Australian dollar wavers after mild RBA interest rate decision

The Australian dollar was little changed during the Asian session as traders reacted to the country’s retail sales and the RBA interest rate decision. Data from Australia showed that retail sales rose by 2.7% in June after climbing by 16.9% in the previous month. In total, sales fell by 3.4% in the second quarter. In June, the country’s exports increased by 3% while imports rose by 1%, leading to a trade surplus of more than $8 billion. In a statement, the Reserve Bank of Australia left interest rates unchanged as most analysts were expecting.

The Japanese yen was little changed against the US dollar after the statistics office released inflation data from Tokyo. The data showed that the headline CPI in Tokyo rose to 0.6% in July after rising by 0.3% in the previous month. In the same month, the core CPI, which excludes the volatile food and energy products rose to 0.4% from 0.2%. As the biggest city in Japan, data from Tokyo tend to be representative of the entire country. The data came a day after we received relatively strong manufacturing PMI data from Japan.

Looking ahead, the economic calendar will have no major events today. In Europe, the Eurostat will release the June factory gate inflation data. Analysts expect these numbers to be relatively weak. In the US, we will receive the June factory orders and durable goods orders data. Additionally, we will receive important earnings releases today. Among the companies to watch will be Walt Disney, Sony, Diageo, BP, Bayer, and Monster Beverage.

EUR/USD

Yesterday, the EUR/USD pair dropped to the important support at 1.1700. It pared some of these losses during the Asian session and is now trading at 1.1765. On the four-hour chart, the price is still above the 50-day and 100-day exponential moving averages while the RSI has stabilized around 40. Therefore, at this point, the outlook of the pair is neutral. A clean break below 1.1700 will see the pair continue its bearish trend. However, a move above last month’s high of 1.1900 will lead to a continuation of the bullish trend.

AUD/USD

The AUD/USD pair was slightly changed as investors reacted to the RBA decision, retail sales, and trade numbers from the country. The pair is now trading at 0.7125, which is below last month’s high of 0.7226. On the four-hour chart, it is above the ascending trend line that is shown in white and the 50-day and 100-day exponential moving averages. The DeMarker indicator has moved to the oversold level. Like the EUR/USD pair, the outlook for the AUD/USD is neutral at this stage.

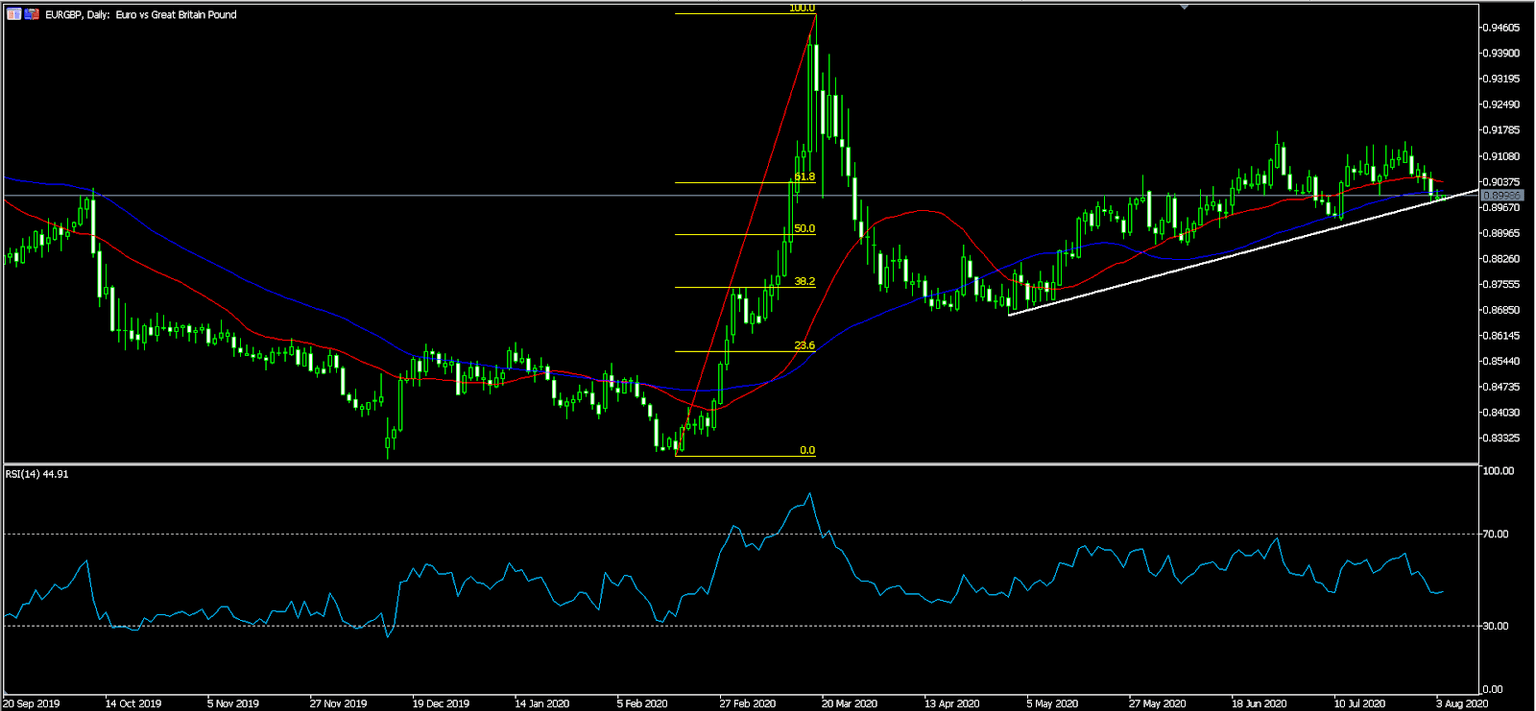

EUR/GBP

The EUR/GBP pair declined slightly during the Asian session. It is trading at 0.900. On the daily chart, the price is along the important ascending trend line that is shown in white. It is also below the 61.8% Fibonacci retracement levels and just below the 100-day and 50-day EMA. Also, the RSI has been falling. Therefore, a clean break below the ascending trendline will see the price continue to fall.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.