CRB index reversal: Impact on commodities, inflation, and the Dollar [Video]

![CRB index reversal: Impact on commodities, inflation, and the Dollar [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Energy/Oil/oil-industry-6501390_XtraLarge.jpg)

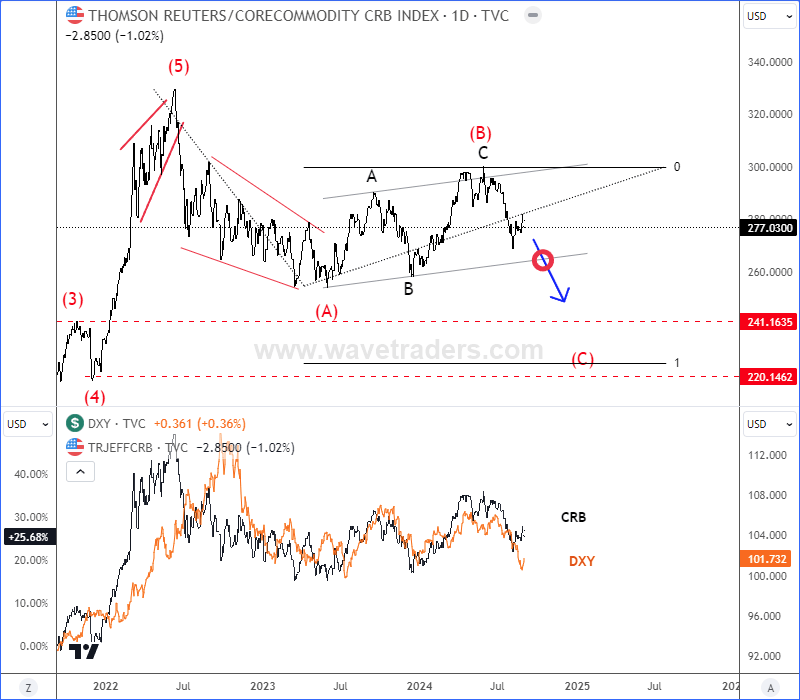

It’s been some time since we last looked at the Thomson Reuters CRB Index, a key indicator for tracking commodity performance and gauging inflation. With inflation softening recently, it’s not surprising that the CRB Index is also reversing. The chart shows a three-wave rally from the 2023 lows, which suggests a corrective movement in an ABC formation, as identified in Elliott Wave theory.

When a correction like this concludes, the next move typically retraces the previous rally. Looking at the CRB Index, we expect prices to move even lower, possibly down to 241. This decline could be further driven by falling crude oil prices, especially if OPEC increases supply as recently announced.

Some may wonder how this will impact the USD. Currently, the correlation is that lower commodities lead to lower CPI, which in turn suggests a lower USD due to expectations of Fed rate cuts. Until the Fed cuts rates a few times, the correlation between a lower CRB and a lower USD could remain in play due to falling US yields. However, once rate cuts are nearing their end, that’s when the dollar may find a bottom.

CRB vs DXY daily chart

If you are interested in detailed view and more analysis like this, you may want to watch below our latest recording of a live webinar streamed yesterday on Monday September 02 2024:

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.