AUD/USD Weekly Forecast: Paying for the commodity reversal

- Commodity prices slide 4% from the February high.

- US Treasury rates have encouraged a rising greenback.

- Technical support at 0.7600 is weak and awaiting a serious test.

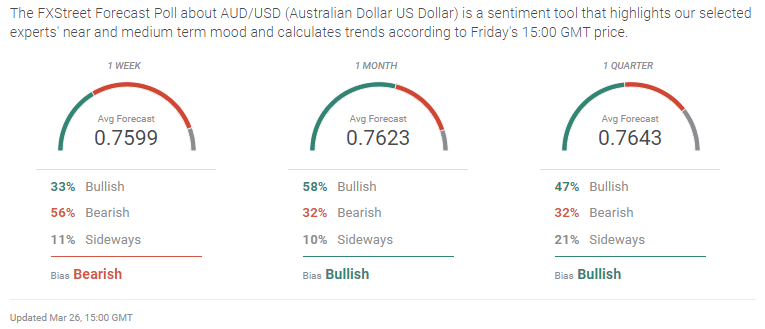

- FXStreet Forecast Poll sees resilient AUD/USD

The Australian dollar spent the week knocking against major support at 0.7600 and if the line held its long-term strength is very much in doubt. Thursday's dip to 0.7562 duplicated this year's February 2 low and Friday's bounce was likely due to a natural market disinclination to break new ground in the final session of the week.

The AUD/USD has been trading at two-year highs since the New Year but the fundamental ground beneath the aussie success has shifted.

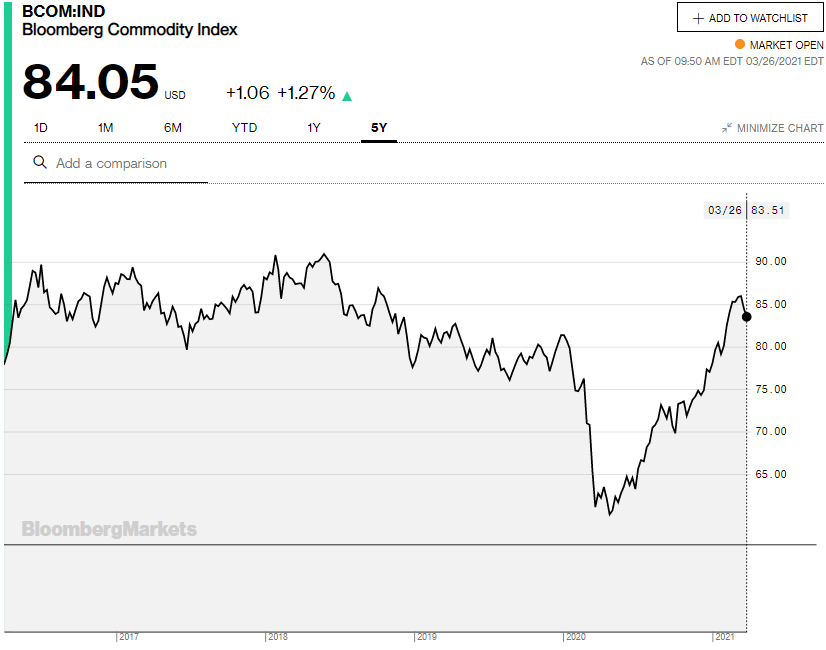

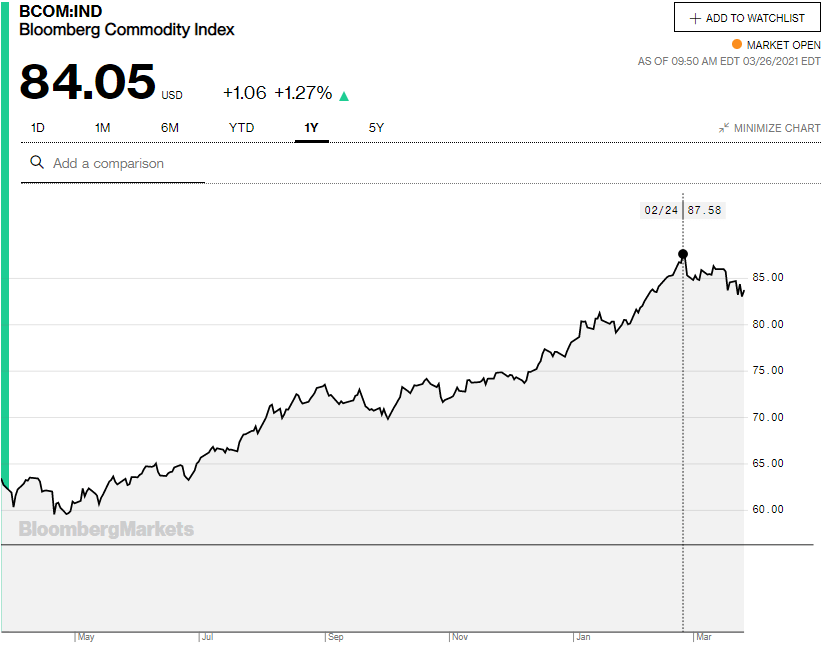

Commodity prices, which had been on a long and sharp increase from their April 2020 low, have reversed. The gain had brought the Bloomberg Commodity Index (BCOM) back to its level in the third quarter of 2018 and anticipated the global recovery from the pandemic.

Since the February 24 high at 87.58 the index has dropped 4%. Commodity prices are one of the earliest indicators of an economic recovery. They are also one of quickest to reverse when growth is at hand.

The general ascendancy of the US dollar this year has been the second reversal for the AUD/USD.

American Treasury rates and improved US data have been the mainspring of dollar strength.

Initial Jobless Claims, the telltale of the pandemic economy, fell to their lowest level since March 13, 2020, the last week before the lockdown explosion. Fourth quarter GDP improved to 4.3% annualized in its final revision from the Bureau of Economic Analysis.

Federal Reserve Chair Jerome Powell successfully threaded the needle in his CARES Act Congressional testimony promising continued support for the economy, and neither praising the sharp rise in Treasury rates as evidence of recovery nor criticizing the bond market for a potential impediment for the still weak US economy.

The 10-year Treasury yield fell 12 basis points to Thursday's close at 1.614% from the prior week's finish at 1.732%, but rebounded to 1.649% on Friday. This benchmark bond remains 73 basis points higher on the year. This is well below its 2-3% range in 2017, 2018 and first-half of 2019 and leaves considerable room for advancement should the US economy continue to improve.

Two factors are driving US rates higher.

Economic growth in the US is expected to accelerate. The Fed's March Projection Materials increased the 2021 GDP estimate to 6.5% GDP from 4.2% in September.

Inflation is also forecast for a rapid gain with the Fed's favorite gauge, the Core Personal Consumption Expenditure (PCE) Price index, rising to 2.2% from 1.8% and the headline rate reaching 2.4% from 1.8% by the end of this year.

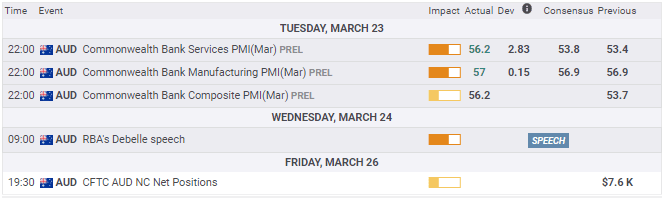

Australian economic data was sparse this week with Commonwealth Bank's PMI measures better than expected in March but hardly the stuff of trading excitement.

Powell and the FOMC: Is it really about the fed funds rate?

AUD/USD outlook

The combination of strong USD fundamentals and weak technical support for the AUD will likely send the aussie lower this week.

