Aussie rises as Australia reported a record trade surplus in May

The Australian dollar rose slightly against the US dollar as traders reacted to the improving trade numbers. According to the statistics office, the country had a record trade surplus of more than $8 billion in May, which was a $195 million increase from the previous month. This happened as exports fell by 4% while imports fell by about 6%. This is after the two declined by 11% and 10% in the previous month, respectively. The data came a day after the bureau reported strong manufacturing PMIs, a signal that the economy is returning to normal.

The US dollar weakened slightly as traders wait for the nonfarm payrolls data. Analysts expect that the economy added more than 3 million jobs in June after adding more than 2.5 million jobs in the previous month. They also expect that the unemployment rate improved to 12.3% from the previous 13.3%. On wages, they expect that they rose by 5.3%, down from the previous 6.7%. Meanwhile, analysts polled by Reuters believe that the initial jobless claims data rose by more than 1.3 million in the previous week. These numbers will come at a time when the number of coronavirus cases in the United States rose by more than 50,000 in a single day.

The Swiss franc was little changed during the Asian session ahead of important inflation data. This number is usually important because it helps the central bank in delivering its rates decision. Analysts expect that the CPI rose by 0.1% on a month on month basis. They see it falling by 1.2% year on year after falling by 1.3% in the previous month. Meanwhile, we will receive the PPI data from the eurozone, trade numbers from Canada, and factory orders numbers from the United States.

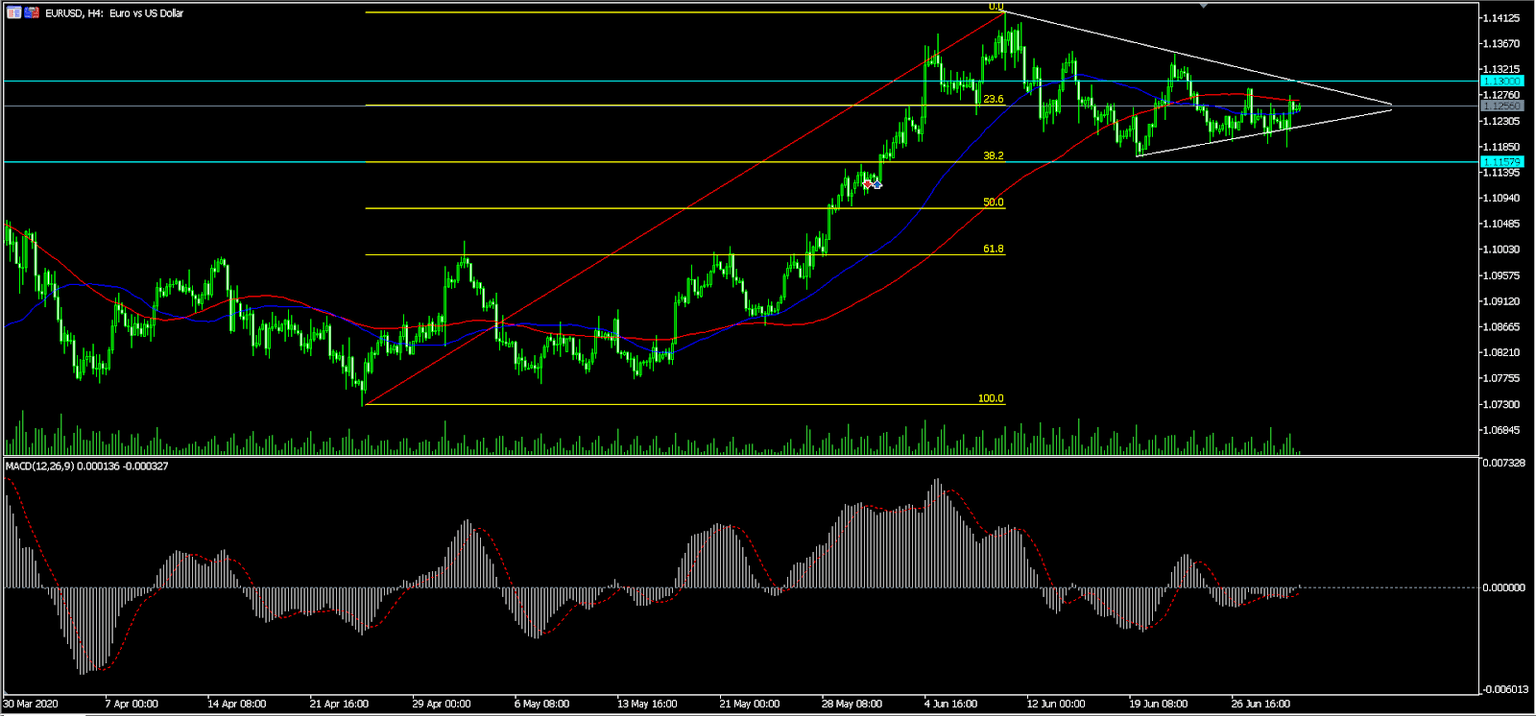

EUR/USD

The EUR/USD pair rose slightly during the American session. It is trading at 1.1256, which is slightly above yesterday’s low of 1.1180. On the four-hour chart, the price is along the 50-day and 100-day exponential moving averages while the MACD has moved above the neutral line. Most importantly, the price is between the triangle pattern shown in white. With this triangle nearing its tip, there is a likelihood that it will make a significant breakout ahead or after the NFP data.

GBP/USD

The GBP/USD pair rose slightly to an intraday high of 1.2480, which is the highest it has been since June 24. On the four-hour chart, the price is slightly above the 50-day and 100-day exponential moving averages while the MACD has risen above the neutral line. Also, the RSI has moved closer to the overbought level. The pair has also moved above the upper line of the triangle pattern. However, this happened in a low volume environment, which means that a reversal is still possible.

AUD/USD

The AUD/USD pair rose slightly to an intraday high of 0.6948. On the four-hour chart, the price is slightly above the 50-day and 100-day exponential moving averages. It is also on the upper side of the triangle pattern. The main line and histogram of the MACD have moved slightly higher, which means that the pair could continue moving higher.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.