BRICS will likely remain a weak group without global muscle

Outlook

Here we go again: Trump said in a televised cabinet meeting that “We should get somebody in there that’s going to lower interest rates,” referring to Fed chief Powell. (Trump is pretending Powell lied to Congress about the cost of building renovations. If that were factually true, it would be just cause for firing him. That Trump is not firing but only demeaning him indicates the accusation is not true.)

Today the WSJ has a story titled “Two Kevins Battle to Be Next Fed Chair in Trump’s Apprentice-Style Contest.” Kevin Hassett has met with Trump at least twice in June.

Warsh is a Fed Gov and the previous front runner. The article is full of juicy nuggets about the two guys but they are irrelevant in the face of the main point—Trump’s demand that everyone who works for him must do as he says out of loyalty, regardless of facts.

Never mind that the Fed chair does not work for the president and the Fed is designed to be politically independent. Analysts and managers all agree that the Trump threat to the Fed’s independence is a big negative for sovereign bonds and the dollar.

According to Heisenberg, reserve managers were asked by UBS to rank the importance of various factors that are likely to come under threat in the near future and influence their asset allocation. Some 40 central banks were in the group. A whopping 65% named Fed independence. Next were data quality/government independence and transparency with 47%, and social cohesion, also with 47%.

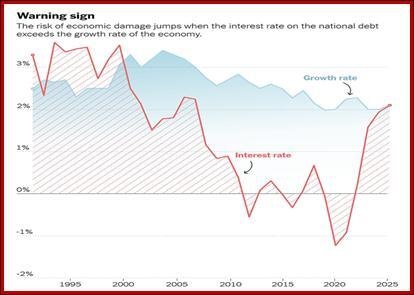

One point against Warsh—he would be okay with a rate cut if the deficit could be managed down. Now cue the bear—Bernstein’s substack today brings out the unhappy idea that a deficit is okay as long as the GDP growth rate is higher than the cost, aka the bond yield. See the chart.

And today we get another Atlanta Fed GDPNow. Last week it was a small rise to 2.6%. That’s for Q2, not the whole year. If it were to become the annual rate, it would be well under any of the T-bill and note yields. The 4-week is 4.17%; the 3-month, 4.26%, the 6-month, 4.303% and the 2-year, 3.897% as of 8 am. It’s possible we are missing something here but we say the chart is scary.

The news today includes the sale of $39 B in 10-years plus wholesale inventories (pre-tariff buying) and the Fed minutes, now irrelevant. We have plenty of juicy stories about the EU-China stand-off at the OK corral, the deteriorating UK political scene, and other politically related issues (Trump is mad at Putin), but honestly, it’s only the US economy that counts. The key question is whether it’s strong enough to overcome the stupid roadblocks put up by an ignorant and reckless president.

Forecast

We have a case of the dog that didn’t bark in the night. Trump offended with shocking announcements, again, and the financial markets are acting as though he’s not there at all. This can mean they expect him to retreat, as before, or that the US economy can withstand and bat away whatever he throws at it. This makes Trump a nuisance rather than a primary player, and once he figures that out, there will be hell to pay. He is sure to retaliate, just to regain the spotlight.

Before the next Trump assault on good management and common sense, it looks like a lower low for the euro and most other currencies before anti-dollar sentiment takes the reins again. It’s not clear why this is happening except position adjustment.

We need to worry about that dollar oversold condition. When everybody and his brother is short dollars, there is no one left to keep the trend going. Well, not anyone with real heft. Remember that the BoA/ML survey of top managers showed they are the most short dollars in over 20 years. At some point, sentiment runs into the brick wall of positioning capability. Traders may still believe the dollar “should” be endlessly weaker, but that’s not how the world works.

And in any case, traders get tired of the same old, same old. This is not to disparage traders, but to point out they are always on the lookout for the latest, newest, shiny stimulus that will drive sentiment and positioning. It’s possible that what we emphasized last week is gaining traction: the US economy is vast and resilient. Not even Trump can bring it to its knees.

Tidbit: It used to be that BRIC was Brazil, Russia, India and China and was formed in 2001. Goldman Sachs gave it the moniker. South Africa made it five in 2010 after attending the first summit in 2009. Now it has expanded to ten and includes Egypt, Ethiopia, Indonesia, Iran and the United Arab Emirates. The original idea came from Russia, even though Russia’s importance has faded considerably. Turkey was invited to join last fall but has not yet done so.

Trump got upset about the anti-American policies of BRICS but in practice, the spread of pro or anti-Americanism is very wide and can’t be pinned down to a catchy phrase. Some of the members are literally at war with one another sometimes (China and India). The UAE is hardly a member of what we used to call “emerging markets” or in olden days, “less developed countries.” Note that important EM’s are missing, like Mexico and the rest of Latin America, Africa and Asia. In fact, BRICS is an odd hodgepodge.

BRICS has almost half the population of the world and about 40% of global GDP. How can it be ignored? Well, one reason to diss BRICS is that it can’t manage its way out of a paper bag. This puts it on a par of mismanagement with Trump, but Trump actually has real power, as we saw with the bombing in Iran.

BRICS has no central governing power over members. It has no army and more to the point, no currency. Remember that when the European Union was being formed and later part of the EU became the EMU, it was always acknowledged that a common currency that facilitated open trade was the linchpin of unity, and along with a common currency came a central bank. Open borders for immigration came later.

BRICS countries can’t manage their own central banks and currencies, let alone agree on common institutions. There is sporadic talk of a common currency backed by some 40% in gold and the rest in a basket of member currencies, but it’s hard to see how it can be established from scratch, especially with some countries (Iran, Ethiopia) in deep financial trouble and others (UAE, Brazil) with well established (if not well-run) institutions. A currency has to have the “full faith and credit” of the issuing entity. A few members could conceivably assert that (Brazil), but who would buy a bond issued by an entity that contains Ethiopia and Iran?

Some are oil producers and most are not. Some are Muslim and most are not. Some are really big (China, Brazil, Indonesia) but most are not.

BRICS will likely remain a weak group without global muscle. We still await a specific, meaningful announcement that has real economic or political impact. That doesn’t mean it can’t have huge rhetorical power. We just saw that when Brazil’s president told the world (re Trump) “We don’t need an emperor.” It got Trump’s goat.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat