AUD/USD Weekly Forecast: Profit-taking of uncertain timing

- AUD/USD reached a nearly three-year high on Thursday.

- Dollar gains on Friday despite dismal US Retail Sales, Jobless Claims.

- Australia employment expected to continue recovery in December.

- Commodity currencies retain strength as global recovery expected.

- FXStreet Forecast Poll predicts a modest correction soon.

The AUD/USD came close again this week, pulling up to 0.7806 on Thursday just shy of the three year high of 0.7820 from January 6. Friday's pullback to support at 0.7700 is not rejection of the overall upward trend that goes back to April, but it may be sign that profit-taking is underway on the very steep ascent from the beginning of November.

The basic logic for the AUD/USD is that of the commodity complex in anticipation of a global recovery as the pandemic relents.That scenario still holds as the final arbiter for 2021 despite the setbacks in pandemic control of varying degrees of seriousness in the US, Europe and China.

The aussie has been more than 40% higher against the US dollar in the last decade than it is now and a full-tilt global expansion would provide many opportunities for the resource driven Australian economy.

Australian data was negligible. Inflation rose slightly in December as did Retail Sales in November.

American data has detailed the impact of the renewed business closures in California, the largest state economy, and modified restrictions in cities like New York which has again shuttered indoor restaurants.

Retail Sales for December fell in every category reflecting the worsening employment picture. Initial Jobless Claims jumped to 965,000 in the January 8 week (released January 14) the highest total in five months. National payrolls (released January 8) shed 140,000 jobs in December. It was the first decrease since the pandemic lockdown crash in March and April April deleted 22.16 million employees.

Poor US statistics are not driving currency valuations. Despite the information the dollar scored the largest one-day gain against the aussie since October 28 on Friday.

Technically, the channel break at 0.7740 and the close at 0.7708 is not conclusive. The minor support at 0.7700 was pierced to a low of 0.7680 on Friday.

Since the beginning of December there have been two single-day runs that have been barely crossed in subsequent trading: December 10 open 0.7441, close 0.7536; December 30 open 0.7608, close 0.7676. Beneath the 0.7700 support the open and closing rates on these two days form the next four support lines. In addition, the scarce liquidity in December means the rise on these two days was probably accompanied by much less trading activity than would be normal for such sustained moves, leaving the ranges vulnerable to stop-loss placement.

AUD/USD outlook

The immediate future for commodity currencies would appear bright. Vaccine enabled pandemic control and elimination is the operative assumption. Even if the tangible results are in the future, currencies have been positioning for that eventuality.

In the general revival of the dollar this week, partly sponsored by the modest recovery of US Treasury rates, the two premier commodity currencies, the Canadian and Australian dollars lost 20 points (1.2713 to 1.2733) and 44 points (0.7752 to 0.7708) respectively. The euro, which is definitely not a commodity currency, lost almost two figures, 1.2266 to 1.2078.

The potential for a profit-taking drop in the AUD/USD to support at 0.7535 is relatively high, particularly if US interest rates continue to rise.

Australian statistics January 11-January 15

Monday

TD Securities Inflation for December rose to 0.5% from 0.3% on the month and 1.5% from 1.3% for the year. Retail Sales for November were revised to 7.1% from 7%.

Friday

Home Loans climbed 5.6% in November after gaining 0.8% in October.

US statistics January 11-January 15

Retail Sales in December were far worse than expected as were Initial Claims but had little impact on the dollar. Market remain focused on the prospective federal stimulus package and US Treasury rates.

Tuesday

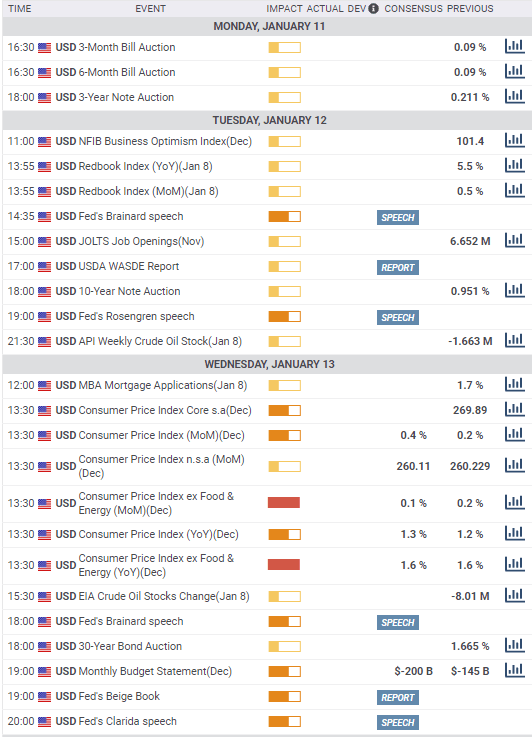

The National Federation of Independent Business Optimism Index (NFIB) dropped to 95.9 in December from 101.4 prior. The forecast was 102.8. The JOLTS Job Openings saw 6.527 million places in November, down from 6.632 in October and below the 6.916 million forecast.

