AUD/USD Price Forecast: Upside target remains at 0.6515

- AUD/USD regained traction and reclaimed the 0.6400 barrier on Tuesday.

- The US Dollar faced renewed downside pressure following Monday’s gains.

- Australia’s Wage Price Index matched consensus in the first quarter.

The renewed selling bias in the US Dollar (USD) lent much needed oxygen to Australian Dollar (AUD) and the risk complex in general, prompting AUD/USD to regain upside impulse and surpass the key barrier at 0.6400 the figure.

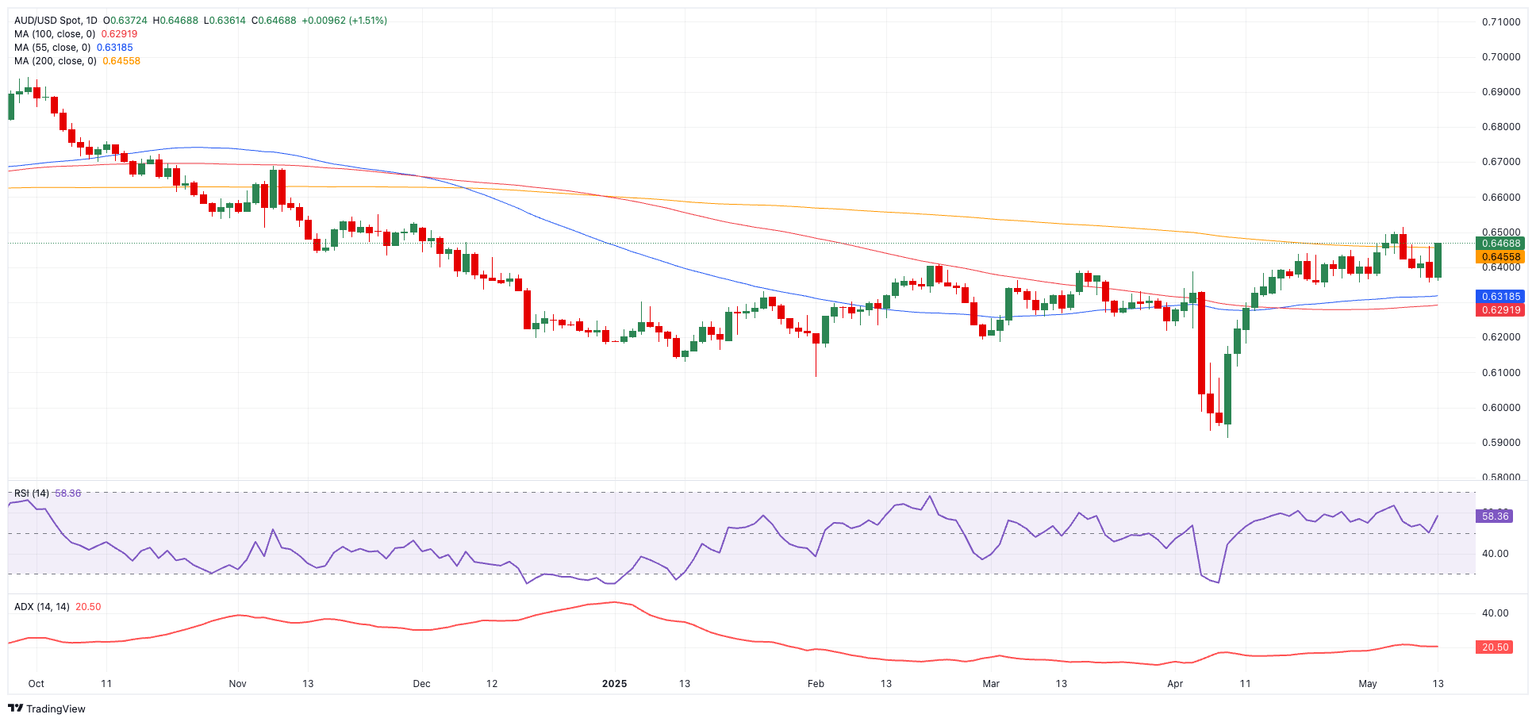

Following Monday’s deep pullback, the pair challenged once again its critical 200-day SMA around 0.6460. Once that key region is cleared, AUD/USD could then embark on a potential visit to its YTD peaks north of the 0.6500 hurdle reached earlier in the month.

For now, investor focus seems to be shifting toward the lack of clarity in the newly announced US-China trade deal—particularly around its extension and what it might mean for a longer-term solution.

That said, any meaningful progress on the trade front should eventually be a positive for the Aussie, given Australia’s strong economic links with China.

China policy easing in focus

On the policy front, the People’s Bank of China (PBoC) introduced last week targeted easing measures in response to sluggish domestic data, including cuts to the 7-day reverse repo rate and the reserve requirement ratio (RRR). Authorities also expanded lending quotas and announced rate cuts aimed at specific sectors.

Adding to the above, inflation data out of China showed a modest 0.1% rise MoM in April, while the annual figure dipped 0.1%, underscoring persistent disinflationary pressures.

Monetary policy divergence at play

Monetary policy dynamics are also weighing on AUD/USD. While both the Federal Reserve (Fed) and the Reserve Bank of Australia (RBA) kept rates unchanged, their guidance diverged.

Fed Chair Jerome Powell struck a cautious but hawkish tone, emphasising patience as the Fed gauges incoming data. Meanwhile, RBA Governor Michele Bullock cited sticky inflation and a tight labour market as justification for keeping the cash rate at 4.10%.

Markets are still pricing in a possible 25 basis point cut at the RBA’s 20 May meeting, but expectations for aggressive easing have moderated. Forecasts now suggest as much as 125 basis points in cuts over the coming year, down from earlier projections.

Around the Fed, and following easing US inflation in April, market participants seem to have started to pencil in a rate cut at the September gathering.

Positioning shows signs of stabilisation

CFTC data released for the week ending May 6 revealed that net short positions on the Aussie fell to an eight-week low of around 48.3K contracts. A modest decline in open interest points to tentative stabilisation in sentiment.

Technical outlook: Mixed signals

From a technical perspective, a decisive move back above the 200-day Simple Moving Average (SMA) would likely improve the short-term outlook for AUD/USD.

Resistance levels are eyed at the 2025 high of 0.6514 (May 7) and the November 2024 peak at 0.6687.

On the downside, transitory support sits at the 55-day SMA (0.6316) and 100-day SMA (0.6290). A breach of these levels could open the door to the 2025 bottom of 0.5913 and potentially the pandemic-era bottom near 0.5506.

Momentum indicators suggest swelling strength, with the Relative Strength Index (RSI) climbing past55, and the Average Directional Index (ADX) looking stable around 21, indicative of a modest strength in the trend.

AUD/USD daily chart

Outlook: Cautiously constructive

Despite mixed technicals and a challenging macro backdrop, sentiment toward the Aussie appears to be stabilising. Still, with domestic inflation proving stubborn and Australia’s economic fortunes closely tied to China’s recovery, price action is likely to remain volatile in the near term.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.