Dollar rebounds ahead of key US CPI test

Good morning everyone. As you know, we have another very important day ahead, with markets waiting for the US CPI figures. This data is especially important after the higher unemployment rate reported two days ago. Now the key question is whether CPI can push expectations towards more Fed cuts, especially if inflation softens. The market is currently looking for inflation around 3.1% versus 3.0% previously, so a higher print would reduce the odds for further cuts, while a softer number closer to 3.0% would support the case for more easing. In that scenario, the dollar would likely see more weakness, which would also be important for stocks. Stocks have already seen a fairly deep retracement, but if inflation softens or at least comes out around expectations, we could still see stabilization there.

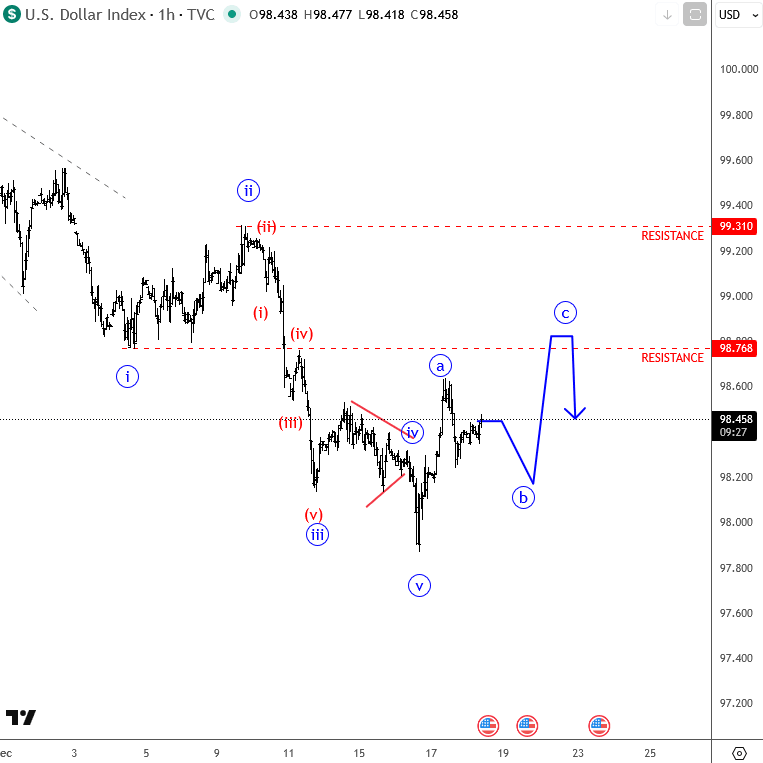

Looking at the Dollar Index, we are already in a recovery phase from yesterday’s lows, which I suspect will unfold in three waves. Ideally this rebound could take us back towards the 98.73 area, which is the first important resistance, and if it extends further then levels around 99 to 99.30 come into focus. The key idea is that this still looks like a temporary corrective bounce within a broader bearish structure, and for now the move higher appears incomplete.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.