AUD/USD Weekly Forecast: Bulls not willing to give up to the risk-averse environment

- The Ukraine-Russia crisis had a limited impact on the aussie, despite stocks plummeting.

- The Reserve Bank of Australia is having a monetary policy meeting next Tuesday.

- AUD/USD is up for a fourth consecutive week and looking to reach fresh 2022 highs.

The Australian dollar managed to advance against its American rival for a fourth consecutive week, trading at around 0.7230 as the week ended. The commodity-linked currency shrugged off the persistent risk-off mood and advanced to 0.7283, its highest since mid-January.

Throughout the week, the market sentiment fluctuated alongside headlines related to the Ukraine-Russia crisis. The latter invaded the first, claiming that Kyiv allying with NATO represents a security concern. Moscow’s military attack took over Chernobyl and reached the capital on Friday when Russia expressed willingness to send a delegation and discuss the possibility of Ukraine becoming neutral.

The news helped stock markets to recover some of the ground lost on Thursday, which in turn underpinned the aussie. The better market mood took its toll on Gold Prices, as the bright metal trimmed weekly gains and now trades below the $1,900 level after topping at $1,974.40 a troy ounce, a multi-month high.

Tensions in Eastern Europe, however, are far from over. The sentiment could take a turn for the worst if things continue to escalate. This pause in risk-off could well be reversed if Moscow keeps advancing into Ukraine and cancels potential talks recently announced.

Busy Australian calendar

On the data front, Australian figures came in mixed. Probably the most concerning reading was the Q4 Wage Price Index, as it advanced a modest 0.7% in the quarter and 2.3% when compared to a year earlier. The Reserve Bank of Australia would like to have wages growing at 3% YoY to consider raising rates. Good news came from the business front as the Commonwealth Bank February flash PMIs came in better than anticipated.

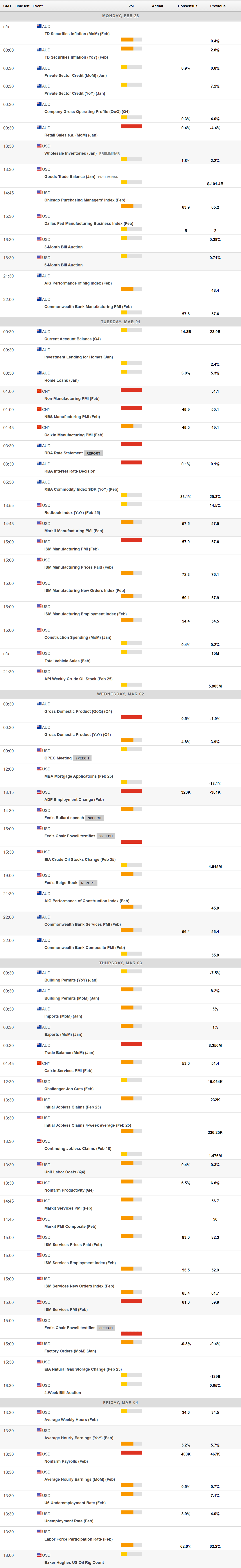

Australia has a busy macroeconomic calendar next week, which will provide further clues on local growth and possible monetary policy decisions. The country will publish February TD Securities Inflation and January Retail Sales on Monday and later will report the official PMIs. Later into the week, the country will publish its Q4 Gross Domestic Product, foreseen at 0.5% QoQ, and the January Trade Balance. Finally, the Reserve Bank of Australia is scheduled to meet next Tuesday, although no changes to the current policy are expected at the time being.

The US will release the official ISM PMIs and February employment figures in the upcoming days. The ADP report is expected to show that the private sector recovered 328K positions after losing 301K in the previous month. On Friday, the country will publish the Nonfarm Payrolls report, expected to show the country added 400K new jobs in the month. The Unemployment Rate is expected to have contracted to 3.9%.

