Australian Dollar Price Forecast: The 200-day SMA continues to hold the downside

- AUD/USD adds to Friday’s gains, reclaiming the 0.6500 barrier and beyond.

- The US Dollar set aside part of the recent losses and improved modestly.

- The Australian labour market report will be the salient event in Oz this week.

The Australian Dollar (AUD) carried last week’s positive momentum into Monday, pushing AUD/USD comfortably above the key 0.6500 level in what’s shaping up to be a promising start to the week.

That move came even as the US Dollar (USD) found some footing, with traders continuing to reprice expectations for Federal Reserve (Fed) rate cuts and growing more optimistic about a deal to end the historic US government shutdown.

Australia’s economy: holding up, but showing some strain

Australia’s economy isn’t surging, but it’s holding up better than many had expected. The October PMIs told a mixed story: manufacturing slipped back below 50 to 49.7 (from 51.4), while services rose to 53.1 (from 52.4).

Retail Sales climbed 1.2% in June, and the September trade surplus widened sharply to A$3.938 billion. Business investment picked up in Q2, helping GDP grow 0.6% inter quarter and 1.1% from a year earlier, not stellar, but steady.

Still, cracks are starting to show in the labour market. The unemployment rate nudged up to 4.5% in September (from 4.3%), while job growth slowed to 14.9K. It’s not alarming yet, but it does suggest hiring momentum is cooling. All eyes this week will be on October’s labour market report for further clues.

RBA stays patient

The Reserve Bank of Australia (RBA) kept the cash rate unchanged at 3.60% for a second straight meeting, no surprises there. The message was calm and steady: no rush to act in either direction.

The RBA acknowledged that inflation remains a bit sticky, while the labour market is still tight despite the slight rise in unemployment. Governor Michele Bullock described policy as “pretty close to neutral”, signalling little urgency to tighten or ease further.

She also pointed out that the 75 basis points of rate cuts already delivered haven’t fully worked their way through the economy. Policymakers want to see how demand evolves before making their next move.

Markets are currently pricing in just over 3 basis points of easing by the December 9 meeting and nearly 15 basis points by early 2026. In other words, very little change is expected in the near term.

China remains the key swing factor

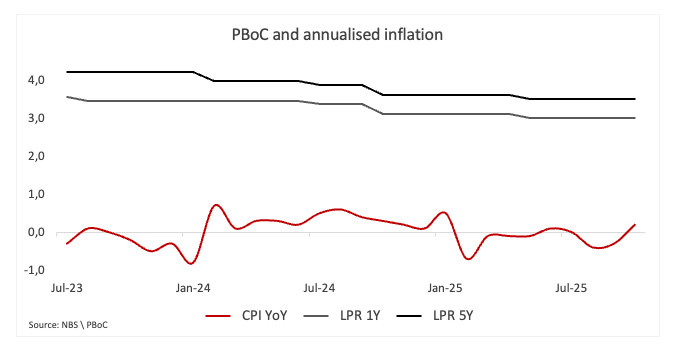

Australia’s outlook continues to hinge on how China performs. Chinese GDP expanded 4.0% on a yearly basis in Q3, while Retail Sales expanded 3.0%. The RatingDog Manufacturing PMI eased to 50.6, and the Services PMI dipped to 52.6 in October, hinting that growth momentum may be losing a bit of steam.

Further data showed China’s trade surplus narrowing from $103.33 billion to $90.45 billion in September, while consumer prices turning positive in October thanks to holiday demand. Indeed, the headline CPI rose 0.2% YoY, the fastest pace since January and well above expectations for a slight decline, marking a notable turnaround from September’s 0.3% drop. Core consumer prices also firmed to 1.2% YoY, up from 1.0% in September and matching its February peak.

Meanwhile, the People’s Bank of China (PBoC) kept its Loan Prime Rates (LPR) unchanged at 3.00% (one-year) and 3.50% (five-year) earlier in October, as widely expected.

Technical view

AUD/USD picks up fresh upside impulse, although its extension and duration remain to be seen.

The continuation of the current bounce could put a test of the October high of 0.6629 (October 1) back on the radar, while the surpass of this region carries the potential to open the door to a visit to the 2025 ceiling of 0.6707 (September 17), prior to the 2024 peak at 0.6942 (September 30), all before the 0.7000 round level.

In the opposite direction, a drop below the key 200-day SMA at 0.6440 could expose a move toward the October floor at 0.6440 (October 14), followed by the August valley at 0.6414 (August 21), and the June trough of 0.6372 (June 23).

Additionally, momentum indicators show some improvement: the Relative Strength Index (RSI) rebounds past the 48 level, suggesting that extra gains could lie ahead, while the Average Directional Index (ADX) below 16 indicates a trend that remains soft.

-1762792357697-1762792357697.png&w=1536&q=95)

The bottom line

For now, AUD/USD remains trapped in its familiar 0.6400–0.6700 range, waiting for a more meaningful catalyst that could emerge from Chinese data, the Fed’s next move, the RBA’s tone, or a broader shift in US–China sentiment.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.