Biden trade policy: Status quo ante?

Executive Summary

President Trump ushered in a new era of trade policy in the United States over the past three years where bilateral trade agreements and tariffs turned the tide toward a protectionist stance. This was most recognizable in the U.S.-China trade war, with each country steadily increasing tariffs and barriers on the other. Trade tensions also escalated with some of America's key allies, such as the European Union, Canada and Mexico.

President-elect Biden likely will conduct trade policy differently than his predecessor, but we remain skeptical that he will completely revert back to the pre-Trump era of trade policy. We expect that Biden will be slightly more protectionist than President Obama, but we also look for him to be more cooperative and less confrontational, particularly with allies like the European Union, than President Trump. In this report, we discuss which tariffs are currently imposed, how trade policy may shift under President-elect Biden and what this means for trade flows and currencies.

Trade to Remain In Focus

On January 20, 2021, former Vice President Joe Biden is expected to be sworn into office as the 46th president of the United States. But it is looking increasingly likely that President-elect Biden will face a divided Congress. Of course, control of the Senate comes down to the two run-off elections in Georgia on January 5. For the Democrats to gain control of the Senate, they would need to win both of the seats up for grabs, resulting in a 50-50 tie in which Vice President-elect Kamala Harris would cast the deciding vote in favor of the Democrats.

In the event Biden does in fact face a divided Congress, or even in the slim chance that Democrats narrowly take control of the Senate, we suspect it will be difficult for Biden to pass sweeping policy legislation. Instead, we expect Biden will focus on efforts where the executive branch has unilateral power, such as trade policy in which we have seen President Trump take action during his presidency.

On Which Countries Are Tariffs Currently Imposed?

The Trump administration has threatened or imposed tariffs on many of America's trading partners over the past few years. These trade partners include, but are not limited to, China, the European Union (EU), Canada and Mexico, countries which accounted for 60% of total U.S. trade in 2019 (Figure 1).

Perhaps the most economically significant as well as headline grabbing has been trade tensions between the United States and China. Over thepast few years, the Trump administration has imposed multiple rounds of tariffs on imports into the United States from China, while Chinese authorities have imposed retaliatory tariffs against the United States. As a quick reminder, U.S.- China trade tensions began in the summer of 2018 with President Trump placing a 25% tariff on $50 billion of Chinese imports. Multiple rounds of additional tariffs occurred in 2018 and 2019, including a U.S. imposed 25% tariff on $200 billion of goods as well as a 15% tariff on $120 billion of goods (Figure 2). In response, China placed tariffs (5%-10%) on an additional $75 billion of American imports.

The two countries reached an agreement on a Phase I trade deal in late 2019, which dialed back trade tensions. The United States agreed to cut the 15% tariff rate on $120 billion of Chinese imports to 7.5%. In return, China agreed to increase purchases of U.S. products by at least $200 billion, specifically, an extra $78 billion in manufactured goods, $52 billion in energy products, $32 billion in agricultural goods and $38 billion in services. Despite the Phase I trade deal, the United States continues to maintain tariffs on about $370 billion of Chinese imports (80% of the total), while China still has tariffs on just about all imports from the United States.

Source: U.S. Department of Commerce, United States Trade Representative and Wells Fargo Securities

The United States and the EU have also experienced a deterioration in their trade relationship over the past few years. The World Trade Organization (WTO) backed the United States in late 2019 in placing tariffs on $7.5 billion of imported European goods as a result of illegal subsidies given to airplane manufacturer Airbus. But, the WTO also ruled that the United States had also given illegal subsidies to Boeing under WTO law, allowing the EU to raise tariffs on up to $4 billion worth of imports from the United States. President Trump also threatened to place tariffs on European autos and auto parts for most of his administration, which placed added stress on the U.S.-EU trade relationship, even though these tariffs were never formally implemented.

Canada and Mexico were not excluded from tariff and trade uncertainty. In mid-2018, the United States imposed a 25% tariff on imports of Canadian steel and a 10% tariff on imports of aluminum. In response, the Canadian government retaliated with countermeasures, imposing tariffs on slightly less than $3 billion worth of U.S. aluminum products. But the United States and Canada subsequently agreed in 2019 to lift steel and aluminum tariffs and end all WTO-related litigation. In Mexico's case, President Trump threatened tariffs on most imports from Mexico in an effort to control illegal immigration into the United States. Although those threatened tariffs were never implemented, trade uncertainty hovered over Mexico as the risk of these tariffs never fully receded. Ultimately, the three North American countries agreed to the United States, Mexico, and Canada Agreement (USMCA), which was put into effect earlier this year.

