brian Twomey

Brian's Investment

Brian Twomey is an independent trader and a prolific writer on trading, having authored over sixty articles in Technical Analysis of Stocks & Commodities and Investopedia.