Bulgaria on track to adopt the Euro, supporting the economic outlook

With inflation under control, Bulgaria is on track to adopt the euro in January 2026, a development which would support the stability of the highly euro-ised economy, improve monetary-policy flexibility and enhance the sovereign’s capital-market access.

Bulgaria’s potential adoption of the common currency would support potential growth of around 2.75% a year and accelerate convergence towards average European Union living standards.

Bulgaria formally requested that the European Commission (EC) and the European Central Bank (ECB) assess the country’s readiness for joining Economic and Monetary Union on 25 February. This represented a crucial step that placed the decision about accession in Europe’s hands, prudently distancing the decision from persistent domestic political divisions on the subject.

Scope Ratings (Scope) expects the ECOFIN Council to approve Bulgaria’s accession by 8 July after this week’s publication of the special convergence report. Recent feedback from European institutions has favoured Bulgaria’s entry. If successful, this would expand the euro area to 21 member states, following Croatia (2023), Lithuania (2015) and Latvia (2014).

Meeting inflation criterion underpins accession case

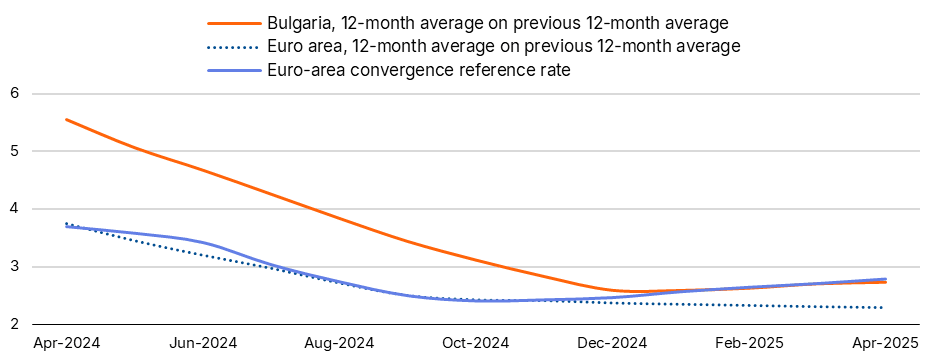

Bulgaria’s efforts at controlling inflation have proven crucial in advancing its bid to join the single currency. Price stability has proven the most challenging of the core euro-convergence criteria over recent years. The harmonised annual inflation rate moderated to 2.8% in April from 4.0% in March. The 12-month-on-12-month rate – the convergence criterion – remained at 2.7% in April, broadly in line with the benchmark of the average of the three euro-area member states with the lowest rates of inflation (France, Cyprus and Luxembourg in April) plus a 1.5pp tolerance margin – totalling 2.8%.

Importantly, Bulgaria currently meets the inflation criterion even without the exclusion of outlier countries in the EC’s and ECB’s calculations, a factor that played a role in Croatia’s approval for entry in 2022. In addition, Bulgaria has typically had comparatively modest inflation, a trend that may reassert itself. Scope forecasts that consumer-price inflation will average an elevated 3.4% this year before falling to 1.6% next year.

Bulgaria meets the final euro convergence criterion as inflation falls

Harmonised inflation, annual change, %.

Note: the reference rate represents the average of the three lowest 12-month-on-12-month inflation rates among euro-area member states (within this illustration, excluding any outliers, which are decided by the European Commission and the European Central Bank), plus a 1.5-percentage-point tolerance margin. Source: Eurostat, Scope Ratings.

Political divisions, amid calls to halt accession process, have proven the main risk to euro adoption

A primary risk to Bulgaria’s accession remains domestic political fragmentation. Sharp divisions between those favouring deeper integration within the EU and those preferring rapprochement with Russia were reflected in the seven general elections held since 2021. This split has compromised government reforms required for the adoption of the euro, resulting in years-long delays to the process.

Divisions regarding the pace of accession persist within the governing coalition, while pro-Russian opposition group Vazrazhdane (Revival) has called for a referendum on euro adoption to seize on public unease about higher inflation if Bulgaria joins the euro and the fiscal challenges facing some euro-area countries.

Pro-Russian President Rumen Radev has backed the idea of a referendum, but the right to call one rests with parliament where the majority of pro-euro parties have rejected the proposal. Radev has referred the matter to the Constitutional Court, but this is unlikely to disrupt the euro-accession timetable.

Fiscal position remains sound, although deficits have risen

Another concern for accession has been the government’s fiscal position. The country has a record of moderate budget deficits and comparatively low public debt, but recent increases in state spending on salaries, pensions, defence and measures to ease the cost-of-living crisis have challenged this record.

Nevertheless, the general government deficit was unchanged at 3.0% of GDP last year from the year before due to strong revenue growth. The authorities have committed to a budget deficit of 3.0% of GDP this year. General government debt will rise steadily, reaching 34% of GDP by 2030 from 24% at end-2024, though remaining among the lowest within the EU.

The EC favourably assessed Bulgaria’s medium-term fiscal-structural plan for 2025-2028 early last month, which is a positive step for euro adoption, suggesting public finances remain stable and sustainable.

Fiscal metrics remain sound, even though deficits are wider and debt is increasing

% of GDP.

Source: IMF World Economic Outlook data, Scope Ratings forecasts

(Brian Marly, a senior analyst of sovereign ratings at Scope and lead sovereign analyst for Bulgaria, contributed to writing this commentary)

Author

Dennis Shen

Scope Ratings

Dennis Shen is Chair of the Macroeconomic Council and Lead Global Economist of Scope Ratings, the European rating agency, based in Berlin, Germany.