Australian Dollar Price Forecast: Amid RBA caution and China’s slowdown

- AUD/USD picked up pace and refocused on the 0.6600 hurdle once again.

- The US Dollar extended its correction following Friday’s poor NFP data.

- China’s trade surplus widened in August to $102.33 billion.

The Australian Dollar (AUD) extended Friday’s gains in a bright start to the new trading week, with AUD/USD once again edging toward the key 0.6600 barrier.

The move came as the US Dollar (USD) stayed on the defensive, slipping toward the lower end of its recent range near 97.50 when tracked by the US Dollar Index (DXY). Meanwhile, investors continue to digest Friday’s disappointing Nonfarm Payrolls (NFP) report, which highlighted ongoing cracks in the US labour market.

Inflation keeps pressure on the RBA

Price pressures remain stubborn in Australia. July’s Monthly Consumer Price Index (Weighted Mean) accelerated to 2.8% from 1.9% in June, while Q2 CPI rose 0.7% on the quarter and 2.1% from a year earlier.

That stickiness explains why the Reserve Bank of Australia (RBA) is moving cautiously.

A resilient economic backdrop

Beyond inflation, Australia’s broader economy is holding up well. The final August Manufacturing PMI printed 53.0, while Services came in at 55.8, both comfortably in expansionary territory. Retail sales rose 1.2% in June and the trade surplus widened to A$7.3 billion in July.

The labour market also looks sturdy, with unemployment edging down to 4.2% as payrolls grew by 24.5K. Private capital expenditure increased 0.2% in the April-June period, while GDP surprised on the upside with 0.6% quarterly growth and 1.8% annualised in the period.

RBA signals data-driven approach

Earlier this month, the RBA trimmed interest rates by 25 basis points to 3.60% and cut its 2025 growth forecasts. Governor Michele Bullock pushed back on calls for aggressive easing, stressing that policy remains data-dependent.

Minutes from the last meeting suggested faster cuts could be on the table if the labour market softens, though a gentler pace is more likely if conditions remain firm. For now, markets expect the RBA to hold the Official Cash Rate (OCR) steady on September 30, with around 30 basis points of cuts priced in by year-end.

China’s recovery remains crucial for the Aussie

China’s economic performance continues to weigh heavily on the Australian outlook.

Second-quarter GDP rose 5.2% YoY, with industrial output up 7%, though retail sales lagged. August PMIs were mixed, with manufacturing slipping to 49.4 while services improved to 50.3. The trade surplus widened last month, and upcoming CPI figures are expected to confirm deflationary pressures in August.

On the policy side, the People’s Bank of China (PBoC) left its Loan Prime Rates (LPR) unchanged in August at 3.00% (1-year) and 3.50% (5-year), as expected.

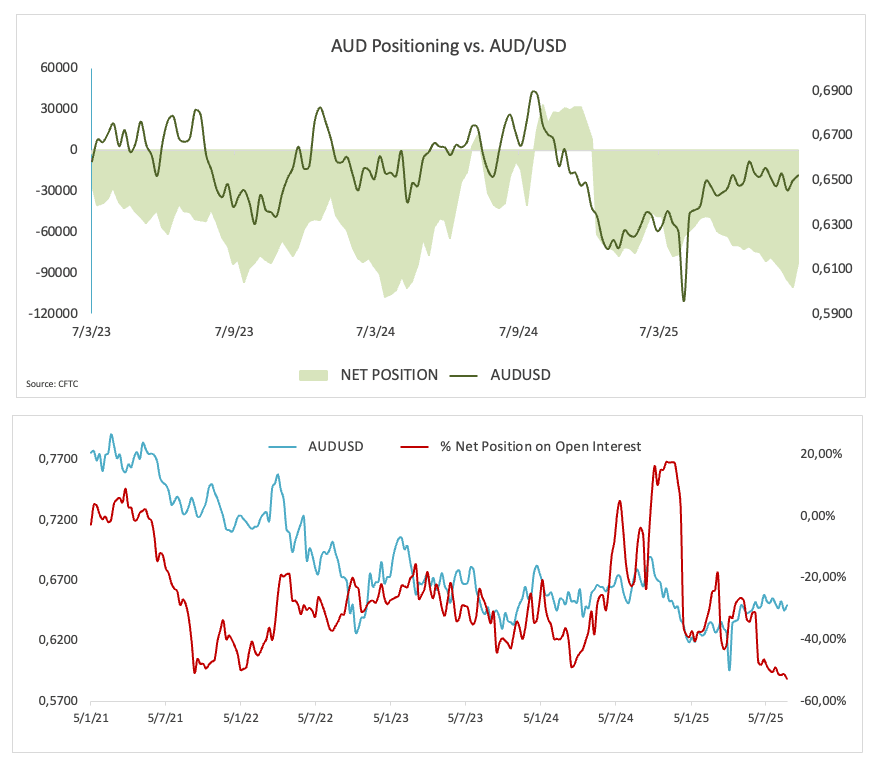

Speculators trim bearish bets on AUD

Positioning data suggests traders are still leaning against the Aussie, though less aggressively. Commodity Futures Trading Commission (CFTC) data showed net speculative shorts fell to five-week lows near 82.7K contracts in the week through September 2. Open interest also dropped to three-week troughs just over 185K contracts.

