China and India steer sentiment, US GDP and PCE decide the path

As we head into the final stretch of August, Asia’s throw of momentum into U.S. markets is setting the tone. China is testing key resistance on the CHN50, India is navigating tariffs and pattern risk, and all eyes are shifting to U.S. data — especially GDP and the Fed’s preferred inflation gauge.

US market bracing for key data

It’s shaping up to be a relatively quiet economic week, but the quality is high. Wall Street is keyed into two major reports:

- Q2 U.S. GDP (2nd estimate) — Recently revised upward to 3.3%, beating expectations and reinforcing the “Goldilocks” scenario of growth without overheating.

- July’s PCE/Core PCE (Friday) — Headline PCE is expected to hold at 2.6%, while core PCE may tick up to 2.9%, the highest since February. Persistent inflation here could complicate the Fed’s September rate-cut narrative.

Markets largely expect a 0.25% rate cut in September, priced in at around 85–90%. These data points will be the U.S. narrative anchor next week.

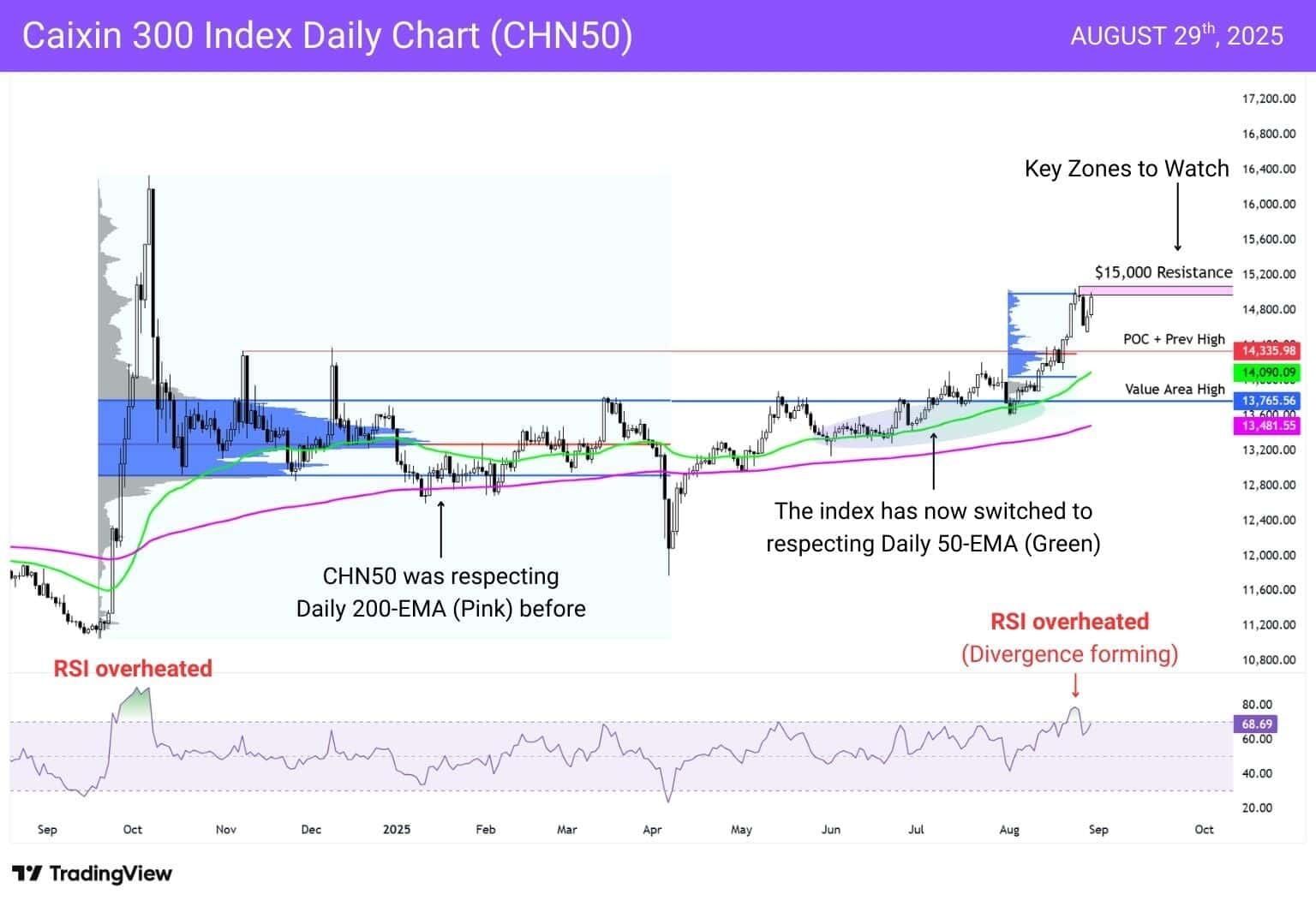

China: Bulls eye $15,000 on CHN50

The Caixin 300 Index (CHN50) has been climbing steadily all year and is now retesting $15,000, where it suddenly declined from on August 26th. A breakout from here warrants a close eye on the RSI momentum. The index is already overbought and a potential bearish RSI divergence could form, especially if a double top or rising wedge develops.

A rejection here could see us revisit:

- $14,355.98: Point of control and previous high.

- $14,090.09: Daily 50-EMA, now the short-term trend marker.

- $13,765.56: Value area high of 2024’s whipsaw consolidation.

Earlier in the year the index respected the 200-day EMA, shown in pink. That has shifted, and price is now tracking the 50-day EMA in green, a sign of stronger momentum and shorter-term trend control.

Fundamentally, the rally is fuelled by Chinese AI and semiconductor stocks, boosted by Beijing’s push for tech independence. This is bullish for local sentiment but complicated for U.S. names. Nvidia has already revised guidance excluding H20 sales to China and lost about $110 billion in market cap as investors digested the implications.

For U.S. traders, CHN50’s test at $15,000 is more than just a local milestone. A breakout would lift global semiconductor sentiment, but for Nvidia it underscores the market it cannot tap because of U.S. export curbs — a giant missed opportunity.

