AUD/USD Price Forecast: The 0.6400 region is just around the corner

- AUD/USD maintained its upside impulse and approached 0.6400.

- The US Dollar partially recouped part of the recent deep retracement.

- The RBA Minutes pushed back against aggressive rate cuts.

Momentum for the Australian Dollar (AUD) carried over from Monday, pushing AUD/USD to the vicinity of the 0.6400 milestone on Tuesday. The pair´s daily uptick came despite a noticeable rebound in US Dollar (USD), even as persistent US-China trade tensions continued to loom.

Escalating trade tensions

Recent tariff announcements have injected fresh anxiety into global markets. President Trump’s decision to impose tariffs ranging from 10% to 50% has sparked retaliation discussions and raised the spectre of a trade war. These developments threaten to slow global growth, elevate consumer prices, and complicate monetary policies worldwide.

Australia, with its strong economic ties to China and its heavy reliance on commodity exports, finds itself particularly exposed. Following China’s own tariff measures, AUD/USD tumbled to multi-year lows, and the situation was further intensified last Thursday when President Trump imposed an unprecedented 145% tariff on certain Chinese goods.

Central bank perspectives

On the American side, the Federal Reserve (Fed) chose to hold rates steady at 4.25–4.50% in March, reflecting a cautious stance amid inflationary pressures and emerging signs of an economic slowdown. Fed Chair Jerome Powell noted that evolving trade headlines could have significant implications for future monetary policy decisions.

In Australia, the Reserve Bank of Australia (RBA) also maintained its Official Cash Rate (OCR) at 4.10%. RBA Governor Michele Bullock emphasised the ongoing challenge of steering inflation back into the 2–3% target range. This decision was interpreted by many traders as slightly hawkish, reducing the likelihood of a 25 basis point rate cut at the May 20 meeting from 80% to 70%.

The RBA Minutes held before the US Liberation Day announcement signalled a clear reluctance to cut rates. Governor Bullock reinforced this cautious stance, noting that domestic data—characterised by gradually declining inflation, a tighter-than-expected labour market, and a temporary drop in employment—aligned with previous forecasts. On the global front, the Minutes added that ongoing uncertainties in trade policy underline the balanced risks to inflation, with outcomes hinging on shifts in aggregate demand and supply. Overall, both domestic and international factors support the decision to hold off on aggressive monetary easing.

Trading sentiment

Recent CFTC positioning data shows that speculative net longs in the AUD have fallen to a four-week low of around 63.3K contracts, while open interest has reached multi-week highs. This environment has contributed to renewed selling pressure, which recently dragged AUD/USD into the 0.5900 range—the deepest move since the first quarter of 2020.

Technical levels to watch

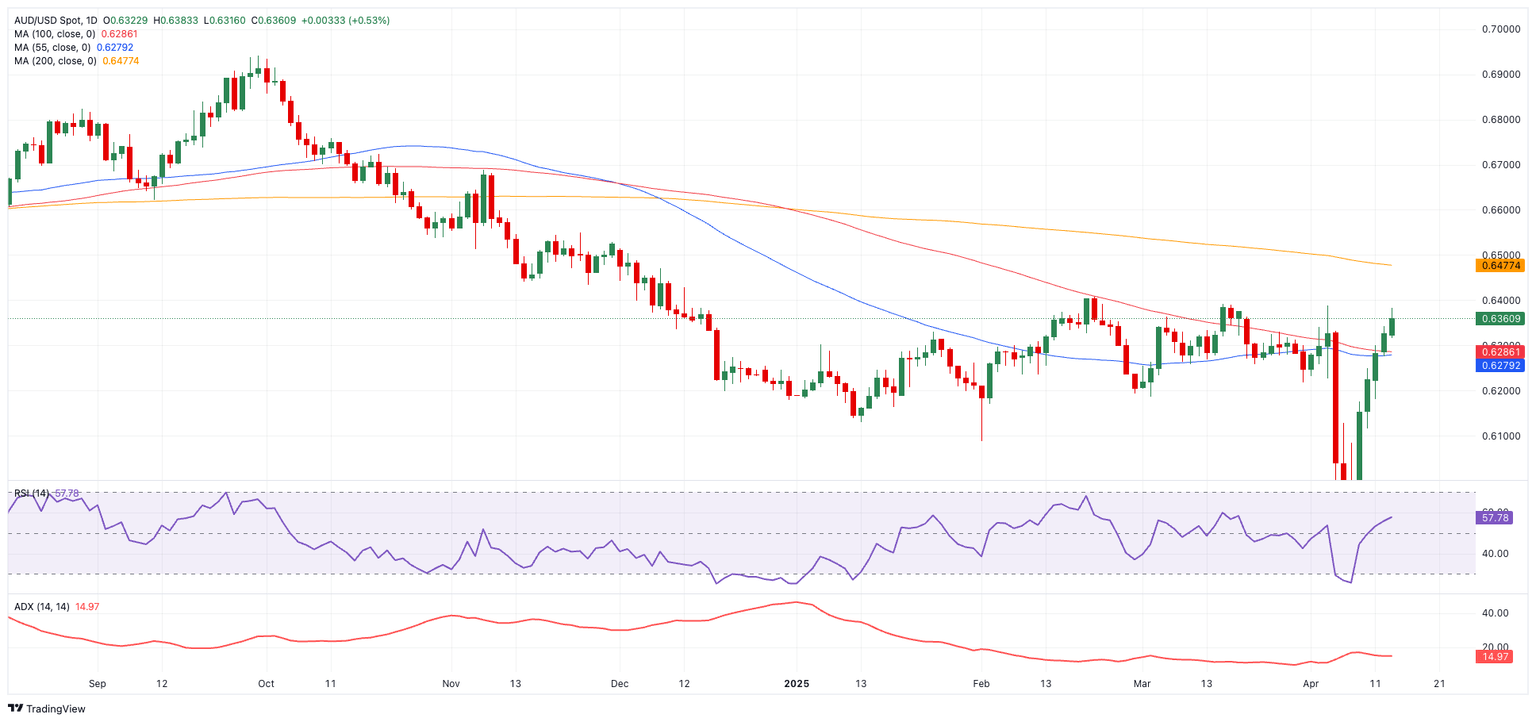

Technically, the outlook remains bearish as long as AUD/USD stays below the 200-day simple moving average (SMA) at 0.6481.

Key support levels include the 2025 low of 0.5913, observed on April 8, and potentially further down at the 2020 level of 0.5506.

On the other hand, a sustained break above the 2025 peak of 0.6408 (February 21) might trigger a rally toward the 200-day SMA and even test the November 2024 high of 0.6687 (November 7).

Additionally, an uptick in the Relative Strength Index (RSI) to around 58 suggests that further upside momentum remains on the table, though the low Average Directional Index (ADX) near 15 warns of the rally’s potential fragility.

AUD/USD daily chart

Upcoming Australian data

Looking ahead, the market will closely watch the Westpac Leading Index, due for release on Wednesday, and a key labour market report scheduled for Thursday.

Final thoughts

With escalating trade conflicts and careful monitoring by both the Fed and the RBA, the Australian Dollar remains highly sensitive to fresh developments in the global trade landscape. As the situation continues to unfold, traders and market participants will be watching these events closely for signs of further volatility.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.