Australian Dollar Price Forecast: Extra gains emerge on the horizon

- AUD/USD picked up extra pace and rose to two-week highs near 0.6560.

- The US Dollar faced extra selling pressure on steady bets on extra Fed easing.

- The Australian labour market release will be the salient event on Thursday.

The Australian Dollar (AUD) extended its rebound on Wednesday, with AUD/USD retesting the 0.6560 region, or two-week highs, as renewed selling in the US Dollar (USD) provided a tailwind.

Australia: Inflation cools, activity perks up

Australia’s Q2 headline CPI rose 0.7% QoQ and 2.1% YoY, while June’s Monthly CPI Indicator printed 1.9%—easing, but grudgingly.

Activity looked brighter into July: the Manufacturing PMI rebounded to 51.6, the Services PMI climbed to 53.8, and Retail Sales rose 1.2% in June.

Trade surprised to the upside, with the surplus widening to A$5.365 billion in June from A$1.604 billion.

Next on tap Down Under will be the critical jobs report on Thursday, following the previous lacklustre readings, where the labour market added just 2K jobs and unemployment ticked up to 4.3%.

RBA: Easing bias without rushing

The Reserve Bank of Australia (RBA) reduced its Official Cash Rate (OCR) by 25 basis points to 3.60% earlier in the week, as expected, and trimmed its year-end 2026 rate forecast to 2.9% from 3.2% in May—nudging policy looser while aiming to keep the labour market steady.

Growth was marked down, with 2025 now at 1.7% (from 2.1%), reflecting global headwinds. End-2025 unemployment and trimmed mean CPI forecasts were left at 4.3% and 2.6%.

Governor Michele Bullock ruled out a half-point move and said the bank will remain “data-dependent, not data-point dependent”, with any further easing contingent on a cooler labour market and softer prices.

China: Still a patchy backdrop

China—Australia’s biggest export market—remains mixed: Q2 GDP grew 5.2% YoY, and Industrial Production rose 7%, but Retail Sales missed the 5% mark.

The People’s Bank of China (PboC) kept the 1- and 5-year Loan Prime Rates (LPR) at 3.00% and 3.50%, respectively, last month.

In addition, July’s official PMIs slipped (Manufacturing 49.3, Non-manufacturing 50.1), and Caixin showed a similar tone. The trade surplus narrowed to $98.24 billion in July, with exports up 7.2% and imports 4.1% YoY. Furthermore, inflation tracked by the CPI rose 0.4% MoM in July but was flat YoY.

Positioning: Speculative shorts remain dominant

Commodity Futures Trading Commission (CFTC) data to August 5 showed speculators adding to net short AUD positions, to about 83.6K contracts—the most since April 2024, while open interest climbed to eight-week highs near 164K contracts.

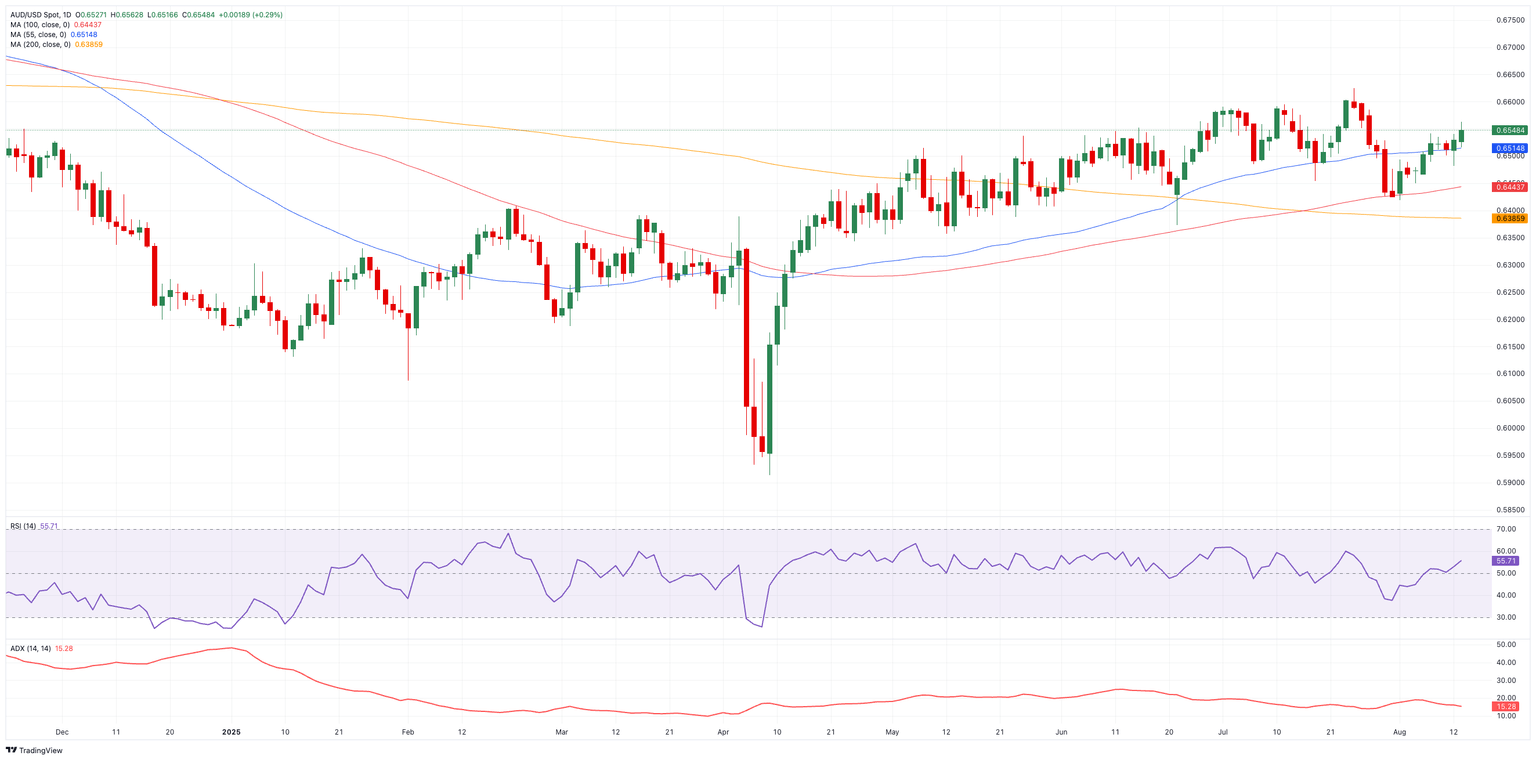

Technical picture: Levels and signals

Initial resistance stands at 0.6625—the 2025 ceiling from July 24—followed by the November 2024 peak at 0.6687 (November 7). A clean break above that area would put the 0.7000 threshold back in view.

On the downside, immediate support is 0.6418 (August 1), ahead of the 200-day Simple Moving Average (SMA) at 0.6388. The loss of this level could spark a potential decline to the June floor at 0.6372 (June 23).

In terms of momentum, the Relative Strength Index (RSI) has risen above 56, which indicates increasing upward pressure, while the Average Directional Index (ADX) at around 15 suggests a weak, non-trending market.

AUD/USD daily chart

Outlook: Range until a catalyst arrives

For now, the Aussie looks trapped between 0.6400 and 0.6600, awaiting a catalyst—an upside surprise in Chinese data, a shift from the Fed, or a turn at the RBA—to break the range.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.