Possible Trade Policy Changes in the Biden Administration

As mentioned previously, the president has a substantial amount of authority and influence over trade policy in the United States. President Trump did not need congressional approval to impose tariffs on American trading partners and withdraw the United States from the Trans-Pacific Partnership (TPP). Therefore, there could be a new direction for American trade policy if, as seems likely, Joe Biden becomes president on January 20. That is not to say we expect to get a full return to policy before President Trump took office; however, we believe it is likely that more conciliatory and less protectionist trade policy returns under a Biden administration.

One of the key pillars of Biden's proposed policy is to strengthen trade relations with American allies via a multilateral approach to trade, rather than the bilateral approach pursued by President Trump. On the campaign trail, Biden hammered home his view of building closer ties with one particular trade partner: the EU. In our view, this could mean an attempt at restoring EU relations back to the pre-Trump era. Tariffs on the $7.5 billion in EU products could wind up being removed, while the threat of future tariffs on European autos and auto parts could also diminish under the Biden administration. Similarly, the Biden administration likely would not threaten to impose levies on Canadian and Mexican goods, and it likely will continue to honor the USMCA trade agreement.

During the campaign, Biden stressed a "hard line" approach towards China to change its behavior. Although Biden's China strategy sounds similar to President Trump's, Biden has not been clear on whether he would use tariffs as a way to incentivize behavioral change from China. In that context, it is difficult to know whether Biden will roll back some, all or none of the Trump administration tariffs. However, we believe an immediate reversal of the Trump administration's China trade policy is unlikely. But Biden has stated explicitly that a multilateral approach against China may be the optimal tactic. Instead of using harsh rhetoric and threats of bilateral action, Biden has said that he plans on using a more coordinated approach, utilizing the EU specifically, as well as other countries to pressure China for reforms.

Implications for U.S. Trade Flows

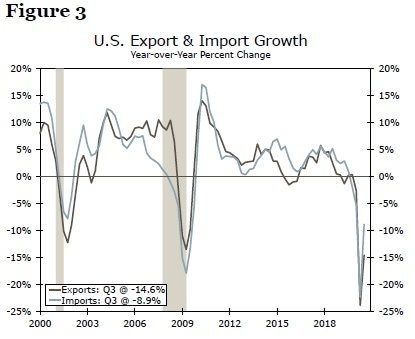

So what does the possible shift in trade policy mean for U.S. trade flows going forward? Weak demand and necessary business and manufacturing closures to curb the spread of COVID caused trade flows to dry up early this year. Indeed, U.S. real exports and imports both fell at a record pace in the second quarter, although some rebound occurred in Q3 (Figure 3). But with virus cases on the rise again and renewed restrictions being put in place, U.S. trade could be subject to further disruption in the near term. Therefore, looking past the virus-induced slowdown is necessary.

Source: U.S. Department of Commerce and Wells Fargo Securities

The trade policy of the Biden administration could have implications for trade flows in a post- COVID world. For example, China slipped below the EU in 2018 as America's most important trading partner as the trade war between the United States and China began to ramp up and weigh on trade between the two economies (Figure 4). Although total U.S. exports peaked in 2018, exports to the EU continued to rise until the onset of the COVID-crisis. If Biden does indeed take a hard line approach toward China and relaxes restrictions on the EU, the latter could continue to gain as America's largest trading partner.

Capital goods represent the largest share of American exports to the EU at nearly 40%, followed by industrial supplies and consumer goods that account for about 23% each. Exports to the EU represents 16% of total U.S. capital goods exports and a quarter of total U.S. consumer goods exports. We would expect exports to the EU, particularly in these three export categories, to grow as restrictions are relaxed. Similarly, the expected cooling in tensions with the EU would be a positive for import growth from that region. Less uncertainty around trade with Canada and Mexico should also support of U.S. trade flows with its North American neighbors. On the other hand, however, we would expect American exports to China to remain restrained if the United States and China maintain tariffs on each other. In that regard, capital goods represent the largest share of exports to China at 40%, followed by industrial supplies at 30%. Additionally, we would expect American imports from China to remain under pressure if tariffs remain in place.

