British pound forms symmetrical triangle after the BOE decision

The euro rallied after the relatively strong European retail sales numbers. According to Eurostat, the bloc’s retail sales rose by 2.7% from February to March. This was better than the median estimate of 1.5%. The sales rose by 12% year-on-year, better than the expected increase of 9.6%. Recent numbers from the bloc have been relatively weak because of the third wave of the virus that spread in the first two months of the year. There is a possibility that the bloc will see a quicker recovery as countries accelerate their vaccination process.

The British pound rose after the Bank of England delivered its interest rate decision. The bank decided to leave its interest rate unchanged at 0.10%, as expected. The vote was unanimous, with all 9 members supporting the measure. The bank also decided to continue with its asset purchases to continue supporting the economy. The decision came at a time when data from the country has been relatively positive. Earlier today, data by Markit revealed that the UK services PMI increased to 61.0, better than the expected 60.1. This growth led to the composite PMI rising to 60.7.

Global stocks were little changed as the market continued to reflect on the potential of higher interest rates. In the United States, futures tied to the Dow Jones and S&P 500 index declined by 17 and 5 points, respectively. In Europe, the DAX index and the FTSE 100 indices declined by more than 0.20% each. There are concerns that global central banks will start to hike interest rates to prevent the economy from overheating. Furthermore, data from most developed countries like the United States and the UK has been relatively positive.

GBP/USD

The GBP/USD rose to an intraday high of 1.3916 today. On the four-hour chart, the pair has formed a symmetrical triangle pattern while the Relative Strength Index (RSI) is at the neutral level of 56. The pair is also slightly above the 25-day moving average. It is also inside the Ichimoku cloud. Therefore, the outlook for the pair is neutral as focus shifts to the upcoming non-farm payrolls data.

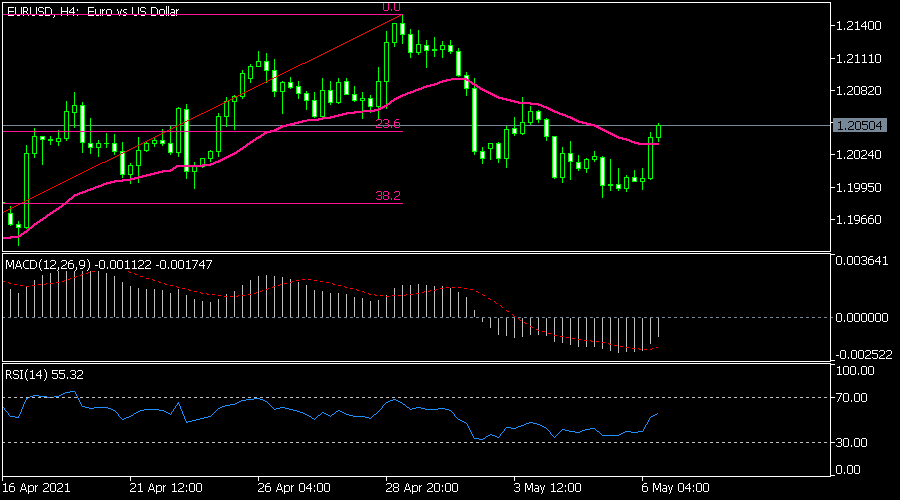

EUR/USD

The EUR/USD pair bounced back after the strong EU retail sales numbers. On the four-hour chart, the pair rose above the 23.6% Fibonacci retracement level. It also rose above the 25-day moving average while the signal line of the MACD has formed a bullish crossover. The Relative Strength Index (RSI) has also started rising. Still, since the pair has formed a head and shoulders pattern, there is a possibility that it will breakout lower.

USD/CHF

The USD/CHF pair declined to an intraday low of 0.9093 today. On the four-hour chart, the pair moved below the 61.8% Fibonacci retracement level. It is also slightly above the important support at 0.7700 and below the two lines of the envelopes indicator. The RSI has also pointed lower. Therefore, it will likely break out lower as bears target the important support at 0.900.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.