AUD/USD Price Forecast: The hunt for 0.6500 and beyond

- AUD/USD added to recent losses and put the 0.6400 level to the test.

- The US Dollar traded slightly on the back foot on mixed US data, trade.

- Australia showed a solid jobs report in April. Inflation Expectations eased in May.

AUD/USD slipped under renewed selling pressure despite a continued softening in the US Dollar (USD) on Thursday. The Australian Dollar (AUD) continued to fade part of Tuesday’s sharp rebound, this time retreating below its critical 200-day Simple Moving Average (SMA) near 0.6460.

Traders appear increasingly focused on the uncertainty surrounding the recently announced US–China trade agreement, particularly over its long-term viability and the potential for a broader resolution. Progress on that front could offer support to the Aussie, given Australia’s close economic ties with China.

The Chinese factor

On the monetary policy side, the People’s Bank of China (PBoC) implemented a suite of targeted easing measures in response to sluggish domestic data. These included a cut to the 7-day reverse repo rate, a reduction in the reserve requirement ratio (RRR), increased lending quotas, and sector-specific rate adjustments.

China’s latest inflation figures highlight the deflationary undertone, with consumer prices edging up just 0.1% in April from the previous month and slipping 0.1% year-on-year — underscoring weak demand conditions despite modest trade optimism.

Moving forward, the PBoC is widely anticipated to keep its 1-Year and 5-Year Loan Prime Rate (LPR) unchanged at 3.10% and 3.60%, respectively, at its May 20 event.

Central banks’ view: Opposite sides?

Meanwhile, diverging signals from central banks are also shaping AUD/USD dynamics. Both the Federal Reserve (Fed) and the Reserve Bank of Australia (RBA) have held rates steady, but their policy tones are diverging.

Fed Chair Jerome Powell struck a measured, slightly hawkish stance, signalling a wait-and-see approach on rate cuts. RBA Governor Michele Bullock, however, pointed to persistent inflation and a tight labour market as justification for keeping the cash rate at 4.10%.

Markets continue to price in a potential 25 basis point cut from the RBA at its 20 May meeting, although expectations for deeper easing have been scaled back. Forecasts now suggest a total of 125 basis points in cuts over the coming year — down from earlier projections.

In the US, softer April inflation data have prompted speculation over a possible Fed rate cut as early as September.

Reinforcing the RBA’s prudent stance, April’s labour market report in Oz saw the Unemployment Rate hold steady at 4.1%, while the Employment Change increased by 89.0K individuals, and the Participation Rate ticked higher to 67.1%. Further domestic data showed the Consumer Inflation Expectations eased to 4.1% in May, according to the Melbourne Institute.

Bearish bets on the Aussie kept shrinking

Positioning data from the CFTC suggests sentiment may be stabilising. Net short positions on the Australian Dollar fell to an eight-week low of roughly 48.3K contracts in the week to May 6, with a modest drop in open interest indicating tentative buying interest.

Technical landscape: Bulls’ challenge to break above 0.6500

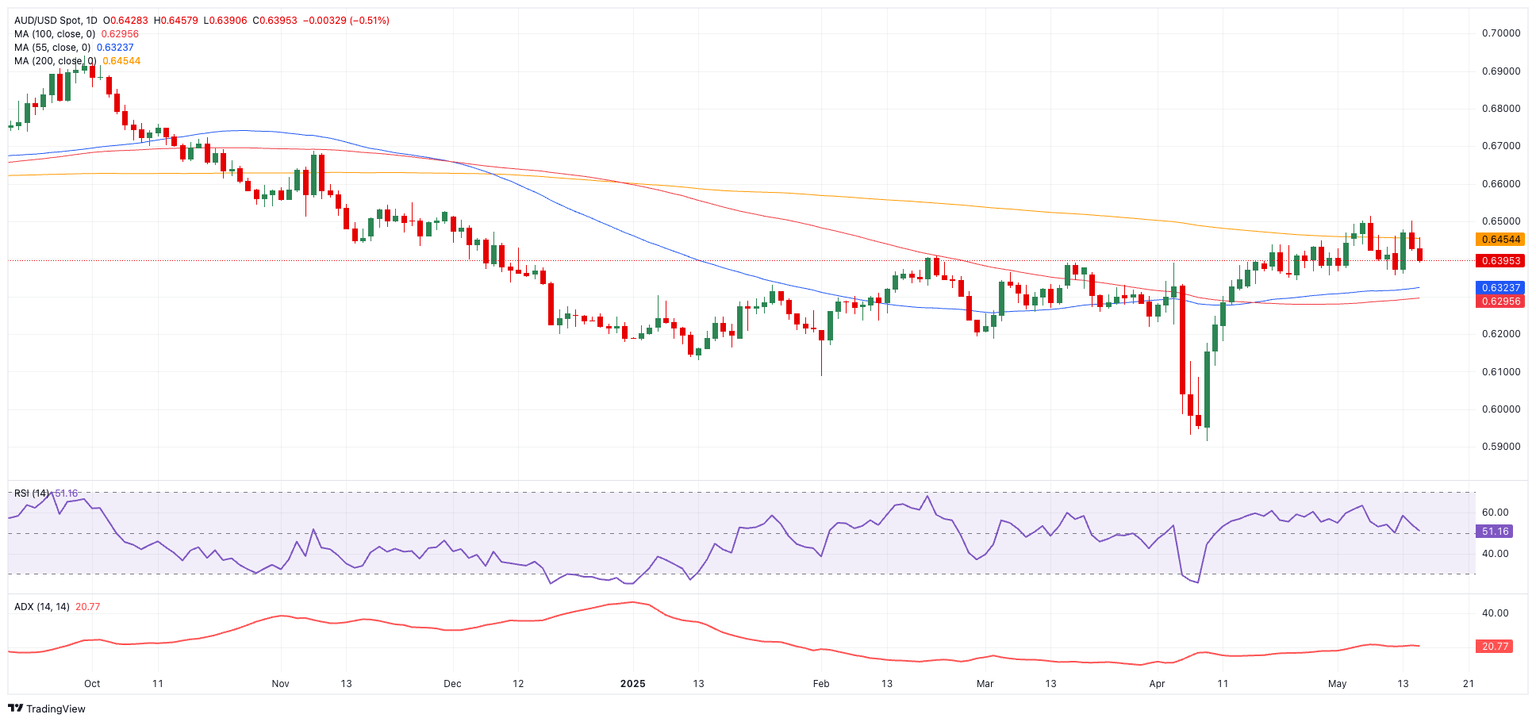

Clearing the key 200-day SMA near 0.6460 would improve the near-term outlook for AUD/USD, with resistance levels to watch at 0.6514 (2025 high from May 7) and 0.6687 (November 2024 high).

On the downside, the 55-day SMA at 0.6322 and the 100-day SMA at 0.6294 provide interim support. A breach below those would expose the 2025 bottom at 0.5913, or even the pandemic-era bottom near 0.5506.

Momentum indicators are leaning modestly positive, with the Relative Strength Index (RSI) around 51 and the Average Directional Index (ADX) near 22, pointing to a mild upward trend.

AUD/USD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.