With the AUD/USD closing just above the major support at 0.7600, the reputation of the early Asian market on Monday in Auckland and Sydney for stop-loss execution will be tested. Having spent the entire year above 0.7600 the likelihood of AUD/USD selling orders just beneath support is quite high. If 0.7600 is breached the first notable support is 0.7530

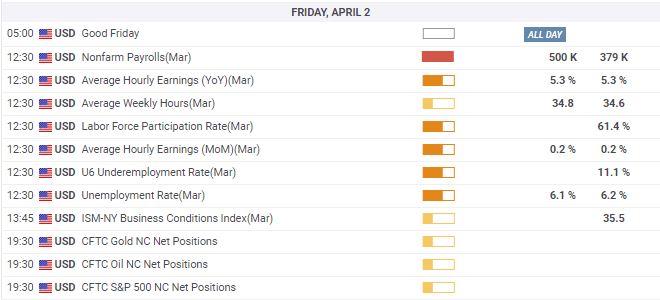

Australian data in the week ahead is from February and of little import. The US Nonfarm Payrolls report on Friday is expected to add 500,000 new jobs and if accurate will further enhance the economic outlook, Treasury rates and the dollar.

Australia statistics March 22-March 26

Tuesday

Commonwealth Bank Services PMI for March rose to 56.2 from 53.4, 53.8 was forecast. The Manufacturing PMI edged up to 57 from 56.9. Composite PMI rose to 56.2 from 53.7 in February.

FXStreet

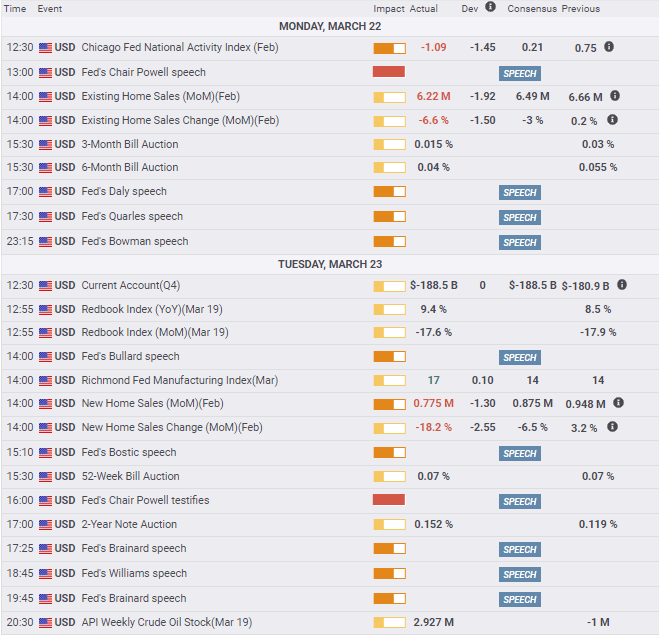

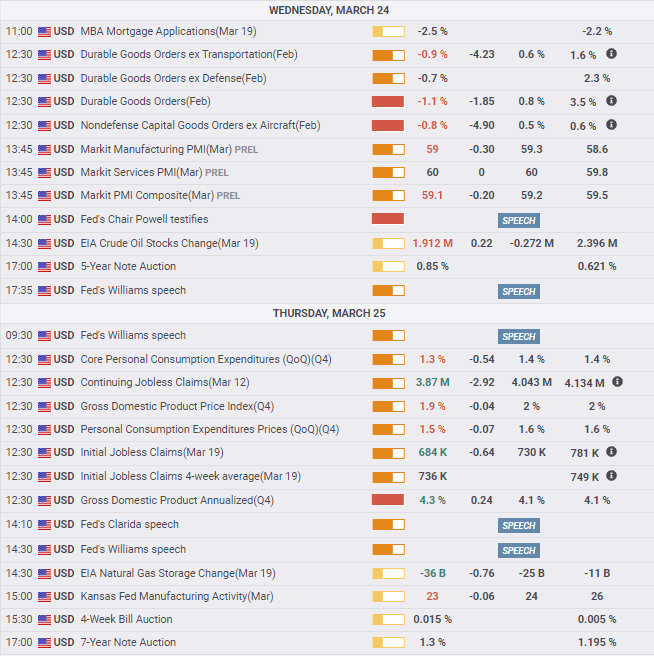

US statistics March 22-March 26

Fed Chairman Powell's Congressional testimony had the most potential for a deliberate or inadvertent market impact. Neither was forthcoming. Mr. Powell is a practiced hand at communication and rarely makes a misstep.