AUD/USD technical outlook

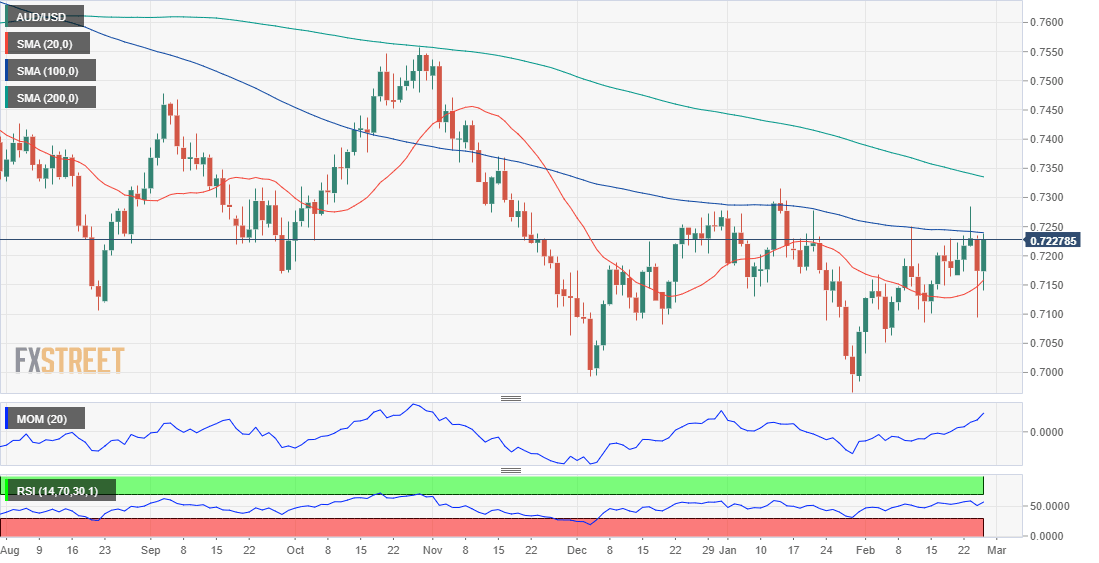

The weekly chart for AUD/USD shows that the risk is skewed to the upside, although additional confirmations are needed. The pair topped at 0.7313 in early January, and a clear break above the level should help to convince bulls. Technical indicators in the mentioned time frame continue to recover from near oversold readings, maintaining their bullish slope within neutral levels. At the same time, the price remains trapped between moving averages, all of them confined to a 100 pips range.

The daily chart shows that the pair has spent the week trading above a mildly bullish 20 SMA while below a bearish 100 SMA. Technical indicators, in the meantime, ticked north within positive levels but remain below their weekly highs, failing to confirm another leg north.

A break through the 0.7310 price zone should lead to a test of 0.7400, while above the latter, the rally could continue towards 0.7470. The immediate support area is 0.7150, followed by the 0.7090 level.

AUD/USD sentiment poll

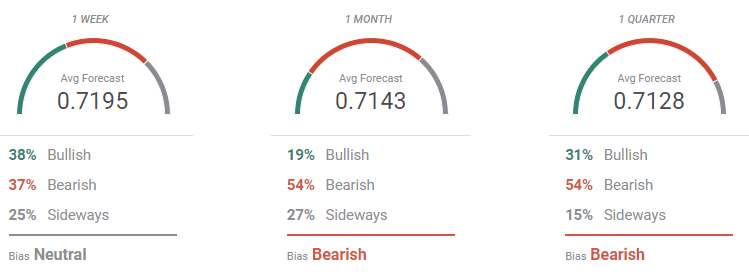

The FXStreet Forecast Poll hints at a bearish extension, as the pair is neutral in the weekly view, but bearish in the monthly and quarterly ones. The pair is seen on average between 0.7100 and 0.7200 in the three time frames under study, reflecting the ongoing uncertainty.

The Overview chart shows that moving averages are directionless, as the spread of possible targets is quite even. It is worth mentioning that the pair is hardly seen surpassing the 0.7400 level in the upcoming weeks, but the chances of a break below 0.7000 increase as time go by.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.