AUD/USD Weekly Forecast: At risk of resuming its decline and falling to fresh 2021 lows

- Upbeat Australian employment data partially offset a dismal market mood.

- The US Federal Reserve doubled tapering in its December meeting, as expected.

- AUD/USD lost momentum heading into the weekend, critical support at 0.7125.

The AUD/USD pair fell to 0.6992, its lowest since November 1, but managed to close the week with gains in the 0.7160 price zone. The pair benefited from broad greenback weakness following the US Federal Reserve decision on Wednesday, and upbeat Australian employment figures.

The Fed delivered as expected, and the lack of news was good news for stocks, which rallied to the detriment of the greenback. The central bank left rates unchanged but doubled its tapering target to $30 billion a month, starting January 2022. That means the central bank will stop buying $20 billion Treasuries and $10 billion Mortgage-Backed Securities per month, and also means sooner rate hikes. The Fed’s dot-plot now implies three rate hikes in 2022 and three more in 2023.

Additionally, the central bank upwardly revised its inflation forecasts to 5.6% for 2021 and 2.6% for 2022, up from 4.2% and 2.2% previously. The Gross Domestic Product is now projected at 4% in 2022, up from the previous median forecast of 3.8%, while the economy is estimated to grow 2.2% in 2023, down from the 2.5% from September.

Australian recovery picking up pace

On Thursday, Australia reported that it managed to create 366.1K job positions in November, much better than the 200K expected. The unemployment rate contracted to 4.6%, while the Participation Rate rose to 66.1%, both beating expectations and hinting at a stronger than anticipated economic comeback. The pair reached 0.7223, its highest in over a month, although the momentum faded afterwards, with stocks turning lower on Friday and dragging AUD/USD alongside.

In the meantime, Australia published the December Commonwealth Bank Manufacturing PMIs, which came in better than anticipated, but below November figures. As for the US, the country published the Producer Price Index, which jumped to 9.6% YoY in November, while Retail Sales in the same month rose a modest 0.3%. In Europe, the German IFO Business Climate contracted to 94.7 in December, while the EU Consumer Price Index was confirmed at 2.6% YoY in November.

The upcoming week will be a light one in terms of data, as the US will publish the final reading of its Q3 Gross Domestic Product and November Durable Goods Orders, while the EU will unveil December Consumer Confidence. Australia will publish the December Westpac Leading Index and November Retail Sales.

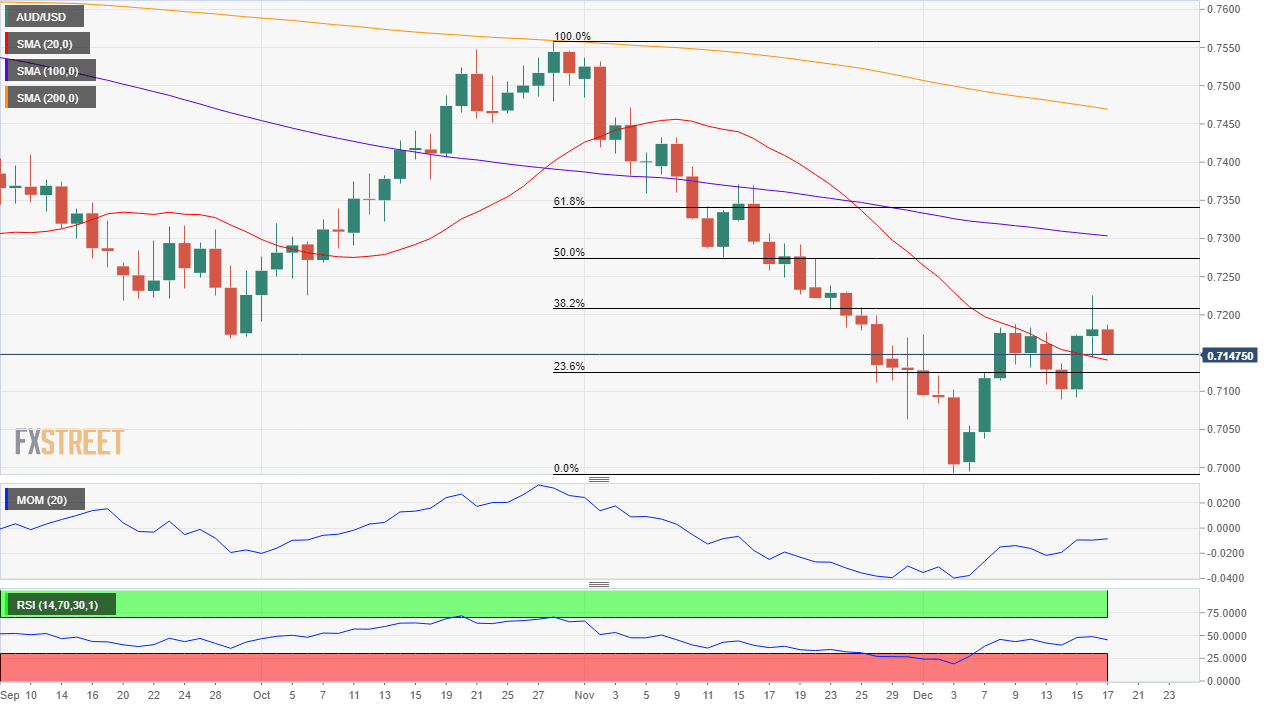

AUD/USD technical outlook

The AUD/USD pair has extended its previous recovery up to the 38.2% retracement of its 0.7555/0.6992 decline at around 0.7210 and currently holds above the 23.6% retracement of the same decline at 0.7125, the immediate support level.

The weekly chart shows that the risk remains skewed to the downside, given that AUD/USD met sellers around its 100 SMA while also retreating from the mentioned Fibonacci level. Technical indicators remain directionless within negative levels, hinting at the possibility of another leg south.

Technical readings in the daily chart support the case for a bearish leg ahead. The AUD/USD pair is barely holding above a bearish 20 SMA, while technical indicators have turned lower, the Momentum is around its midline and the RSI is already within negative levels.

Additional gains towards 0.7300 are likely once above the mentioned weekly high, although a steady advance is out of the picture for now. A break below 0.7125 could see the pair falling towards 0.770 first and 0.6990 afterwards.

AUD/USD sentiment poll

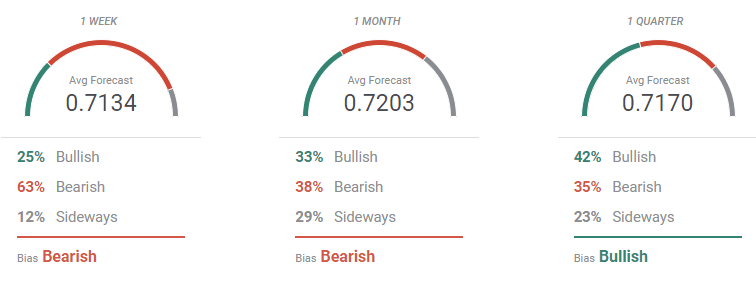

The FXStreet Forecast Poll suggest AUD/USD will likely resume its decline during the upcoming weeks. Bears are a majority in the weekly and monthly perspectives, although bulls take over in the quarterly view. However, those seeing the pair ranging are a large proportion of the polled experts in the longer-term views. On average, the pair is seen above 0.7000.

The Overview chart shows that the moving averages are painting quite a mixed picture, but overall lacking clear directional strength. The range of possible targets is quite wide in the monthly and quarterly views, also hinting at high levels of doubts among speculative interest.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.