Crude oil prices soar after encouraging US inventories data

The price of crude oil rose in overnight trading after relatively impressive inventory data from the United States. According to the American Petroleum Institute (API), inventories rose by more than 5.7 million barrels last week. This increase was better than the previous week's increase of more than 1.6 million barrels. It was also better than the median estimate of 2.7 million barrels. The EIA will publish the official data later today.

The US dollar index was relatively unchanged in early trading as the market reflected on the relatively hawkish statements by Fed members. In a statement yesterday, Raphael Bostic, Richard Kaplan, and Esther George said that the bank could raise interest rates or taper asset purchases earlier than expected. This will depend on how fast the economy recovers this year. The price also reacted to the latest JOLTs job openings data. In total, the number of openings fell to 6.52 million from last month's 6.62 million. The currency will react to the latest CPI data from the US that will come out today.

The economic calendar will be relatively muted today. The only major event will be a speech by Christine Lagarde, the head of the European Central Bank (ECB). In her first speech of the year, she will provide more indications on the likely actions by the bank. Other important data will be the machine tools sales from Japan, wholesale prices from Germany, and the Eurozone industrial production. Traders will also be waiting for tomorrow's speech by Joe Biden about his stimulus plans.

EUR/USD

The EUR/USD pair bounced back after dropping in the past few days. It rose to 1.2215, which is slightly above this week’s low of 1.2135. On the four-hour chart, the price has moved above the 23.6% Fibonacci retracement level. It has also moved slightly above the 25-day and 15-day moving averages while the MACD has formed a bullish crossover pattern. The ADX, which measures the strength of a trend, has also declined slightly. Therefore, while the pair may rise to 1.2230, the overall trend is bearish.

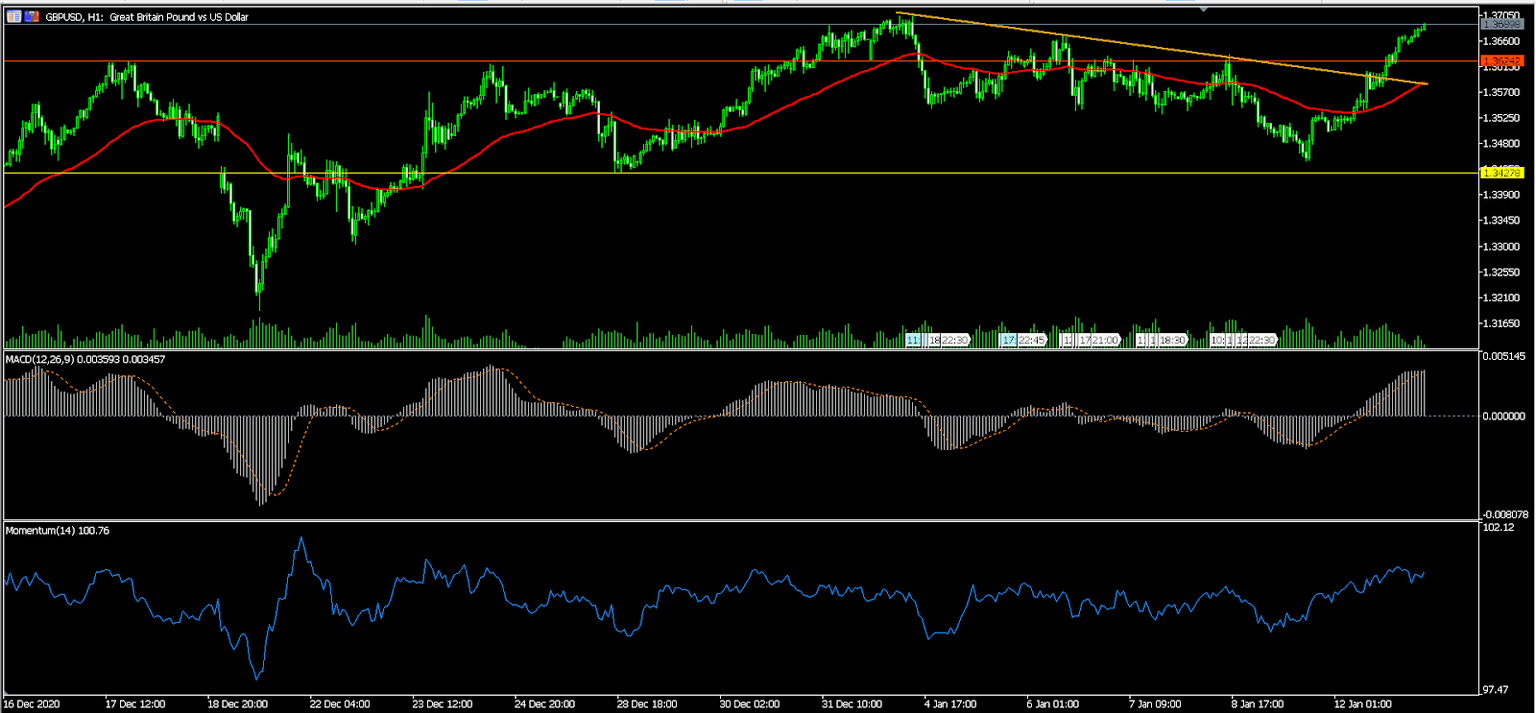

GBP/USD

The GBP/USD pair bounced back in overnight trading after BOE governor Andrew Bailey talked about the complexities of negative rates. The pair is trading at 1.3688, which is the highest level since January 4. It also moved above the descending trendline that touched the highest levels this year. It has also moved above the 25-day moving average while the momentum and MACD have continued rising. The pair will possibly continue rising as bulls target the next resistance at 1.3700.

XBR/USD

The XBR/USD pair rose to an 11 month high of 57.20. On the four-hour chart, this price is along the upper line of the Bollinger Bands. It has also moved above the short and longer-term moving averages while oscillators have continued rising. The pair will likely continue rising as bulls target the next resistance at $60.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.