Crude Oil Elliott Wave: Sliding into support

Executive summary

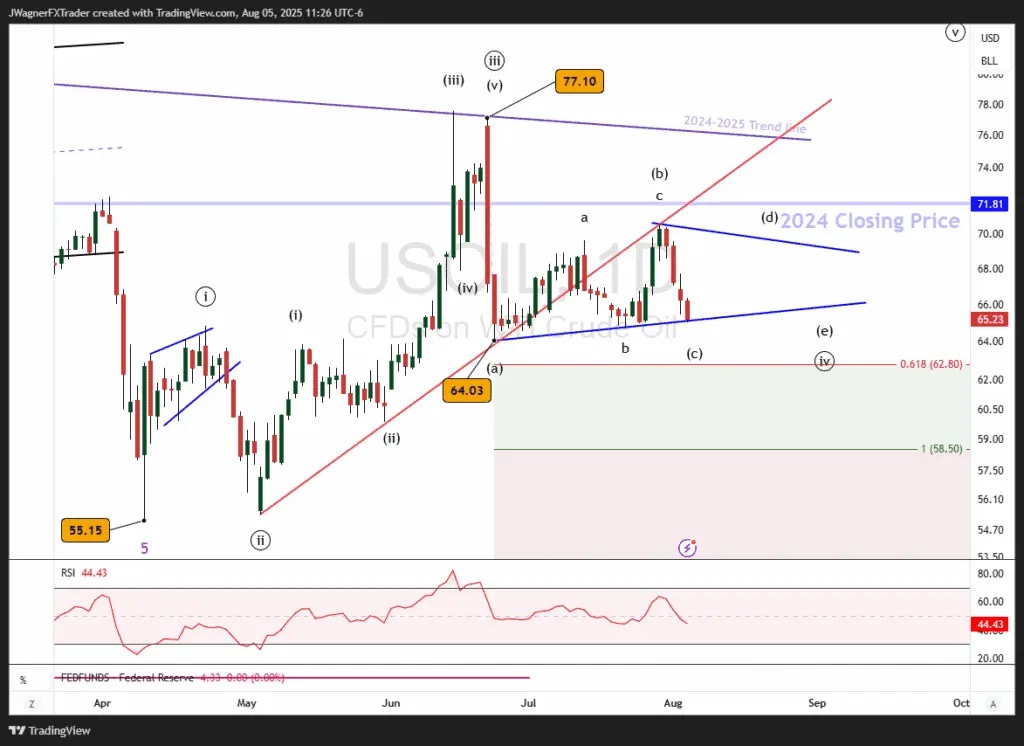

- Crude oil has been consolidating the May rally.

- We suspect a bounce rally may develop above $64.03.

- A break below $64.03 opens the door to $58.50.

Current Elliott Wave analysis

The analysis of Crude oil on the daily chart suggests that we are observing a corrective consolidation pattern. There are several options of patterns that could be developing. I suspect this is a symmetrical triangle where the wave (c) of the triangle is complete or nearly complete. This current decline would need to finalize above the wave (a) low of $64.03.

Under this Elliott wave count, a small rally in wave (d) would develop then another small decline in wave (e).

Once the triangle is completed, then a rally to retest the new all-time high near $77.10 and possibly higher levels.

There is a support trend line floating near the current price that may support and cause prices to bounce higher.

If Crude oil were to fall below $64.03, then we’ll consider a larger bearish zigzag pattern unfolding to $58.50. This price level of $58.50 represents the 100% Fibonacci extension of wave (a).

Bottom line

Crude oil appears to be nearing the end of wave (c) of ((iv)), a symmetrical triangle. Once the triangle pattern is completed, then a rally is anticipated to retest $77.10.

If $64.03 were broken to the downside, then Crude oil may target $58.50.

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.