Economic data was good with Jobless Claims falling below 700,000 for the first time in the pandemic era and fourth quarter GDP improving to 4.3% from 4.1% annualized. Durable Goods Sales were worse than forecast in February but restated the already released Retail Sales information.

February Personal Income and Spending also rehearsed old news.

Monday

Existing Home Sales fell 6.6% in February, twice the -3% prediction, to 6.22 million annually from 6.66 million.

Tuesday

New Home Sales plunged 18.2% in February almost three times the -6.5% forecast, to 775,000 from 948,000. Frigid weather in most of the country was the likely culprit.

Wednesday

Durable Goods Orders dropped 1.1% in February from 3.5% in January, 0.8% had been forecast. Goods orders ex Transportation sank 0.9% on a 0.6% prediction and 1.6% in January. Nondefense Capital Goods Orders ex Aircraft fell 0.8% on a 0.5% forecast and 0.6% gain in January.

Thursday

Initial Jobless Claims dropped to 684,000 in the March 19 week from 781,000. The forecast was 730,000. Continuing Claims fell to 3.87 million in the March 12 week, well below the 4.043 million estimate, from 4.134 million prior.

Fourth quarter GDP was revised to 4.3% from 4.1%. Personal Consumption Expenditure Prices (PCE) rose 1.5% on the quarter and Core PCE Prices rose 1.3%.

Friday

The PCE Price Index rose 0.2% on the month and 1.6% on the year in February from 0.3% and 1.4% in January. Core PCE Prices rose 0.1% and 1.4% from 0.3% and 1.5% in January. Personal Income fell 7.1% after January's 10.1% gain. Personal Spending fell 1% from 2.4% in January.

FXStreet

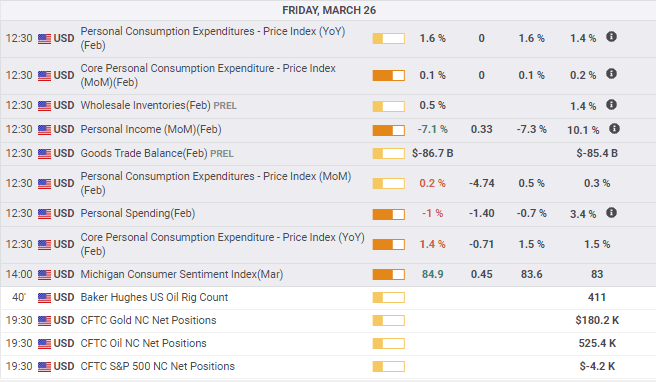

Australia statistics March 29-April 2

Wednesday

Building Permits in February are expected to drop 3% after crashing 19.4% in January. Commonwealth Bank Manufacturing PMI for March: February 57.

Thursday

Retail Sales in February are forecast to rise 0.6% after falling 1.1% in January. February Imports: January -2%. February Exports: January 6%. RBA Commodity Index SDR (YoY) for March: February 23.9%.

FXStreet

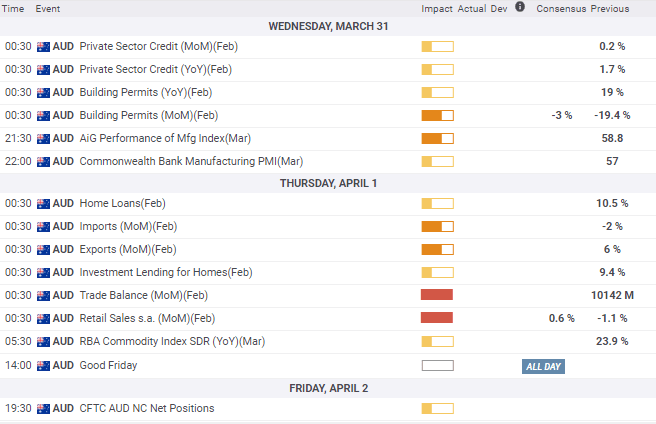

US statistics March 29-April 2

March payrolls rule the week with half-a-million new jobs forecast. If the number is as predicted or better it will give the dollar and Treasury yields a healthy boost. ISM Manufacturing PMI for March could provide additional positive news.

