Australian Dollar Price Forecast: Extra gains remain in the pipeline above 0.6510

AUD/USD appears to be losing some upside momentum after approaching the 0.6760 level earlier in the week and is now hovering back around 0.6700 as profit-taking mixes with a firmer US Dollar.

The Aussie Dollar (AUD) comes under renewed pressure on Thursday, with AUD/USD retreating from fresh 15-month highs near 0.6760 to revisit the 0.6680 area in a move that left behind a three-day winning streak, though spot still retains a solid start to the year overall.

Despite the near-term hesitation, the broader picture remains constructive. The pair is still comfortably above both the 200-week and 200-day SMAs at 0.6627 and 0.6511, respectively.

The pause higher looks less like a shift in fundamentals and more like a bout of profit-taking in a market still short on clear FX direction, rather than any real deterioration in the underlying AUD story.

A steady backdrop, not a spectacular one

Australia isn’t producing eye-catching upside surprises, and that’s not necessarily a bad thing. The economy continues to tick along at a measured pace, with recent data broadly consistent with a soft-landing narrative.

December PMI figures reinforced that view. While both Manufacturing and Services edged slightly lower in the preliminary readings, they remain firmly in expansionary territory. Retail Sales are holding up well, and although the trade surplus narrowed to A$2.936 billion in November from A$4.356 billion, it remains comfortably positive.

Growth did come in a bit softer than expected, with GDP expanding 0.4% QoQ in Q3 versus 0.7% previously. Still, annual growth held steady at a respectable 2.1%, broadly in line with what the RBA had anticipated for year-end.

The labour market is showing early signs of cooling as the employment fell by 21.3K in November, while the jobless rate held steady at 4.3%.

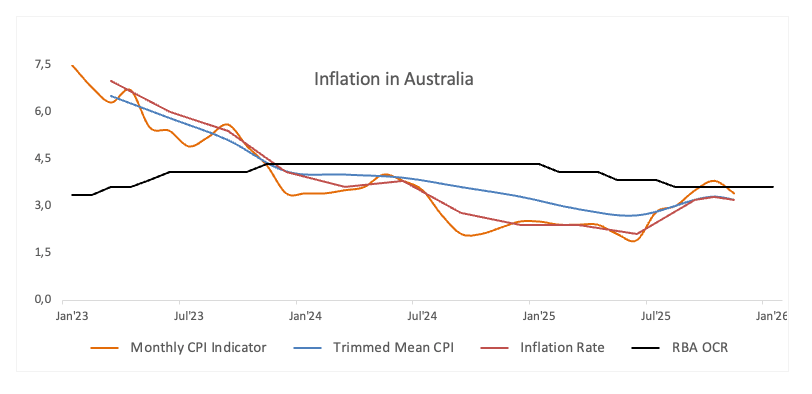

Inflation, meanwhile, remains sticky despite easing momentum. Headline CPI slowed to 3.4% in November, while the trimmed mean edged down slightly to 3.2%, still uncomfortably above target.

China still supportive, but no longer doing the heavy lifting

China continues to offer a supportive, if less powerful, tailwind for the Aussie.

GDP growth held at 4.0% YoY in the July-September period, and Retail Sales rose 1.3% YoY in November. Solid numbers, though well short of the growth impulses seen in earlier cycles. More recent indicators suggest some modest improvement in momentum: both the official Manufacturing PMI and the Caixin gauge moved into expansion at 50.1 in December.

Services activity also picked up: the non-manufacturing PMI climbed to 50.2, while Caixin’s Services PMI remained firmly expansionary at 52.0. The trade surplus widened to $111.68 billion in November, with exports rising nearly 6% while imports contracted by almost 2%.

There are a few tentative bright spots: headline CPI remained positive, rising 0.7% YoY in November, though Producer Prices continued to fall, down 2.2% YoY, a reminder that deflationary pressures haven’t fully disappeared.

For now, the People’s Bank of China (PBoC) is staying patient, as the Loan Prime Rates (LPR) were left unchanged in December at 3.00% (one-year) and 3.50% (five-year), reinforcing the view that any policy support will remain gradual rather than aggressive.

An RBA that isn’t ready to blink

The Reserve Bank of Australia (RBA) delivered a widely expected “hawkish hold” at its latest meeting.

The Official Cash Rate (OCR) was kept unchanged at 3.60% in December, but the tone of the statement stayed firm. Policymakers continue to flag capacity constraints and weak productivity as medium-term risks, even as the labour market shows early signs of cooling.

Governor Michele Bullock pushed back against expectations for near-term easing, stressing that the Board is considering an extended pause, or even the possibility of further tightening, if inflation proves stubborn. Q4 trimmed mean CPI was highlighted as a key input, though that data won’t arrive until late January.

The meeting Minutes suggest a degree of internal debate, with policymakers openly questioning whether financial conditions are restrictive enough. There’s some soul-searching underway, and the message is clear: rate cuts next year are far from guaranteed.

That leaves the late-January inflation data as a potentially pivotal moment for AUD pricing.

So far, market participants see nearly 34 basis points of tightening this year, although the RBA will most likely leave its interest rate unchanged at its February 3 gathering.

Positioning quietly turning less negative

The Commodity Futures Trading Commission (CFTC) data for the week ending December 23 showed speculative net shorts in AUD falling to around 26K contracts, the lowest level since late September 2024.

At the same time, open interest dropped sharply to roughly 217K contracts from nearly 294K the prior week. That suggests the improvement reflects reduced conviction and lighter exposure rather than a decisive shift into bullish positioning.

What markets will be watching next

Near term: Investors will be scrutinising the US NFP data for very near-term direction in AUD/USD.

Risks: A sharp risk-off move, renewed pessimism around China, or a meaningful rebound in the US Dollar could all quickly cap the upside.

Technical picture

The resumption of the bullish impulse should initially motivate AUD/USD to revisit its 2026 ceiling of 0.6766 (January 7), ahead of the 2024 top at 0.6942 (September 30), all prior to the 0.7000 yardstick.

On the downside, there are minor support levels at the weekly lows at 0.6659 (December 31) and 0.6592 (December 18). If the pair breaks below the latter, it could then face a short-term contention zone in the 0.6585-0.6570 band, where sit the 55-day and 100-day SMAs. South from here comes the key 200-day SMA at 0.6510, seconded by the November valley at 0.6421 (November 21).

The pair’s near-term positive outlook is expected to persist as long as it trades above its 200-day SMA.

Momentum indicators continue to lean bullish: The Relative Strength Index (RSI) sits near the 59 mark, while the Average Directional Index (ADX) above the 32 level suggests quite a robust trend.

-1767889969589-1767889969590.png&w=1536&q=95)

So where does that leave AUD/USD?

No fireworks for now, but the bias still points gently higher.

The AUD remains highly sensitive to global risk appetite and China’s mood. The pair’s clean break above 0.6800 would likely be needed to unlock a more convincing uptrend.

For now, an indecisive US Dollar, steady domestic data, an RBA that isn’t flinching, and modest support from China keep the balance tilted toward gradual gains rather than a sharp move higher.

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.