Chart of the Week: Gold price reaches a wall of resistance

- XAU/USD has been in the hands of the bulls as fundamentals ripen.

- The charts, on the other hand, may paint a different picture, at least in the meantime.

Gold positions have got longer in both the futures and spot markets as the rate environment has become more favourable to the yellow metal as US nominal rates have started to trend lower which points to additional upward price pressure for XAU/USD. This means we should see additional short covering and new longs in the coming weeks.

A disappointing Nonfarm Payrolls report which has featured higher-than-expected wage increases and unemployment rates will likely see gold challenge technical resistance near $1,850/oz in the coming days or weeks.

This brings us to the charts.

The following is a top-down analysis that illustrates the structure of the market across the main time frames.

Monthly chart

While the fundamental bias is to the upside, the monthly chart still has some work to do before a convincing technical bullish case can be made.

The correction of the last bearish impulse is still too shallow at a 50% mean reversion.

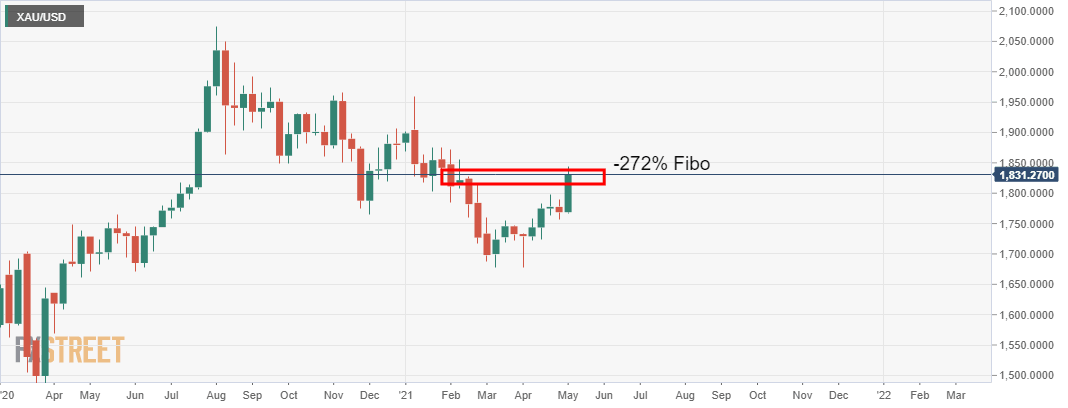

Weekly chart

The weekly chart shows that the impulse has made a -272% Fibonacci retracement of the prior bullish impulse as it takes on resistance.

Daily chart

Meanwhile, there is scope for a deeper retracement on the daily chart to test the 38.2% Fibo of the prior daily impulse.

However, the bullish close is compelling, which leaves an upside continuation deeper into the supply zone on the cards for the opening session.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.