Australian GDP Preview: September quarter contraction only a ‘setback’?

- The Australian economy is seen shrinking by 2.7% in the third quarter of 2021.

- RBA sees Q3 contraction only as a ‘setback’, remains upbeat on the recovery.

- AUD/USD is poised for a rebound as the downturn appears fully priced in.

AUD/USD has tumbled to fresh 2021 lows below 0.7100 in the lead up to the third quarter Australian GDP release due on Wednesday. The economy braces for a contraction in the three months to September, as it bears the negative impact of the lockdowns imposed due to the Delta covid variant on the country’s largest population states.

The third quarter (Q3) GDP data is scheduled for release at 0030 GMT on Wednesday and is likely to report a 2.7% contraction vs. a 0.7% growth booked in the three months to June. That would be the biggest fall since a 7% decline seen in Q1 2020, just when the pandemic hit the world. Meanwhile, the economy is expected to grow merely by 3% YoY in the reported period vs. a solid 9.6% expansion seen in the second quarter.

Upside risks remain to Australian Q3 GDP

Investors have long priced in the third quarter GDP contraction for the Australian economy, in the face of the huge hit to the activity from Delta covid strain lockdowns in New South Wales (NSW) and Victoria.

For the third quarter, Australia’s public spending added A$3.5 billion ($2.50 billion), or 0.7 percentage points, to GDP while real net exports contributed 1.0 percentage points to GDP. The nation’s consumer spending jumped by 4.9% in October as shops reopened.

These upbeat indicators are likely to alleviate the pressure on the economic performance, as the future business spending plans appear robust despite a 2.2% fall in the country’s capital expenditure in the given quarter. In light of these encouraging inputs, an upside surprise is expected to the Q3 GDP numbers.

Upbeat on the prospects of the economic recovery, the Reserve Bank of Australia (RBA) brought its economic projections forward while leaving the Official Cash Rate on hold at a record low 0.1% at its November monetary policy meeting.

The central bank hinted that a weak GDP outcome will only be a “setback”, citing that “a bounce-back is now underway” after the Delta outbreak, with companies now hiring and the job rate set to trend lower for the next couple of years.

Next month’s monetary policy decision, however, will be crucial, as the RBA may consider the potential impact of the new Omicron covid variant on its fourth-quarter economic forecasts.

AUD/USD Technical outlook

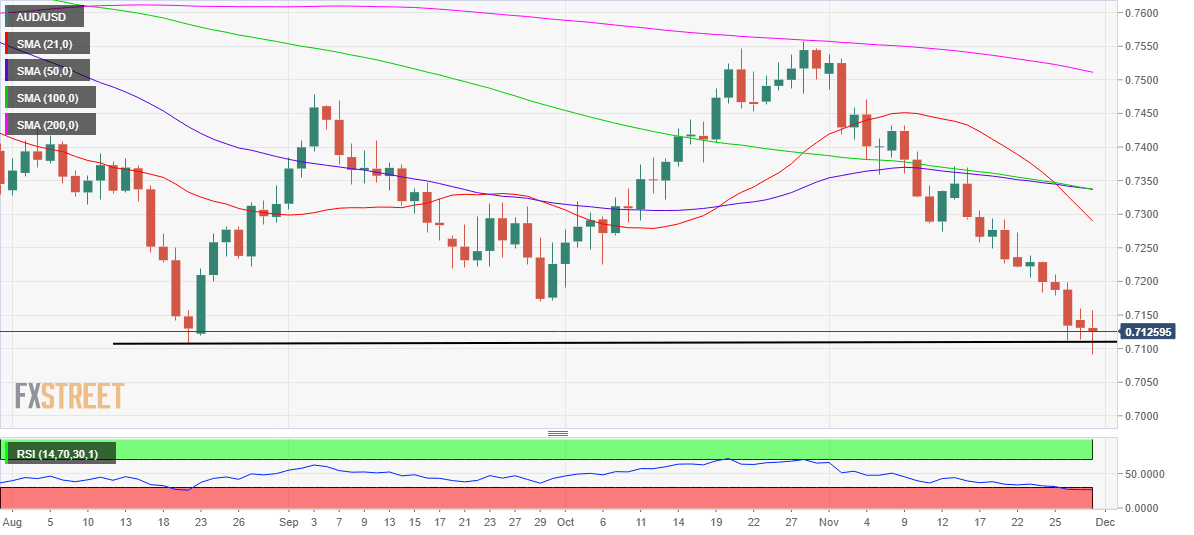

The fears over the new variant revived this Tuesday after Moderna Inc.’s CEO said that “there will be a material drop in vaccine effectiveness against Omicron.” Amidst the latest risk-aversion wave, AUD/USD tumbled to the lowest level since November 2020 at 0.7092. The pair is licking its wounds just above 0.7100, as of writing, as investors find some comfort from the Treasury yields sell-off driven drop in the US dollar.

Against the backdrop of the persistent covid worries, the reaction to the Australian GDP report could be limited, as broader market sentiment, yield dynamics and the influence of the greenback will continue to dominate the pair.

AUD/USD: Daily chart

From a technical perspective, the daily chart shows that AUD/USD tested the critical horizontal support line at 0.7100. So long as the aussie defends the latter on a daily closing basis, a rebound in AUD/USD remains on the table.

On an upside surprise to the GDP and risk recovery-driven extended US dollar weakness, the aussie could extend the recent range highs near 0.7160, above which a test of the 0.7200 mark would be in the offing. The Relative Strength Index (RSI) is in the oversold region, backing the premise for a potential upturn in the pair. If the Australian economy sees a bigger than expected contraction in Q3 or downside risks to the next quarter projections, then the major could resume the downtrend towards the 0.7050 psychological level.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.