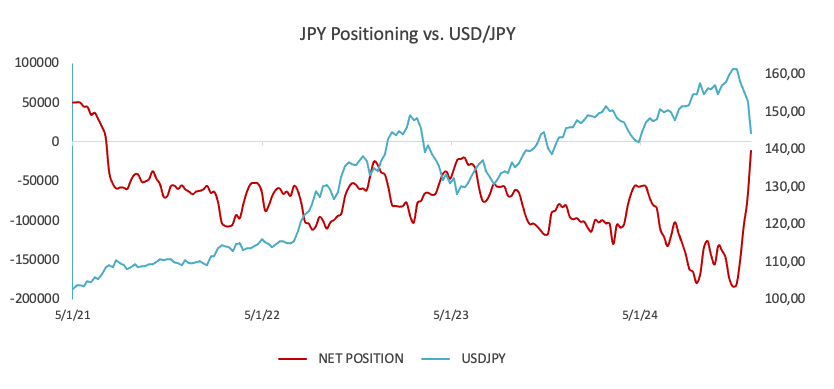

CFTC Positioning Report: JPY Net shorts at multi-year lows

These are the main highlights of the CFTC Positioning Report for the week ending on August 6.

- Net shorts in the Japanese yen extended their retracement during last week, this time reaching levels last seen in Q1 2021 around 11.3K contracts. During that period, investors continued to buy the Yen in response to the change of heart around the currency in the wake of the hawkish move by the BoJ at its meeting on July 31.

- The neutral tone at the FOMC meeting, disheartening NFP data, and the hawkish tilt by the BoJ reignited recession fears and sparked a pronounced sell-off in the US Dollar in tandem with speculation of an emergency rate cut by the Fed. That said, net shorts in the Greenback dwindled to eight-week lows, and DXY sank to multi-month lows near 102.15.

- Net longs in the European currency nearly doubled from the previous week. While EUR/USD managed to surpass the key 1.1000 barrier during the period, that move eventually fizzled out in the following days.

- Net longs in the British pound retreated to five-week lows in line with a poor performance of GBP/USD, which flirted with the critical 200-day SMA near 1.2660 as investors continued to assess the BoE’s interest rate cut on August 1.

- Gross longs in the Australian Dollar continued to edge lower last week, prompting net shorts to advance for the third straight week. Persistent demand concerns from China and the incessant weakness in commodity prices sent AUD/USD to new 2024 lows near 0.6350 just before the cut-off data on August 5.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.