Bank of America is eyeing all-time highs from 2006 [Video]

![Bank of America is eyeing all-time highs from 2006 [Video]](https://editorial.fxsstatic.com/images/i/usa-1_XtraLarge.png)

Bank of America (BAC) is one of the largest banks in the world, serving millions of consumers, businesses, and institutions. It has a broad mix of operations — consumer banking, wealth management, corporate banking, and global markets — which helps keep its earnings stable. The bank has been heavily investing in digital services and technology, aiming to improve efficiency and customer experience. Its size and global reach make it a key player in the U.S. and global financial system.

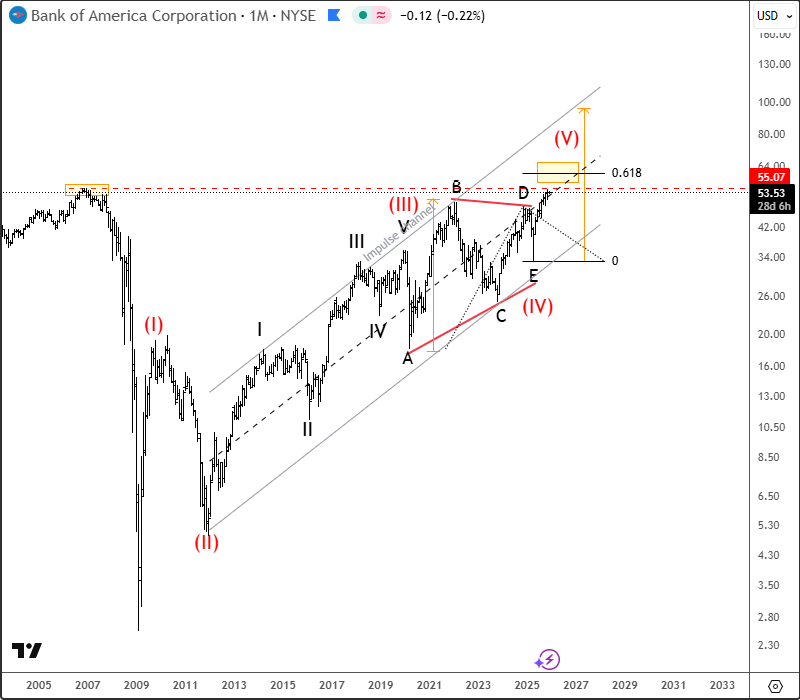

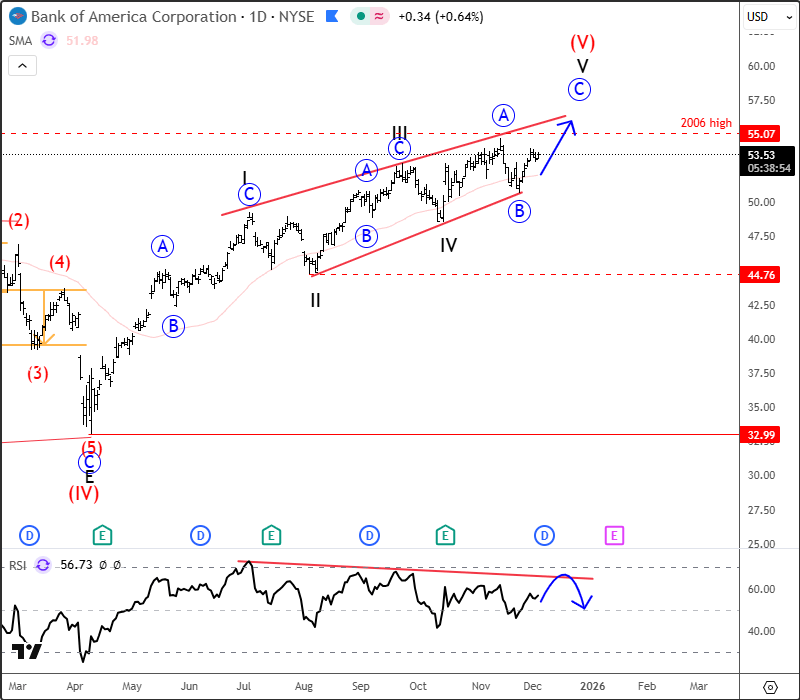

Bank of America is in an uptrend with a very strong rebound since April 2025, and the price is now approaching the 2006 highs. That area around 55 is extremely important because the current structure looks like an ending diagonal in wave five, meaning we could be in the late stages of a higher-degree bullish cycle. The push up this year also comes out of a very big triangle on the monthly chart, so despite the positive momentum, we should be aware that resistance is getting closer and bullish momentum may slow down. We also see RSI divergence on the daily chart, which is very common when diagonals mature. So while the trend is still up for now, it makes sense to be careful around 55, as a potential reversal in 2026 would not be a surprise.

Highlights

Trend: Bullish but late-stage (ending diagonal risk).

Resistance: 55-56 area (2006 high).

Invalidation of a bull trend: broken trendline support.

Note: Watch RSI divergence and respect the 55/56 zone as potential exhaustion of wave five.

For more analysis like this, you may want to watch below our latest recording of a live webinar streamed on December 01:

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.