Outside of specific trade relationships, addressing supply chain risk will be another factor at play in the coming trade environment. COVID has revealed vulnerabilities in international supply chains, and the pandemic may cause a shift toward reshoring. Although a complete on-shoring of supply remains unlikely, we expect part of the focus in the post-COVID recovery will be a rethinking of key vulnerabilities in supply chains, which has the potential to weigh on import growth. Although the cost of diversifying and/or stockpiling certain goods are high and can impede growth, some shift in supply chains will likely result from the virus. In that regard, Biden has articulated a push for ‘Buy American' legislation, which supports a less reliant America in support of some supply chain reorientation.

Currency Implications

Over the past few years, financial markets have reacted sharply to both negative and positive headlines on global trade. Tariffs and other escalations in trade tensions between the United States and China rattled financial markets and pushed volatility higher, while temporary "cease-fires" and the signing of the Phase I trade deal resulted in a risk-on tone across global financial markets (Figure 5). If, as we believe, Biden alters the direction of U.S. trade policy, then it is possible financial markets will pay just as close attention to trade-related headlines in 2021 as they did over the past few years.

Source: Bloomberg LP and Wells Fargo Securities

In the event the Biden administration is successful at implementing a less protectionist trade agenda with the EU, Canada, Mexico and other trade partners, we believe financial markets, in particular currency markets, could adopt a risk-on stance. In that context, we would expect currencies such as the euro, Canadian dollar and Mexican peso to rise, while other risk-sensitive G10 and emerging market currencies could also experience some upside. On the other hand, typical safe haven currencies such as the U.S. dollar, Japanese yen and Swiss franc could broadly depreciate as risk-taking comes back into the marketplace.

However, Biden's approach to China could play out a few different ways in markets. Post-election, market participants broadly believe Biden will ultimately look to ease trade tensions with China as rhetoric and threats are likely to dissipate. While we tend to agree with this assumption, it is possible Biden's approach to China turns out to be not all that dissimilar from President Trump. As mentioned, Biden's stance on tariffs is somewhat unclear and we do not think an immediate snap back to pre-Trump policy is likely. This could mean tariffs stay in place for longer than markets are expecting, while a coordinated approach against China turns more hostile as the Chinese government digs in not only against the United States, but the EU and other powerful, influential countries.

Although this scenario is more of a tail-risk at this point, financial markets would probably adopt a risk-off stance, and risk-sensitive currencies could sell-off rather sharply. In this scenario, emerging market currencies broadly would depreciate, with commodity and China-linked currencies the most impacted. Currencies such as the Australian and New Zealand dollar would likely come under pressure, while the Chinese renminbi, Mexican peso, Brazilian real and most emerging Asian currencies would also come under pressure. We would expect the U.S. dollar to rally on safe haven capital flows as uncertainty builds and the path of the global economy and recovery from the COVID-induced slowdown becomes more unclear.

In the event Biden's multilateral approach to China is successful and tariffs are rolled back, a Phase II deal is made or some other tension-easing developments are finalized—which seems more probable than our tail-risk scenario above, though still not our base case—we would expect foreign currencies to rally. In this scenario, high beta emerging market currencies such as the Mexican peso, Brazilian real and South African rand could outperform. Tariff related pressure would be lifted off the Chinese economy and the renminbi would likely strengthen, while emerging Asian currencies and G10 currencies with the strongest trade linkages to China would strengthen as well. This scenario may be the most negative for the U.S. dollar and Japanese yen, as market participants would have limited rationale for deploying capital towards safe haven assets or seeking exposure to traditional safe haven currencies.

Conclusion

U.S. trade policy will shift gears under President-elect Biden, although a complete reversal to the pre-Trump era of trade remains unlikely. We expect Biden's priority when it comes to trade policy will be to mend relations with America's allies such as the EU, Canada and Mexico. This will likely result in a rollback of existing tariffs or the quelling of tariff threats.

Further, although Biden will likely continue a hard line approach towards China, his exact strategy vis-à-vis that country remains unknown. In our view, Biden will likely seek a coordinated approach against China and work closely with allies such as the EU rather than continue the bilateral approach under President Trump. Although we expect American trade flows to pick up again as the pandemic-induced global recession comes to an end and as trade tensions with allies subside, the COVID shock could lead to some reorientation of supply chains. A general relaxation in trade tensions likely would lead to some downward pressure on the dollar, although the greenback could find some safe-haven support if trade tensions with China were to take center stage again.

Download The Full Special Commentary

Author

Wells Fargo Research Team

Wells Fargo