Aussie extended its gains after RBA

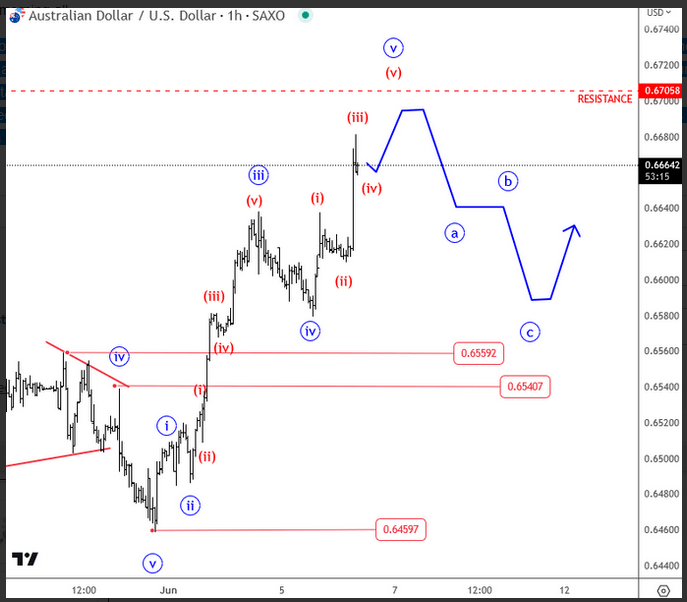

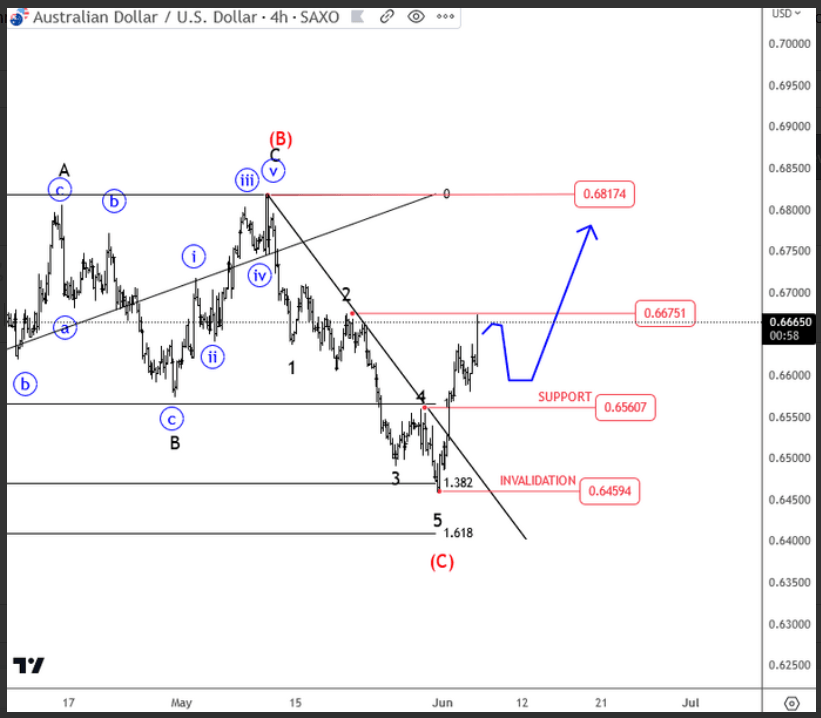

Move of the Asian session was Aussie because of RBA rate decision. AUD is up across the board after another rate hike by CB. They said that this hike will provide greater confidence that inflation would return to the target. More importantly, they added that some further tightening may be required. From an Elliott wave perspective, we see nice push higher, but ideally, that's still fifth wave of the first big impulse so possibly more gains after a pullback. Next pullback can be an opportunity for longs.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.