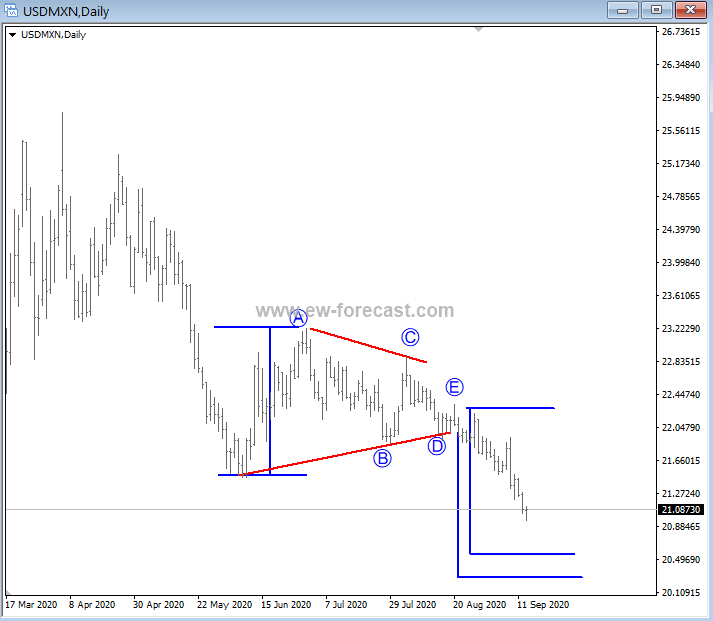

Breakout of a triangle on usdmxn – Elliott wave analysis

Hello traders,

In this analysis we will talk about a triangle pattern. Those who are familiar with them, will know that these are one of the most popular patterns. The reason why they are so interesting is because while they are unfolding, momentum is decreasing, volume is low, therefore everyone wants to catch the breakout, because we know that sooner or later every correction comes to an end. And very often moves out of a triangle are sharp and fast!

One of a triangles that we recently recognized was on USDMXN that we covered also back in August in this article.

What happened since then is a breakdown that can still continue towards the target. But if you dig deeper into the Elliott wave triangles then you will know that new reversal may show up in a few weeks, as this breakdown can be final leg withing a higher degree of a trend as I describe below.

USD/MXN, daily

However, not all of the triangles are easy to be recognized, and that is where Elliott Wave shows its strength. Theory suggests that triangle unfolds in five waves, A-B-C-D-E, so if you know the wave principle and you see five subwaves, then you can already be one step ahead of others because it indicates that potential breakout is coming. Another thing that is very important is that triangles occur within ongoing uptrend, so you know in which direction the breakout is most-likely going to happen.

Also, its very good to know in which position of an Elliott Wave cycle do triangles occur. It can occur in wave 4 of an impulsive structure, wave B, and in wave X. By understanding the Elliott Wave theory you know that once a triangle is complete the market is very often going to make a final move within a higher degree of a trend. So, not only that you spot the direction of a breakout but also understand that after that breakout, the market can be in final part of a higher degree structure.

Triangle with Fibonacci application and guidelines.

Want more Elliott Wave Analysis on a daily basis? Click Here And Try our services for 7 Days

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.