Wednesday

The Consumer Price Index (CPI) rose 0.4% on the month and 1.4% on the year in December up from 0.2% and 1.2% in November. Core CPI rose 0.1% and 1.6% from 0.2% and 1.6% prior. The Fed's Beige Book, prepared for the January 29-30 FOMC meeting, said the economy grew “modestly” in the final weeks of 2020, with the return of COVID-19 cases hampering activity.

Thursday

Initial Jobless Claims jumped to 965,000 in the week of January 8, the highest in five months, from 784,000 previous, 795,000 had been expected. Continuing Claims rose to 5.271 million from 5.072 million, 5.061 had been forecast.

Friday

Retail Sales fell 0.7% in December, far worse than the flat expectation, and the November result was revised to -1.4% from -1.1%. Control Group Sales fell 1.9% from -1.1% in November, its forecast was 0.1%. Sales ex-Autos dropped 1.4% on a -0.1% forecast. November was revised to -1.3% from -0.9%. The Producer Price Index (PPI) rose 0.3% in December after a 0.1% gain in November. On the year it was unchanged at 0.8%. The Core PPI Index was unchanged at 0.1% on the month and 1.2% on the year after 1.4% in November. Industrial Production jumped 1.6% in December, quadruple its 0.4% forecast and more than three times the 0.5% November rate. Capacity Utilization in December fell to 79.2% from 80.7%. The Michigan Consumer Sentiment index slipped to 79.2 in January from 80.7 prior. The forecast was 80.

FXStreet

Australia statistics January 18-January 22

Monday

Employment Change for December is expected to add 50,000 positions following 90,000 in November. The recovery has rehired 79% of the workers laid-off in April and May. The Unemployment Rate is forecast to drop to 6.7% from 6.8% and the Participation Rate to edge to 66.2% from 66.1%. Full-time Employment was 84.2% and Part-Time 5.8% in November. The Commonwealth Bank Purchasing Managers' Indexes for January are due. In December the Manufacturing Index was 55.7, the Services Index was 57 and the Composite Index was 55.6.

Friday

Retail Sales for December will be released, November rose 7.1%.

FXStreet

US statistics January 18-January 22

Initial Jobless Claims are front and center for the labor market, though with the focus on the stimulus package, they will not move trading.

Wednesday

National Association of Home Builders (NAHB) Housing Market Index is expected to be unchanged at 86 in January.

Thursday

Housing Starts in December should rise to 1.562 million annualized in December from 1.547 million in November. Building Permits are forecast to drop to 1.61 million annualized from 1.635 million. Initial Jobless Claims are projected to drop to 860,000 in the January 15 week from 965,000. Continuing Claims were 5.271 million in the January 1 week.

Friday

Markit Manufacturing PMI is expected to fade to 56.5 in January from 57.1. The Services PMI is forecast to drop to 54 from 54.8. Existing Home Sales should drop to 6.46 million annualized in December from 6.69 million prior.

AUD/USD technical outlook

The Relative Strength Index has lost its overbought status this week but at 55.95 is still a sell-signal.The steep and almost unbroken rise in the AUD/USD in the last two months has made the 21-day moving average into a nearly parallel line to the upward channel and at 0.7678 it backs support at 0.7675. The 100-day average at 0.7345 and the 200-day at 0.7092 are well-beyond likely profit-taking range.

The area down to 0.7550 is vulnerable to profit-taking but below that the support is firm and substantiated by fundamental trends.

Resistance: 0.7740; 0.7820; 0.7900

Support: 0.7700; 0.7675; 0.7610; 0.7535; 0.7440

FXStreet Forecast Poll

The FXStreet Forecast Poll expects support at 0.7675 to hold in the initial test but that AUD/USD will eventually succumb to profit-taking to 0.7550. One possible caveat to the delayed drop is US interest rates. If Treasury rates begin to rise again, they stalled this week, the AUD/USD becomes increasingly vulnerable.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.