AUD/USD Price Forecast: Tough hurdle remains above 0.6500

- AUD/USD made a U-turn and gave away Monday’s marked advance.

- The US Dollar remained on the back foot, adding to recent losses.

- The RBA lowered its OCR by 25 bps to 3.85%, as widely expected.

The Australian Dollar (AUD) staged an abrupt U-turn on Tuesday, surrendering almost all of gains made in the previous day and coming under renewed pressure after failing to reclaim its critical 200-day SMA.

Indeed, AUD/USD reversed course and briefly pierced the 0.6400 floor on Tuesday despite the mild retracement in the US Dollar (USD) and following the dovish message from the Reserve Bank of Australia (RBA) at its gathering earlier in the Asian trading hours.

Policy divergence shapes FX outlook

Monetary policy divergence between the Federal Reserve (Fed) and the RBA is also becoming a key driver of the AUD/USD outlook.

That said, the Fed kept interest rates unchanged at its May 7 meeting, with Chief Jerome Powell maintaining a cautious stance, reiterating a wait-and-see approach to future cuts. Softer April inflation data and trade optimism have recently prompted traders to start pencilling in the first Fed rate cut around September.

In contrast, RBA trimmed its OCR by 25 basis points to 3.85% on Tuesday, matching the broad consensus.

The bank’s decision slightly eases the policy stance amid a clouded economic outlook. In fact, the Monetary Policy Report (MPR) assumes the policy rate will settle around 3.2% by 2027, signalling a gradual shift away from tight conditions. Officials noted that monetary policy is now “somewhat less restrictive,” but maintained a prudent tone, citing elevated uncertainty around both demand and supply dynamics.

From the statement, the bank reduced its GDP growth forecast for the year to December 2025 to 2.1% and lowered its projection for trimmed mean inflation to 2.6%.

Chinese data lends a hand

The Aussie found support on Monday from mixed Chinese economic results that, while showing signs of softening, continued to reflect resilience. Indeed, solid industrial output but weaker-than-expected retail sales and fixed asset investment, suggested a humble loss of momentum in the January-March period. Still, the economy appears on track for around 5% growth in Q2.

However, ongoing uncertainty over US tariffs and persistent weakness in China’s property sector remain headwinds.

Early on Tuesday, the People’s Bank of China (PBoC) lowered its 1-Year and 5-Year Loan Prime Rate (LPR) by 10 bps to 3.00% and 3.50%, respectively.

Speculators back off bearish AUD bets

Bearish positioning on the Aussie appears to be easing. The latest CFTC report showed net shorts hovering near an eight-week low at 49.3K contracts as of May 13, with open interest also receding somewhat.

Chart watch: Outlook is far from clear

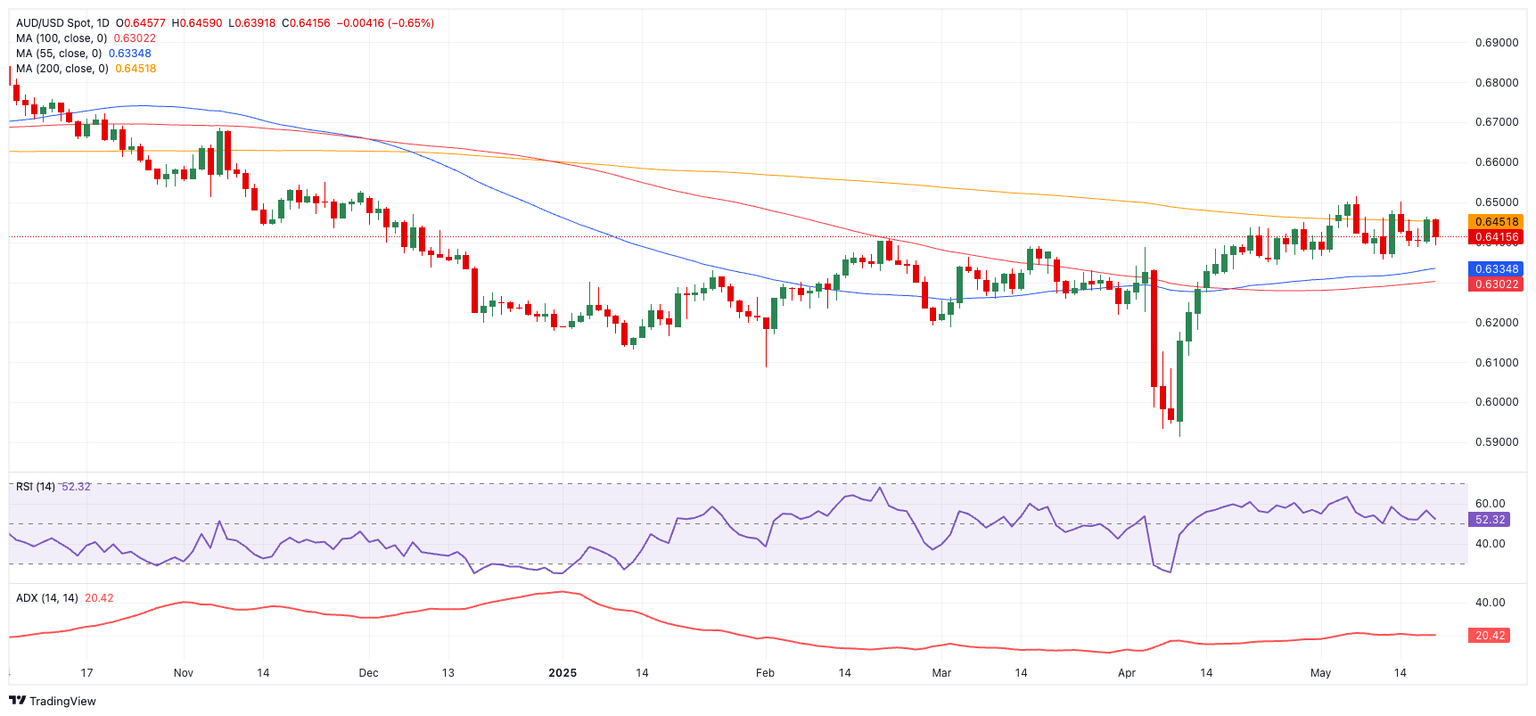

Technically, AUD/USD must clear its 200-day simple moving average (SMA) at 0.6454 to sustain its upward momentum. A break above this region could pave the way for a retest of the YTD high at 0.6514 (May 7), with further gains targeting the November 2024 top at 0.6687.

On the other hand, intermediate contention sits at the 55-day and 100-day SMAs at 0.6333 and 0.6300, respectively, seconded by the 2025 floor at 0.5913 and, further out, the pandemic-era trough at 0.5506 (March 19, 2020).

Momentum indicators are mildly constructive, with the Relative Strength Index (RSI) nearing 52 and the Average Directional Index (ADX) around 21 pointing to a modest upward trend.

AUD/USD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.