Bean there, paying that: The rise of coffee prices

As a devoted coffee addict, I couldn’t help but notice that the price of my favorite espresso—or even a double espresso—has been creeping up over the past year. I've seen the same trend with my monthly coffee bean purchases. So, what’s going on with this divine elixir?

Coffee prices have soared to record highs, driven by a perfect storm of adverse weather, supply chain challenges, and market speculation. Multiple factors are converging to create an environment where both supply disruptions and robust global demand are fueling the surge.

Adverse weather and crop disruptions

Unprecedented weather events in key coffee-producing regions have hit supply hard. In Brazil—the world’s largest coffee producer—unexpected frosts and drought conditions have severely damaged crops last year. Even though late rains have offered some relief, many Brazilian farms remain vulnerable, with trees sprouting too many leaves and too few cherries. Some farmers have even delayed deliveries, hoping to cash in on even higher prices, which only tightens supply further.

Vietnam, the top producer of robusta coffee (widely used for instant coffee), is also facing harvest delays due to recent storms. Traders warn that this season’s output could drop by up to 10%, potentially marking the lowest production in a decade. Meanwhile, in Costa Rica, heavy rains linked to Hurricane Rafael and Tropical Storm Sara triggered a national emergency in late 2024. Nearly 15% of the country’s annual coffee harvest was wiped out, with floods and landslides affecting over 27,000 coffee-producing families, more than 300 processing mills, and around 90 exporting companies—resulting in estimated losses of $45M.

Market dynamics and speculative trading

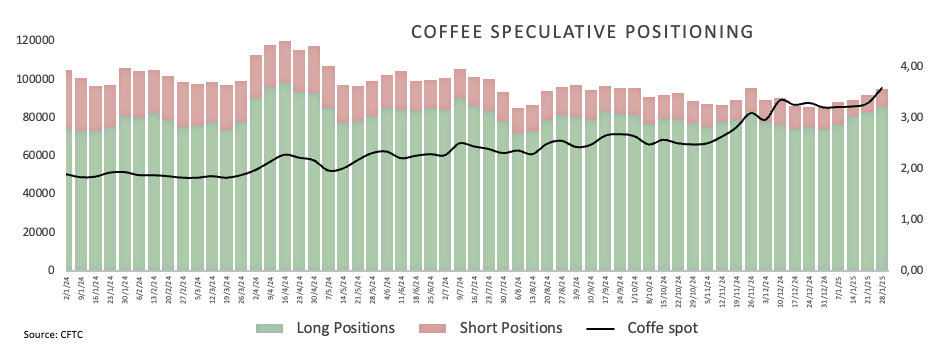

These weather-induced supply constraints are compounded by ongoing supply chain challenges. Rising shipping costs and logistical delays have made it both more expensive and more difficult to transport coffee from farms to markets. At the same time, speculative trading in the commodities market is creating a feedback loop, as investors bet on further price increases. This speculation is fueling the upward momentum, driving prices even higher.

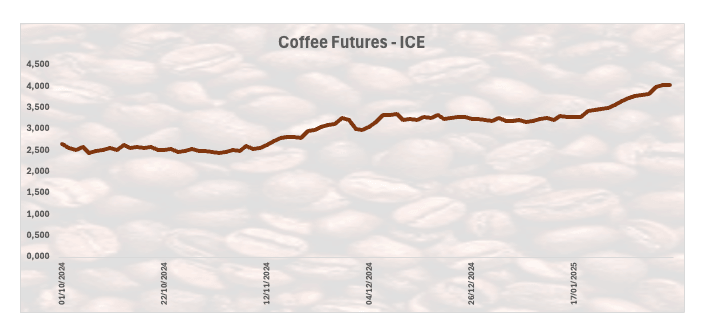

Arabica coffee futures on the Intercontinental Exchange (ICE) surpassed $4.10 per pound for the first time in history on February 6. Investors are rethinking their outlook on next year’s Brazilian crop, while growing concerns about Vietnam’s robusta crop add to the overall market uncertainty. Although robusta and arabica coffees cater to different segments—roast and ground blends versus instant coffee—they are somewhat interchangeable. Consequently, a shortage in one often boosts demand for the other, intensifying overall price pressures.

Outlook and industry impact

Experts predict another year of lackluster coffee output. One of the world’s largest traders recently slashed its forecast for Brazil’s 2025/26 arabica production from over 50M bags to just 34.4M—a reduction of 11M bags. This forecast sets the stage for an “unprecedented” fifth consecutive global coffee deficit, estimated at 8.5M bags for the 2025/26 season. Persistent deficits, exacerbated by climate change and ongoing production challenges, are expected to keep prices high.

While the surge in prices boosts potential earnings for coffee farmers, it also poses significant challenges for traders. Skyrocketing hedging costs on exchanges and the scramble to secure deliveries are fueling market volatility. Forward sales for Brazil’s 2025/26 coffee crop are notably lagging, with only 12% sold compared to 19% at the same point last year—the long-term average being around 21%.

Historical context

The current price levels harken back to a turbulent past—the last comparable spike occurred in 1977 when heavy snow devastated vast swathes of Brazilian coffee plantations. Adjusted for inflation, those 1977 prices would equate to about $17.68 per pound today, underscoring just how severe the current market conditions are.

Conclusion

In conclusion, the record highs in coffee prices are the result of a perfect storm: adverse weather in key producing regions, persistent supply chain hiccups, and intense speculative trading. As farmers, traders, and consumers navigate these challenges, the outlook remains uncertain, with experts predicting continued volatility and constrained production in the seasons ahead.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.