China's bold stimulus measures: What it means for markets

After months of weak economic data and growing concerns over missing this year’s growth target, the urgency for aggressive policy support in China reached a peak.

Following last week's 50bp rate cut from the Fed and the resulting strengthening of the yuan, the People’s Bank of China (PBOC) now had a window to ease monetary policy without worrying too much about currency stability.

And they did!

Importantly, rather than implementing gradual, smaller easing measures, the PBOC took a more aggressive approach, announcing a series of bold moves aimed at stabilizing both the economy and the stock market.

A flurry of easing measures: "Stimulus blitz"

PBOC Governor Pan Gongsheng has unleashed a “stimulus blitz” – a coordinated set of policies intended to tackle economic headwinds. Here's what the PBOC rolled out:

-

7-day reverse repo rate cut by 20bps: The new rate stands at 1.5%, surprising markets that expected smaller, gradual cuts.

-

Reserve requirement ratio (RRR) cut by 0.5%: This move frees up 1 trillion yuan ($142 billion) in liquidity and could be followed by another 0.25-0.5% cut later this year.

-

1-year MLF rate cut by 30bps: Further easing to stimulate credit and investment.

-

Lower mortgage rates for existing loans: This was long expected and aims to provide relief for households, potentially boosting consumption.

-

Down payment ratio for second homes cut to 15% from 25%: Aimed at reviving property market activity, though the impact is likely limited given low sentiment.

-

Loan prime prate and deposit rate cuts: These will help mitigate the impact on bank margins, keeping financial institutions liquid.

-

500 billion yuan liquidity support for Chinese stocks: Funds and brokers now have access to PBOC liquidity to buy stocks, signaling strong support for equity markets.

Targeting multiple sectors

The PBOC’s measures go beyond just interest rate cuts. By lowering the reserve ratio, adjusting mortgage terms, and providing liquidity support for stock buybacks, the central bank has signaled its commitment to supporting various parts of the economy:

-

Property sector: Reduced mortgage rates and lower down payment requirements are meant to spark housing market activity. However, with overall sentiment still downbeat, this may not result in a rapid recovery.

-

Financial markets: The announcement of stock market support, combined with potential stock buybacks from listed companies, could stabilize the markets. Valuations are already low, and any signs of stability may attract bargain hunters.

-

Corporate liquidity: By freeing up liquidity for banks and brokers, the PBOC is clearly targeting increased lending and investment flows into risk assets.

The big question: Will it work?

While these moves are impressive in their scope, they raise several questions about sustainability.

There is no silver bullet that can bring China back to the double digit growth levels markets have been used to. There is no single policy step that will resolve China’s structural issues of debt, deflation and demographics. But the direction of travel is encouraging, and this can help to repair some of the confidence levels in the economy and policymakers.

What is still needed is execution of the announced measures, coordination from other policies particularly on the fiscal side, and more follow-up measures to continue the momentum.

Investors' outlook: Cautious optimism

Investors, burned by previous false starts, may remain cautious. However, with valuations at attractive levels, signs of stabilization could lure buyers back into the market. There’s plenty of money on the sidelines waiting for more concrete signs of recovery.

Another major risk that could counterbalance the positive effects of these stimulus measures is the upcoming US elections and the potential for increased tariffs on China.

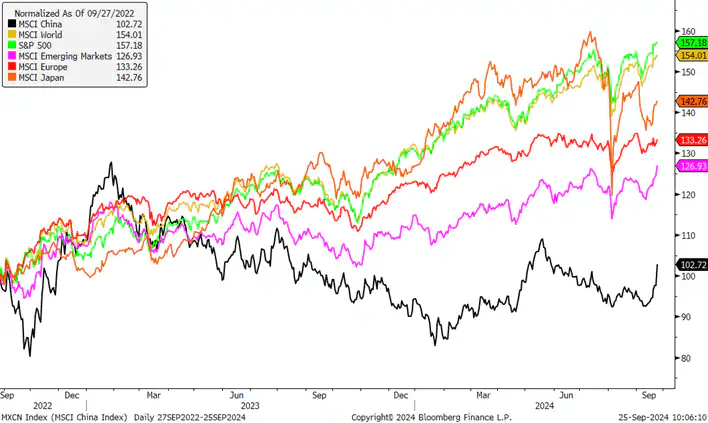

China equities are trading at a significant discount to global markets. Source: Bloomberg, Saxo

Read the original analysis: China's bold stimulus measures: What it means for markets

Author

Saxo Research Team

Saxo Bank

Saxo is an award-winning investment firm trusted by 1,200,000+ clients worldwide. Saxo provides the leading online trading platform connecting investors and traders to global financial markets.