AUD/USD Weekly Forecast: Pressure mounts in the near-term, but bulls still has an ace up the sleeve

- The Reserve Bank of Australia took action to curb the yields rally.

- The US Federal Reserve is having a monetary policy meeting this week.

- AUD/USD could fall towards 0.7620 but the long-term bullish picture persists.

The AUD/USD pair is has managed to post a modest advance this week, recovering well above the 0.7700 threshold. The greenback strengthened on the back of soaring government bond yields, but in the case of AUD/USD, the stronger dollar was partially offset by Wall Street reaching all-time highs. The Dow Jones Industrial Average and the S&P both hit records on Thursday, after US President Joe Biden signed the $ 1.9 trillion stimulus bill into law, granting more easy money to markets.

Meanwhile, the American currency continued to trade alongside government bond yields. The yield on the benchmark 10-year Treasury yield topped 1.62% at the beginning of the week, plummeted to 1.47% on Wednesday, and resumed their advances on Friday. Concerns surged in the US about rising inflationary pressures, as rising yields imply higher borrowing costs. In fact, several major central banks have taken measures to try to curb yields, but to no avail.

RBA vs the Federal Reserve

The Reserve Bank of Australia Governor Philip Lowe reiterated that “the bank remains committed to the three-year yield target,” but he did not leave alone with words, he turned to deeds. The RBA stopped the Commonwealth treasury lending out three-year government bonds, denying short-sellers access to these assets to dump on market. Additionally, it massively increased the cost of borrowing these bonds, making it prohibitively expensive to short-sell them. US Federal Reserve chief Jerome Powell has repeated multiple times that changes to the monetary policy do not depend on yields but mostly on a recovery in the employment sector. The different stances give an advantage to the aussie.

Worth noting that the Australian economy is in a V-shaped recovery, after expanding at a much faster-than-expected pace in the final quarter of 2020, as the RBA expanded its massive stimulus and the government maintains firm strategies to keep the pandemic in check.

Australian data released these last few days confirmed the better performance of the local economy. NAB’s Business Confidence improved in February to 16 from 10, while NAB’s Business Conditions jumped from 7 to 15 in the same month. March Westpac Consumer Confidence came in at 2.6%, beating expectations. Finally, Consumer Inflation Expectations were up to 4.1% in March.

The US reported February inflation data, with the core annual Consumer Price Index contracting from 1.4% to 1.3%. Initial Jobless Claims for the week ended March 5 improved to 712K. On Friday, the country released the preliminary estimate of the March Michigan Consumer Sentiment Index which beat expectations, printing at 83, beating the expected 78.5 and the previous 76.8.

The upcoming week will start with RBA’s Governor Lowe speaking at a Melbourne Business School online conference. On Wednesday, the country will publish the February Westpac Leading Index while, on Thursday, it will release February employment figures.

In the US, the main event will be the Federal Reserve Monetary Policy Meeting. The central bank is widely anticipated to maintain rates and stimulus programs unchanged, mainly considering the better pandemic-related situation of the US. However, policymakers will likely reiterate that the ultra-loose monetary policy is here to stay, at least until the employment sector recovers to pre-pandemic levels. The US will also release February Retail Sales seen at 0% MoM after printing at 5.9% in January.

AUD/USD technical outlook

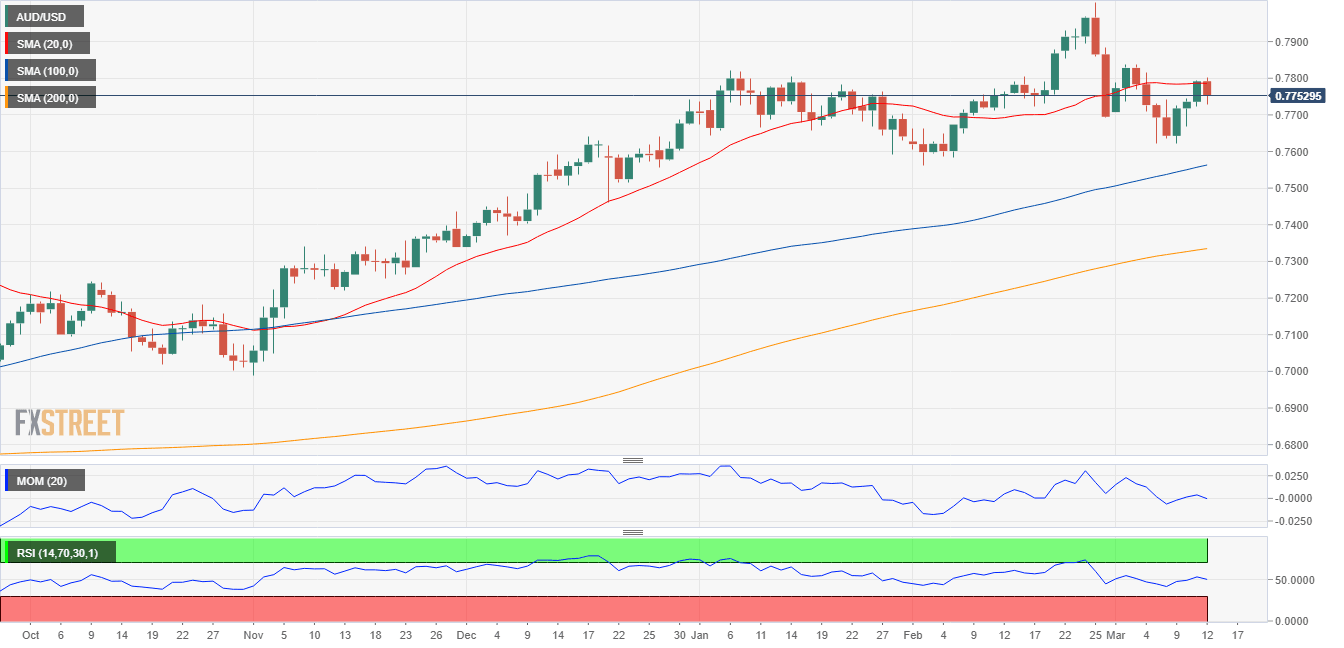

The downside seems well limited for AUD/USD in the weekly chart. The pair remains above a bullish 20 SMA, which advances beyond the longer ones. Technical indicators have lost their bearish strength within positive levels and are currently attempting to recover ground, reflecting increasing buying interest.

In the daily chart, on the contrary, the risk is skewed to the downside. The 20 SMA capped advances, flat in the 0.7780 region, while technical indicators have resumed their declines within negative levels. The 100 and 200 SMA maintain their firm advances well below the current level.

Bulls have better chances of getting good results on a break above 0.7840, opening the doors for an extension towards the year high at 0.8000. An intermediate resistance level comes at 0.7920. The risk will turn lower on a break below 0.7700, with the next relevant support at 0.7620.

AUD/USD sentiment poll

The FXStreet Forecast Poll shows that investors can’t foresee a clear trend in AUD/USD, mostly seen holding within familiar levels. The near-term perspective is bearish, but on average, the pair is seen at 0.7618. Experts are mostly neutral in the monthly and quarterly perspectives, with the pair seen between 0.7630 and 0.7750.

The Overview chart reflects the neutral sentiment, as three moving averages are directionless, as the range of possible targets is limited to 0.7500/0.8000.

Related Forecasts:

EUR/USD Weekly Forecast: Bond yields shattering central banks´ plans

GBP/USD Weekly Forecast: Will the Fed trigger febrile price action? BOE may boost the pound

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.