AUD/USD technical picture

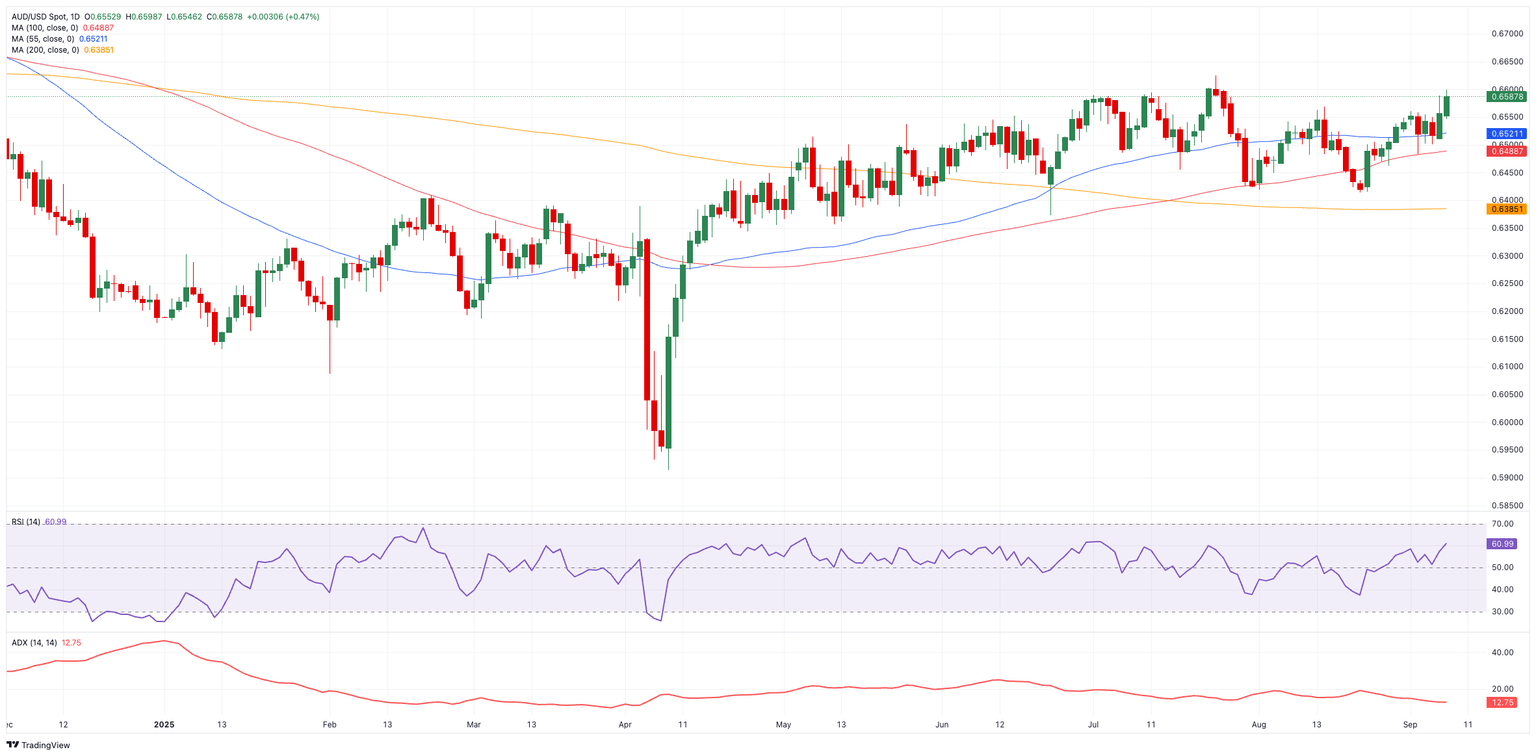

For now, AUD/USD remains boxed between 0.6400 and 0.6600. Resistance comes first at the September high of 0.6598 (September 8), followed by the 2025 ceiling of 0.6625 (July 24). A break above the latter could open the door to the November 2024 peak at 0.6687 (November 7), before the psychological 0.7000 mark.

On the downside, there is an initial support at the August base of 0.6414 (August 21), ahead of the 200-day Simple Moving Average (SMA) at 0.6386, and the June low of 0.6372 (June 23).

Momentum indicators remain mixed: The Relative Strength Index (RSI) has picked up pace and surpassed 61, suggesting strengthening buying pressure, although the Average Directional Index (ADX) below 13 points to a juiceless underlying trend.

AUD/USD daily chart

Short-term outlook

With no immediate catalyst on the horizon, AUD/USD looks set to remain range-bound. A stronger run of Chinese data, a shift in Federal Reserve (Fed) policy, or a surprise move from the RBA would likely be needed to break the current stalemate.

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.