Tuesday

Conference Board Consumer Confidence is forecast to rise to 96 in March from 91.3.

Wednesday

ADP Employment Change is forecast to add 550,000 workers in March after 117,000 in February.

Thursday

Initial Jobless Claims are expected to rise to 690,000 in the March 26 week from 684,000. Continuing Claims should drop to 3.5 million in the March 19 week from 3.87 million. ISM Manufacturing PMI for March expected 61.2, February 60.8; Employment expected 53, February 54.4; New Orders February 64.8. Total Vehicle Sales for March: February 15.7 million.

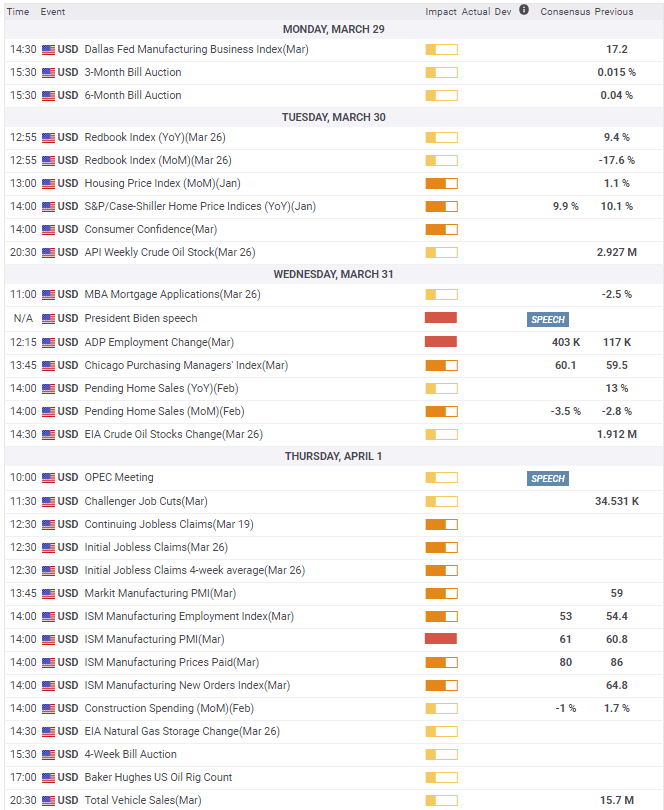

Friday

Nonfarm Payrolls for March, 655,000 forecast, February 379,000. Unemployment Rate 6.0% expected, 6.2% February. Average Hourly Earnings expected 0.1% monthly, 4.6% annually. Underemployment Rate February 11.1%. Labor Force Participation Rate February 61.4%. Average Weekly Hours expected 34.7, February 34.6.

FXStreet

AUD/USD technical outlook

Support at 0.7600 is the main pivot. It held on Friday but has a poor prognosis. Given the change in aussie fundamentals and US dollar strength a permanent return to the range above 0.7625 appears unlikely.

The array of recent vintage resistance lines starting at 0.7660 will prove good levels to establish new short positions should the AUD/USD move higher. The 23.6% Fibonacci of the March 2020 to February ascent is not until to 0.7445 and coincides with support but the true goal of a fall will be closer to the 50% retracement line at 0.6878 and the AUD/USD range in the latter half of 2019.

The Relative Strength Index at 42.90 is neutral. The 21-day moving average (MV) at 0.7718 joins resistance at 0.7715. The 100-day MV at 0.7620 is weak support just below the Friday close. The 200-day MV at 0.7374 will be effective support when reached.

Resistance: 0.7660, 0.7715, 0.7770, 0.7800

Support:0.7620 0.7600, 0.7530, 0.7450, 0.7400, 0.7345

AUD/USD Forecast Poll

The FXStreet Forecast Poll has faith in the technical support at 0.7600. In the medium and long term a rebound in the AUD/USD would depend on a reversal in commodities to counter US dollar strength from rising Treasury rates. With Europe and Japan showing few signs of economic strength commodity prices appear likely to drift lower, undermining the chance for an aussie revival.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.