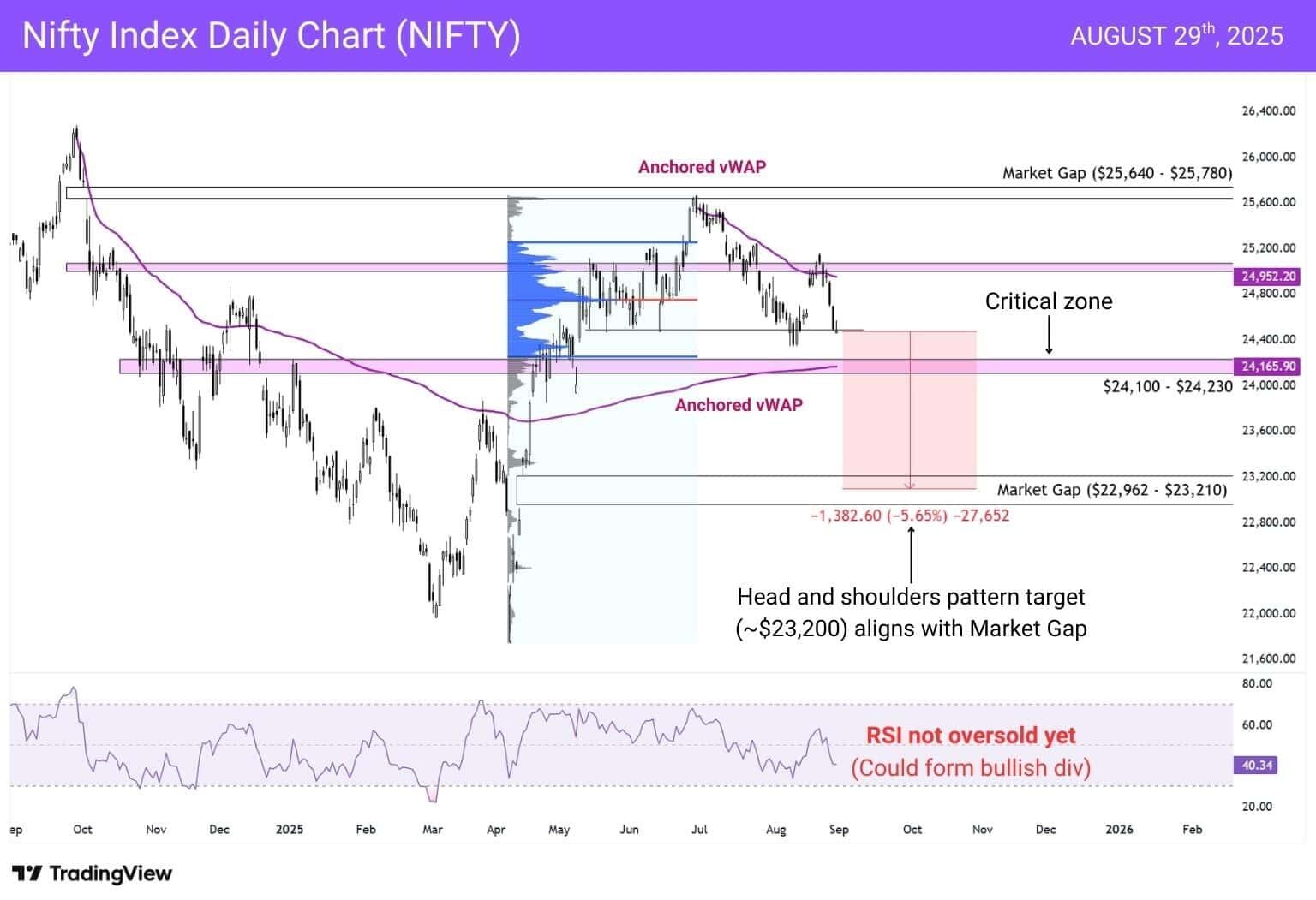

India: Tariffs weigh on Nifty

The Nifty Index is sitting right at a critical zone near $24,500, where the neckline of a potential head and shoulders pattern is being tested. The $24,100–$24,230 area is the key level to watch. It combines anchored VWAP, a previous support-resistance zone, and the value area low of the last bullish leg.

A break below this neckline could trigger a move toward:

- $24,100–$24,230: Demand zone with anchored VWAP support and VAL confluence.

- $22,962–$23,210: An unfilled gap that aligns with the head and shoulders target.

The U.S. has doubled tariffs on many Indian exports from 25% to 50% —impacting up to 55% of exports worth around $87 billion, including garments, jewelry, footwear, furniture, and chemicals.

Market response in India has been swift and negative. Equities dropped, especially in export-heavy sectors. Small and medium exporters are scrambling to reroute shipments to Europe, Africa, and other markets.

For U.S. markets, the direct impact is modest. Tariffs add to inflationary pressure and signal rising protectionism, but investors remain more focused on Fed policy. India’s struggles, however, could cool flows into emerging markets and weigh on U.S. small caps and cyclical sentiment.

Big picture: Asia’s signal to Wall Street

Asia is setting the mood, but the decisive cues will come from Washington. China’s breakout could energise global risk, India’s tariffs will test EM flows, and the Fed’s reaction to incoming data will ultimately set the tone for September.

Investors are juggling a three-way cross-current: China’s tech surge without Nvidia, India’s tariff drag, and the U.S. balancing act between growth and inflation.

In short, Asia is laying out the sentiment backdrop, but U.S. macro data — especially PCE and GDP — will dictate whether markets keep running or pause.

- China’s rally supports global risk appetite and semis but highlights Nvidia’s limited access to Beijing’s tech boom.

- India’s tariffs pressure exports and equity flows, a reminder of how trade policy can dampen emerging-market risk appetite.

- U.S. equities remain data-driven: with PCE, CPI, and jobs on deck, the Fed’s next move still sets the overall tone.

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.