Brexit – Sterling and UK100

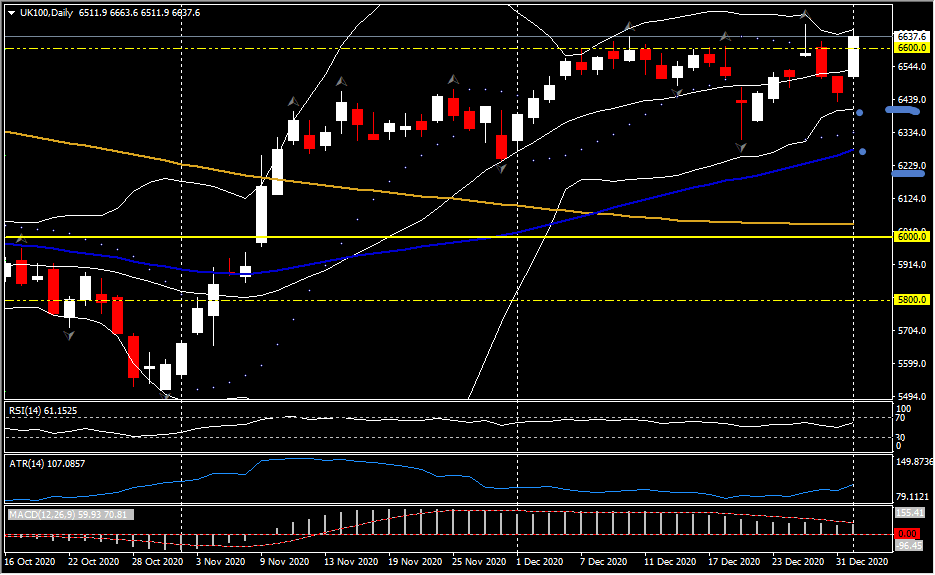

UK100

A Brexit deal materialized on Christmas Eve, and was ratified by the UK parliament and unanimously approved by all 27 EU ambassadors. The deal took effect on January 1, and in the eurozone is operating on a provisional basis until the EU parliament members have formally ratified it. The UK has left the EU’s common market and customs union, and freedom of movement has ended. The new relationship will be governed by the “Trade and Cooperation Agreement”, which will provide tariff and quota free trading of goods between the EU and UK. With regard to fishing rights, the EU will give up 25% of its existing quotas in UK waters over a five-and-a-half-year transition, after which there will be annual renegotiations.

EU law will cease to apply in the UK, and the jurisdiction of the European Court of Justice will end. The biggest hurdles to a deal being reached were the level playing field rules and state aid issues, which were overcome with the principle of “managed divergence”, which gives both sides the right to a judicial review and possible retaliation if they believe the other side has gained an unfair competitive advantage. Overall, the major red lines of both sides have been respected. The EU’s “four freedoms” — the free movement of goods, services, capital and people — have been preserved, while a hard border on the island of Ireland has been avoided.

From the UK’s perspective, a free trade agreement on goods has been achieved, full sovereignty in setting laws has been returned, and a digestible compromise was found on fishing rights, while the “managed divergence” pathway, rather than the Brussels-favoured “dynamic alignment” path, proved to be crucial in avoiding a no-deal scenario. Ahead, there are many challenges, but also opportunities for the UK. Trading frictions (aka non tariff barriers) will rise, while the UK’s service sector will face major long-term challenges. Regarding financial services, which is a crucial generator of tax revenue in the UK, the EU’s system of equivalence — which grants market access to foreign banks, insurers and other financial firms if their rules and standards are deemed by Brussels to be sufficiently close to EU rules — should maintain London’s dominance in this area, at least for now. Financial centres on continental Europe lack the critical mass to compete with London in many areas. Over time, this is sure to change, though the UK government is aiming to offset this by attracting greater business from other parts of the world, such as in tech finance. The EU and UK relationship will be an evolving one, and there will be lots of tweaks to the agreement in the months and years ahead.

Overall, Sterling has continued to accrue following the deal and the UK100, which spent most of 2020 underperforming, is showing significant signs of life as key levels continue to be tested. The UK100 leads the way in Europe today, up nearly 3% as of 10:15 GMT. The GER30 and CAC40 are posting gains of 1.3% and 1.8% respectively, despite the prospect of prolonged and/or tightening virus restrictions in many parts of Europe, with the UK in particular struggling with a surge in new case numbers that are likely to swell hospital admissions in coming weeks. The ongoing virus situation is likely to also ensure ongoing central bank support.

Author

With over 25 years experience working for a host of globally recognized organisations in the City of London, Stuart Cowell is a passionate advocate of keeping things simple, doing what is probable and understanding how the news, c