AUD/USD Price Forecast: Positive outlook awaits above 0.6460

- AUD/USD reversed part of its recent weakness and returned above 0.6400.

- The US Dollar sold off sharply following Moody’s US credit downgrade.

- The RBA is widely anticipated to lower its OCR by 25 bps on Tuesday.

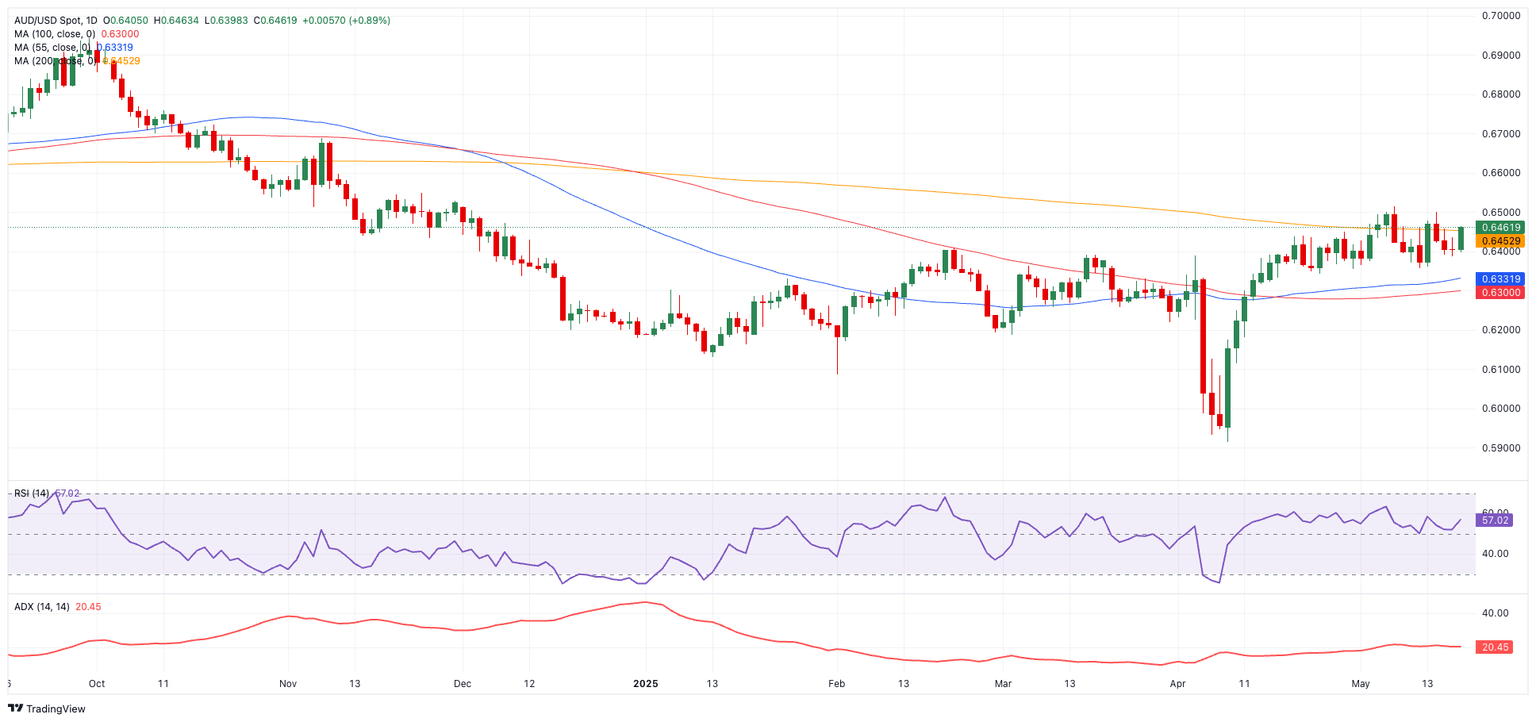

The Australian Dollar regained balance on Monday, rapidly leaving behind part of the weakness seen in the past few days. That said, AUD/USD managed to reclaim the 0.6400 barrier and beyond in quite auspicious start to the trading week, flirting at the same time with its key 200-day Simple Moving Average (SMA) near 0.6460.

Monday’s marked advanced followed the resurgence of the strong selling pressure on the US Dollar (USD), which was particularly triggered after agency Moody’s downgraded the US credit rating by one notch. Further weakness around the Greenback also stemmed from steady doubts over the durability of the recently announced US–China trade agreement.

China’s influence grows

The Aussie is also deriving some support from the mixed data releases in China, after April’s economic results pointed to continued resilience despite the ongoing tariff war. That said, while Industrial Production remained firm, Retail Sales and Fixed Asset Investment slightly underwhelmed relative to expectations. Although the figures suggest some loss of momentum from the first quarter, overall activity has held up well, supporting prospects for around 5% growth in the second quarter.

Nevertheless, uncertainty around US tariffs persists, and weakness in China’s housing market continues to weigh on the outlook. A recent reduction in tariffs has helped ease pressure on growth, diminishing the likelihood of further stimulus.

Furthermore, the policy package unveiled at the NPC in March, if fully implemented, is expected to offset much of the drag from remaining tariffs.

In light of the imminent meeting, markets broadly expect the PBoC to keep its 1-Year and 5-Year Loan Prime Rates unchanged at 3.10% and 3.60%, respectively.

Diverging central bank signals

Diverging central bank stances are adding complexity to the outlook for AUD/USD.

The Federal Reserve (Fed) held interest rates steady at its May 7 meeting, with Chair Jerome Powell striking a cautious but mildly hawkish tone, signalling a patient approach to rate cuts. Reinforcing this, softer-than-expected April inflation data and renewed optimism on the trade front prompted markets to push back expectations for the first Fed cut to September.

In contrast, the Reserve Bank of Australia (RBA) is widely expected to lower its Official Cash Rate (OCR) by 25 basis points at its May 20 meeting, as signs of easing inflation emerge despite ongoing strength in the domestic labour market.

Bearish bets on the AUD stalled

Bearish sentiment toward the Aussie seems to have hit a wall. CFTC data saw net short positions hovering around eight-week lows around 49.3K contracts as of May 13, while open interest deflated somewhat.

Technical landscape

Further gains in AUD/USD need to, initially, clear its key 200-day SMA at 0.6455. A breakout above this region could open the door to a test of the 2025 peak at 0.6514 (May 7 high), ahead of 0.6687 (November 2024 high).

On the downside, interim support lies at the 55-day and 100-day SMAs (0.6330 and 0.6299, respectively), with deeper losses potentially exposing the 2025 bottom at 0.5913 and even the pandemic-era trough near 0.5506.

Momentum indicators remain mildly constructive, with the Relative Strength Index (RSI) climbing to the vicinity of 57, and the Average Directional Index (ADX) around 21, pointing to a shallow upward trend.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.