Canadian dollar surges, BoC next

Bank of Canada likely to show caution

The spotlight will be on the Bank of Canada today, which holds its final policy meeting of this year. Lurking in the background is the Omicron variant, which caused a panic in the financial markets over fears of a new wave of Covid. These concerns have subsided and risk appetite has returned. The Canadian dollar has benefitted from higher risk appetite, as USD/CAD has fallen 1.52% this week.

The BoC is unlikely to deliver any surprises at today’s meeting. The bank will maintain the cash rate at 0.25%, and with QE all wound up, the next question is when will the bank press the rate trigger? The markets are projecting a rate hike early next year, perhaps as early as January. The markets have been more hawkish about a rate hike than the BoC, although the bank has brought forward its guidance to mid-2022, after admitting that inflation will be higher and last longer than the bank had expected.

Canada’s economy is improving, and there are a number of factors which support a rate hike sooner rather than later. The November jobs report was much stronger than expected, inflation has hit 30-year highs, and the red-hot housing market bubble could burst. If there is a good reason to be cautious, it is due to concerns over Omicron. Preliminary reports show that the variant is very contagious but appears less severe than previous Covid variants. The BoC won’t have the luxury of seeing additional data about Omicron before the meeting, and may try to dampen expectations about a rate hike by saying that more time is needed to assess the impact of Omicron. If the bank surprises and sends a hawkish message to the markets, the Canadian dollar should be able to extend this week’s impressive rally.

USD/CAD technical

-

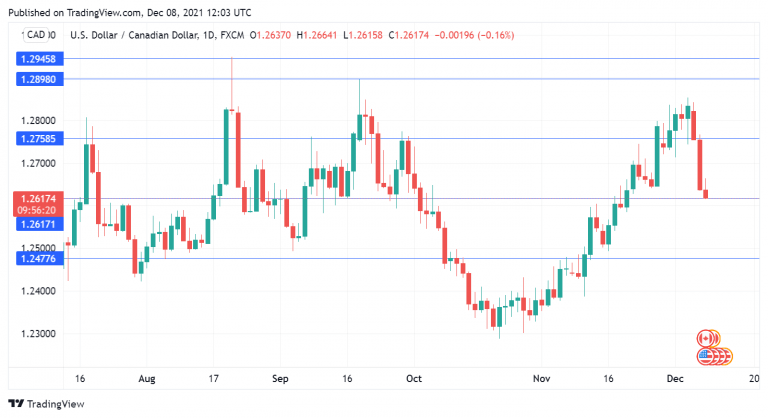

USD/CAD continues to fall and break below support levels. The pair is testing support at 1.2618. Below, there is a monthly support line at 1.2477.

-

There is resistance at 1.2758 and 1.2898.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.