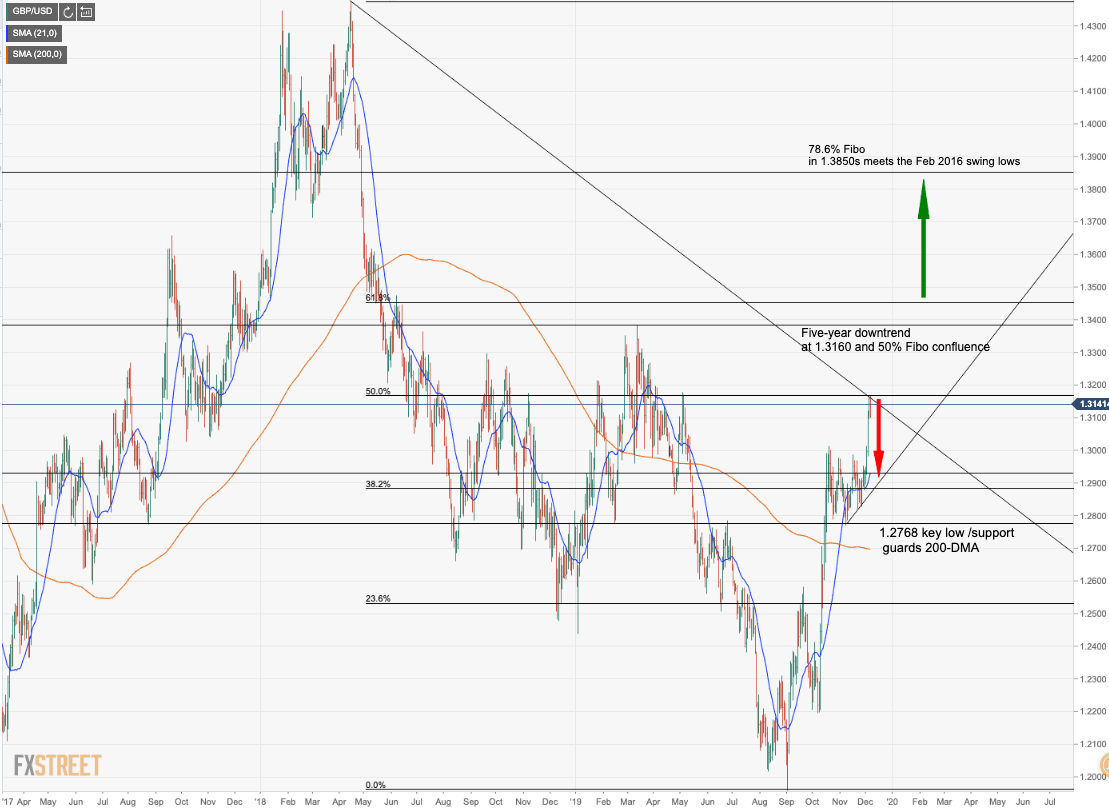

Chart of the week: GBP/USD bulls target closes above critical 1.3160/90 on UK election week

- UK elections in focus and GBP will be a major head-turner for the week ahead.

- With Tories leading weekend polls, the technical levels will come into play.

- Bulls will look for a crucial close above the five-year downtrend resistance area between 1.3160/90.

- Conversely, the 200-DMA will be in play at 1.2695.

- Bullish targets: 1.3160/87, 1.3380, 1.3850.

- Bearish targets: 1.3013, 1.2930, 1.2768.

The weekend UK polls continue to point to a Tory victory in this week's UK general elections and point to a potential retest of a key technical upside level of 1.3160 for the open.

Indeed, GBP/USD is technically bullish with a series of daily closes above the 38.2% Fibonacci of retracement of the mid-April and 3rd September range as well as the confluence of the assurgent 21-day moving average.

Bullish scenario

- Depending on what goes down in UK politics for the week ahead, the technical areas are well mapped, with bullish targets set on a firm break above the 50% mean reversion of the mid April-3rd September range in the 1.3160s and a five-year downtrend with a confluence of the 200-week moving average. 1.3187 May high reinforces the said resistance. Through the March 2019 highs of 1.3380, the 78.6% Fibo of the same range in the 1.3850s that meet the Feb 2016 swing lows will b a focus.

Bearish scenario

- Failures below the 1.3160s open downside risks towards the minor support area between the 1.3013 October high and the 21-day moving average around 1.2930, just above a prior 38.2% retracement. The 8th November low comes in at 1.2768 and guards the 200-day moving average at 1.2695.

4-hour outlook favouring an upward extension

"In the shorter term, and according to the 4-hour chart, technical readings continue favoring an extension upward, as the intraday slide was contained by buyers aligned around a firmly bullish 20 SMA, while technical indicators eased amid the pair holding within familiar levels, with the RSI steady at 70,"

– Valeria Bednarik, Chief Analyst at FXStreet.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.