Bessent is rumored to head the Fed. Is the central bank's independence threatened?

Scott Bessent, the current US Treasury Secretary and a close associate of US President Donald Trump, is being considered as a potential successor to Jerome Powell as head of the Federal Reserve (Fed).

"A growing chorus of advisers inside and outside the Trump administration are pushing another name to serve as the next chair of the Federal Reserve: Treasury Secretary Scott Bessent," Bloomberg said in an exclusive report.

This information was immediately denied by the White House... but continues to fuel discussions on Wall Street.

"The report acknowledged that formal interviews for the role have not yet begun, and later in the day the White House denied that Bessent was a contender," notes Deutsche Bank in a report.

With Powell's term of office not expiring until May 2026, this rumour raises a fundamental question: which Fed for the years to come, in an ultra-politicized political and economic context?

Scott Bessent, a credible but unusual contender

Scott Bessent, a former star investor with Soros Fund Management, has never served on the Fed. However, his appointment as head of the Treasury in 2024 had reassured the markets.

His technical profile, knowledge of the global financial system, and ability to act as a bridge between Wall Street and the White House had been hailed.

"This pick should please markets given Bessent's in-depth understanding of financial markets and the economy", Sarah Bianchi, Evercore ISI's chief strategist of international political affairs and public policy, wrote about his nomination as Treasury Secretary in 2024, in a note mentioned by CNBC.

But as Fed chairman, he is still the subject of debate.

"Given the amount of trust and confidence that the global financial community has in Scott Bessent, he's an obvious candidate," said Tim Adams, president and CEO of the Institute of International Finance, in the Bloomberg report.

However, some economists believe he has a major handicap in leading the Fed.

Economist and Trump ally Arthur Laffer said Bessent "is wonderful, but he already has a job. And his specialty is not monetary policy", according to Bloomberg.

What markets think of Bessent at the head of the Fed

On Wall Street, reactions are divided. On the one hand, many see Bessent as an "adult in the room", capable of reassuring markets with his professionalism. He has already publicly defended prudent fiscal policies, such as his "3/3/3" plan (growth, fiscal discipline, energy production).

His approach to interest rates is pragmatic. He has emphasized that markets were anticipating interest-rate cuts without ever publicly questioning the Fed's independence.

But on the other hand, appointing a Treasury Secretary to head the Fed means crossing a symbolic red line between fiscal and monetary policy.

"A Fed chair with close ties to fiscal policy could risk undermining the central bank's independence, raising concerns about political influence over monetary decisions", signaled Quiver Quantitative.

Rabobank noted in a report: "It would be a successive switch from Treasury to Fed when we are constantly told these are sacrosanct positions which must co-ordinate but always remain fiercely independent of each other".

In particular, this could give rise to a "shadow president" before his time, undermining the credibility of the current Chairman Powell and creating unnecessary instability.

"That's a year before it's even vacant, which is not how things used to work and suggests the risks of a Shadow Fed Chair emerging, with a remains-to-be-seen effect on markets", added Rabobank.

The risk of an instrumentalized Fed

At the heart of the debate over Bessent's appointment is the thorny question of the central bank's independence. Trump has never concealed his frustration with Powell, whom he appointed in 2017, for his reluctance to lower interest rates in the face of tariff uncertainty.

If Bessent or another person close to the President were to become Fed Chairman, the question of their autonomy from the White House would immediately be raised.

For the markets, this independence is crucial to preserving the credibility of the fight against inflation.

Deutsche Bank warns in its report that the next candidate to head the Fed will have to prove his or her independence and the credibility of his or her commitment to achieving the central bank's inflation targets. If the candidate is from the government, this challenge could be even greater.

Bessent "would be given the benefit of the doubt from the financial community" that he would preserve the independence of the Fed's rate-setting authority, IIF's Adams said, according to Bloomberg.

The question of independence will also be scrutinized by the Senate, which will have to validate President Donald Trump's choice.

Other names in the running

In addition to Bessent, a number of other names are circulating. Kevin Warsh, former Fed governor and close economic advisor during the 2008 crisis, seems to be the front-runner and has the support of conservative figures such as Arthur Laffer.

"As I told the president, I think Kevin Warsh is just perfect for the job," said Arthur Laffer, according to Bloomberg.

Christopher Waller, a member of the Federal Reserve Board of Governors since 2020, stands out for his accommodating stance compatible with Trump's agenda. Deutsche Bank considers him one of the most "realistic" candidates in a scenario where Trump would seek to push a more flexible monetary policy towards lower interest rates.

Other names, such as Kevin Hassett (ex-director of the National Economic Council) or David Malpass (ex-president of the World Bank), are also mentioned, but with less momentum.

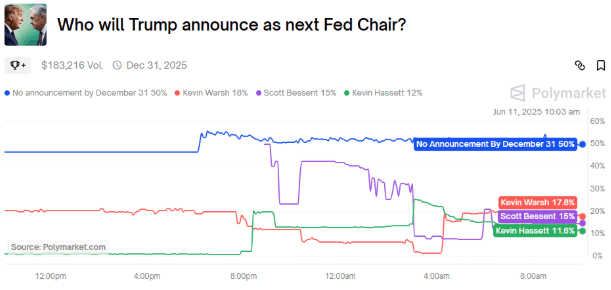

Polymarket: analysis through predictive betting

The Polymarket prediction market, often used to gauge expectations in American politics, saw the probability of Bessent's nomination rise to 50% just after the publication of the Bloomberg article.

But the trend quickly reversed following the White House's denial. Bessent is now down to 15%, behind Kevin Warsh (17.8%), still the favorite.

Kevin Hassett gets just 11.6%, and 50% of punters believe that Trump will not announce a successor before the end of 2025.

Conclusion: between institutional continuity and political rupture

Even if the Bessent rumor seems to be running out of steam, it reveals a major tension. Trump wants a more flexible Fed, more aligned with his vision of economic growth. But he will have to deal with institutional safeguards and the need to reassure markets about the durability and independence of the US central bank.

Whether it's Bessent, Warsh or Waller, the next Fed chairmanship promises to be a real-life test of the balance between political power and monetary independence. And that test could well begin... sooner than expected.

Author

Ghiles Guezout

FXStreet

Ghiles Guezout is a Market Analyst with a strong background in stock market investments, trading, and cryptocurrencies. He combines fundamental and technical analysis skills to identify market opportunities.