Australian Dollar Price Forecast: The hunt for 0.6600

- AUD/USD failed to extend the upside past the 0.6570 zone, or two-week tops.

- The US Dollar regained the smile and advanced markedly, supported by data, yields.

- The Australian labour market performed strongly in July.

The Australian Dollar (AUD) partially faded its weekly recovery on Thursday, motivating AUD/USD to surrender the initial uptick to new two-week highs near 0.6570 to then refocus on the downside following a marked rebound in the US Dollar (USD).

Australia: Inflation cools, activity perks up

The second-quarter consumer price index (CPI) rose by 0.7% QoQ and 2.1% YoY, while June’s monthly CPI indicator came in at 1.9%—still easing, but only slowly. On the activity side, July brought better news: the Manufacturing PMI bounced to 51.6, the Services PMI rose to 53.8, and Retail Sales grew 1.2% in June.

Trade numbers also impressed, with the surplus widening to A$5.365 billion in June from just A$1.604 billion.

Contributing to this set of constructive data, July’s labour market report saw the Unemployment Rate tick lower to 4.2%, the Employment Change increase by 24.5K individuals, and the Participation Rate hold steady at 67%.

RBA: Tilting looser, but no rush

Earlier this week, the Reserve Bank of Australia (RBA) trimmed the Official Cash Rate (OCR) by 25 basis points to 3.60%, in line with expectations, and lowered its year-end 2026 rate forecast to 2.9% from 3.2% in May.

In the bank’s statement, growth for 2025 was marked down to 1.7% from 2.1%, reflecting global headwinds, while end-2025 unemployment and trimmed mean CPI forecasts were left unchanged at 4.3% and 2.6%.

In her press conference, Governor Michele Bullock dismissed the idea of a half-point cut and stressed that policy would remain “data-dependent, not "data-point dependent,” with further easing contingent on a softer labour market and cooler prices.

China: Still a patchy backdrop

China—Australia’s biggest export destination—remains a mixed picture: Q2 GDP rose 5.2% YoY and Industrial Production climbed 7%, but Retail Sales missed the 5% mark. The People’s Bank of China (PBoC) held the 1- and 5-year Loan Prime Rates (LPR) steady at 3.00% and 3.50% last month.

July’s official PMIs slipped (Manufacturing 49.3, Non-manufacturing 50.1), and Caixin readings told a similar story. The trade surplus narrowed to $98.24 billion in July, with exports up 7.2% and imports up 4.1% YoY. Finally, CPI inflation rose 0.4% MoM but was flat YoY, highlighting the entrenched deflationary pressure.

Positioning: Shorts still in control

Commodity Futures Trading Commission (CFTC) data for August 5 showed speculators increasing net short AUD positions to about 83.6K contracts — the largest since April 2024 — with open interest climbing to an eight-week high near 164K contracts.

Technical picture

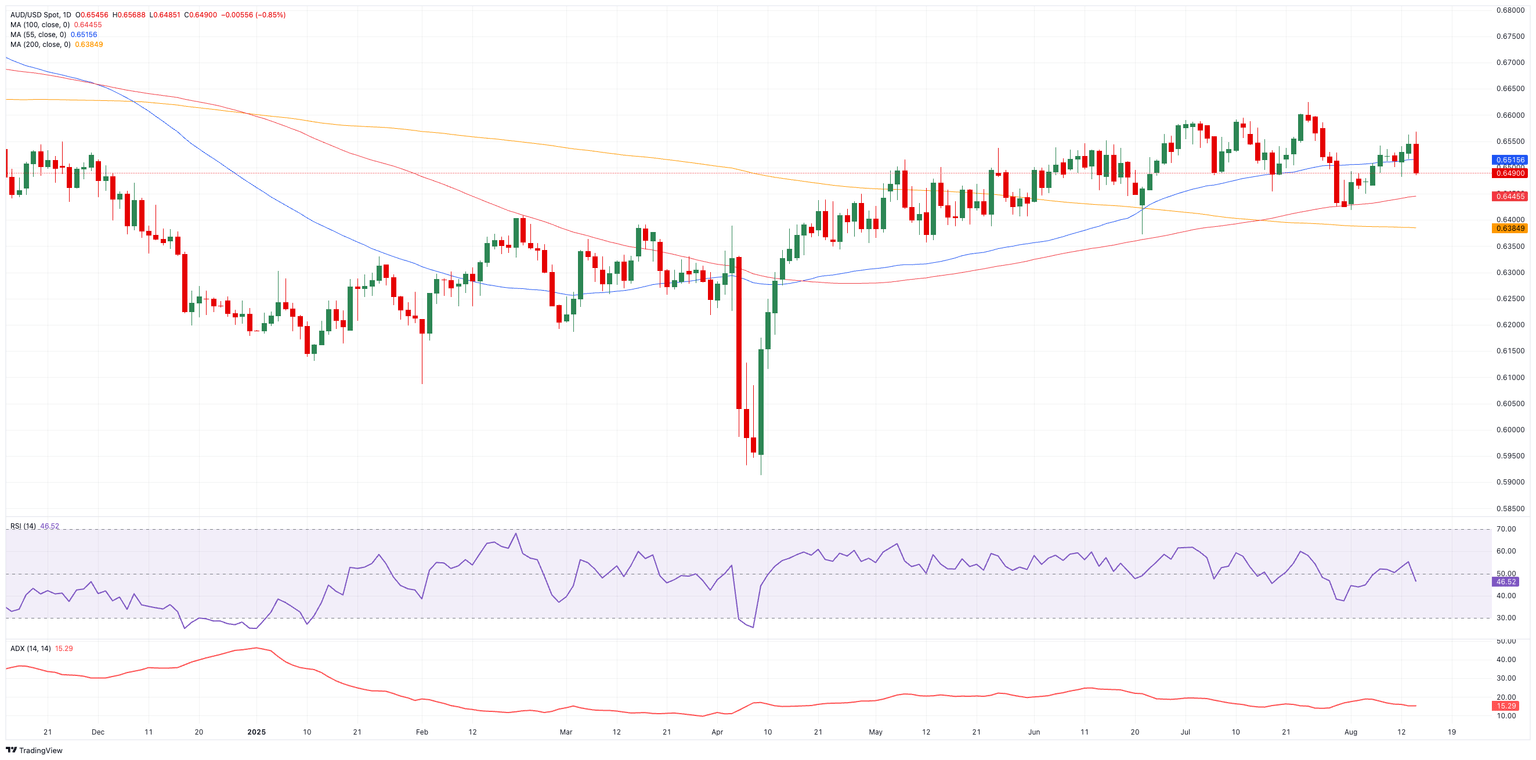

Resistance is first seen at 0.6625, the 2025 ceiling from July 24, followed by the November 2024 peak at 0.6687 (November 7). A break above would put the 0.7000 threshold back in play.

On the downside, support sits at 0.6418 (August 1), ahead of the 200-day Simple Moving Average (SMA) at 0.6387, with a drop through there exposing the June floor at 0.6372 (June 23).

The Relative Strength Index (RSI) has decreased to approximately 46, indicating an increase in downside momentum, while the Average Directional Index (ADX), which is around 15, suggests a weak and non-trending market.

Near-term outlook

For now, the Aussie looks boxed in between 0.6400 and 0.6600, awaiting a catalyst — whether that’s stronger Chinese data, a shift in the Fed’s stance, or a change in tone from the RBA — to break the range.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.