BTC/USD approaches key resistance as sentiment improves

The Australian dollar tilted higher in early trading even after weak flash manufacturing and services PMI data. According to Markit, the services PMI declined from 44.2 in July to 43.3 in August. In the same period, the manufacturing PMI declined from 56.9 to 51.7. This performance was mostly because of controversial new lockdowns. Some of these lockdowns could go on for weeks as New South Wales recorded more than 818 new cases today. Further data showed that a quarter of all patients in ICU in the country were below the age of 40.

US and European futures rose in early trading as the market reflected on the improving situation in China. In a statement, the country’s government said that it recorded zero new local transmission. This happened after the country recorded more cases last week, pushing the government to record some lockdowns. The indices rose even as investors continued buying the dips after last week’s substantial sell-off. Meanwhile, Treasury yields ticked up while the US dollar declined. Further, the equities are rising because of the price of crude oil and the upcoming Jackson Hole symposium.

The economic calendar will be dominated by the upcoming flash manufacturing and services PMI numbers by Markit. The overall estimate is that the financial market remained steady in August even as countries continued dealing with the Covid-19 pandemic. In the Eurozone, analysts expect the data to show that the manufacturing PMI declined from 62.8 to 62.0 while the services PMI fell to 59.8. In the US, the two are expected to decline slightly to 62.8 and 59.4. The next key data to watch will be the existing home sales from the US. These sales are expected to have dropped from 5.86 million to 5.81 million.

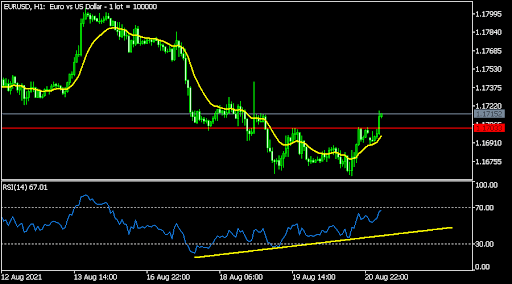

EUR/USD

The EURUSD pair popped in early trading as the risk-off sentiment eased. The pair rose to 1.1715, which was the highest level since August 18. On the four-hour chart, the pair managed to move above the 25-day and 15-day moving averages. It also rose above the key resistance at 1.1700 while the Relative Strength Index (RSI) has formed a bullish divergence, The pair also seems like it has formed a double bottom pattern. Therefore, the pair will likely keep rising as bulls target the next key resistance at 1.1750.

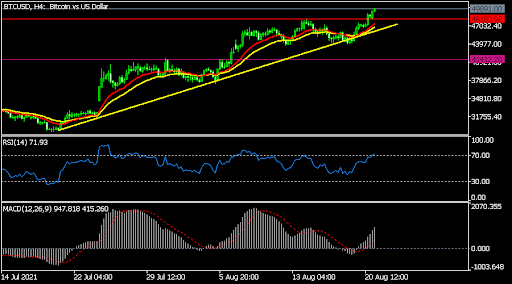

BTC/USD

The BTCUSD pair approached the 50,000 milestone during the weekend as enthusiasm about cryptocurrencies rose. The pair is trading at 49,900, which is above the short and longer-term moving averages. It has also moved above the upper side of the ascending channel. It also rose above the key resistance level at 48,183, which was the highest on May 16. Its MACD and the Relative Strength Index (RSI) have been on a bullish trend. Therefore, the pair will likely keep rising as bulls push it to 50,000.

AUD/USD

The AUDUSD pair rose to 0.7155, which was the highest it has been since Monday last week. The pair also formed a double-bottom pattern at 0.7100. It also rose slightly above the 25-day moving average while the MACD and the Relative Strength Index (RSI) have been in a strong bullish trend. The pair will likely keep rising with the next key target being at 0.7200.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.