Chart of the week: EUR/USD carry trade unwind done, mean reversion opportunities

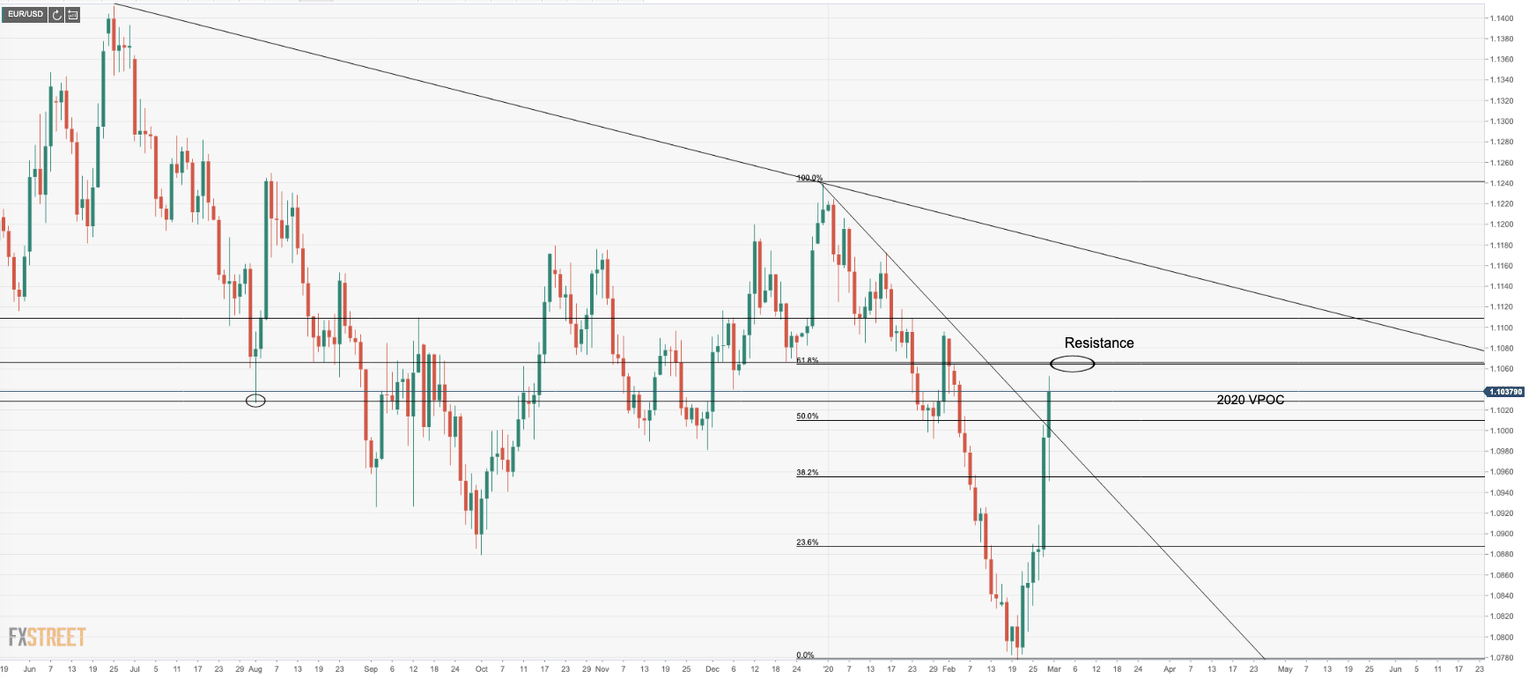

EUR/USD has been a funding currency of choice due to the second most negative implied yield in the G10 FX space behind the CHF. Prior to the coronavirus, in Sep 2019, we saw a low of 1.0879 due to weak eurozone fundamentals. Then, in 202, the US dollar took over as the driver and we saw a fresh low of 1.0779. We have seen a recent reversal of price to a high of 1.1053 due to what appears to be an unwind of the carry trade as investors seek to step away from the risks of the contagion effects of the global economy, buying back the euro that had been used as a liquid currency to finance risker investments at a low borrowing cost. This is what makes the charts so compelling and taking a deeper dive into the volume profile, technical analysis, we can assume a downside correction is on the cards as a low-risk trade set-up.

Weekly trendline (bearish below)

While there is room to the weekly trendline, the 1.1150s, there is a fairly high hurdle above 1.1095 (2020 VPOC) for a continuation of EUR/USD rally at this juncture. The path of least resistance appears to be to the downside when factoring in the volume profile and the 61.8% Fibonacci retracement of the 31st December peak to YTD lows. The 1.1095 (2020 VPOC) would usually act as a magnet/support/resistance target, so it should not be ignored at this juncture, despite the recent rally sitting in overbought conditions.

Daily chart, price runs towards 61.8% Fibo/resistance

The 2020 VPOC should prove to be a strong level of resistance and a level which bulls will target the accumulation of buy stop liquidity. On the daily chart, we now have a doji, (bearish). High volume nodes are accumulated below the close of 1.1025 and the prior day's VPOC is located at 1.0977, a support zone seen clearly on the 4-hour time frame and a 61.8% retracement of Friday's range.

4-HR support

The VPOC of Friday is located at 1.1000, a 50% retracement of the range which is the first target for a mean reversion trade. On a break and follow trough, beyond the aforementioned 61.8% retracement opens risk to 1.0950 and low volume nodes of price on Friday's session. Bears will be motivated on a spike of hourly sell tick-volume in the open with A/D moving back into distribution territories. 1.0920 guards a drop to 1.0870 according to VPOC, 25th Feb (correlates with a 161.8% Fibo).

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.