Canadian jobs preview: Long-lasting volatility provides opportunities– Three USD/CAD scenarios

- Canada is expected to report an increase of only around 10,000 jobs in September.

- The low bar opens the door to an upside surprise that may benefit the loonie.

- FXStreet's volatility tools show that traders have time to digest the data and take advantage of any move.

Finding a job Canada has been easier than many expected in 2019 – and the employment report for September may repeat recent history. The Canadian jobs figures are not published alongside the US Non-Farm Payrolls, allowing the data to move USD/CAD on its own.

Scenarios: higher chances of an upside surprise

The FXStreet economic calendar is showing that actual employment change in Canada has beaten expectations in seven out of nine labor reports so far in 2019. Here are expectations vs. reality, dating back to mid-2016.

Moreover, expectations stand at an increase of 10,000 jobs, modest in absolute terms and also when looking at August's increase – 81,100 positions. While the economy likely gained fewer posts than in the previous month, a sharp slowdown seems somewhat over-cautious.

Therefore, the main scenario is for the actual figure to beat estimates – sending the Canadian Dollar higher. An increase of 20,000 jobs or more should be sufficient for an upwards move in the loonie.

In case Canada lost jobs last month, the loonie may extend its losses – driven so far by concerns about trade and falling oil prices.

Other factors that may influence the loonie

And in case Canada gained up to 20,000 positions, other factors may come into play. The Unemployment Rate stands at 5.7% and estimates stand at a repeat of that figure. Any deviation is dependent also on the Participation Rate – which is also projected to stay put at 65.8%. In comparison, the US jobless rate is only 3.5%, but participation is significantly lower at 63.2%.

If Canada's unemployment rate and participation rise at the same time, markets will likely regard it is good news – as it reflects more people drawn into the workforce. However, a drop in the jobless rate that is a result of fewer people participating in the labor force is adverse news.

The wildcard remains Average Hourly Wages. Annual salary growth accelerated to 3.78% in August. The rise in income is seen as a sign of a tight labor market and boosts the loonie. There are no expectations for September's wage numbers.

Level playing field for USD/CAD traders

The market reaction to the Canadian jobs report is relatively slow. USD/CAD tends to jump in the right direction – falling on robust Canadian data and rising on weak figures. Later on, it tends to advance gradually along with the trend. This behavior allows retail traders to digest the figures and jump on the trade.

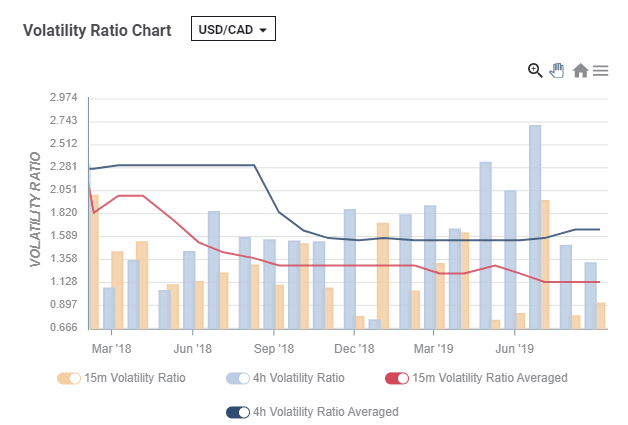

FXStreet's volatility tools are showing that in the past few months, USD/CAD price action in the four hours following the publication has exceeded movements in the first 15 minutes. The graph below shows how traders can still join the rally or sell-off after reading all the figures with cool heads.

Conclusion

Low expectations and a series of better-than-expected headline job figures imply higher chances that Canada's job growth easily surpasses 10,000 job gains expected. In that case, the Canadian dollar may rise. If the nation lost positions in September, the loonie has room to fall. If the actual figures meet expectations, other job figures will likely play a role in determining the trend. The USD/CAD reaction is slow and price action lasts longer, allowing retail traders a level-playing field with the big investors.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.